Foreign investors considering establishing a business in Türkiye often ask about the cost of employing staff. Understanding wage structures and associated costs is essential for accurate budget planning and financial forecasting. This article provides an overview of employee wage costs in Türkiye, based on 2025 payroll parameters.

In Türkiye, employees may be hired under either net or gross wage agreements. However, it is more common for companies to agree on net wages with their employees. Regardless of the wage type, certain deductions are made from salaries paid through payroll. These include social security premiums, income tax, and stamp tax—except in specific exempt situations.

The social security premiums deducted from salaries are declared monthly to the Social Security Institution (SSI) of Türkiye. Similarly, income and stamp tax deductions are reported and paid monthly to the tax office via the withholding tax return.

When an employee is hired, an employment contract is signed between the employer and the employee, detailing the working conditions—one of the most important clauses being the one related to wages.

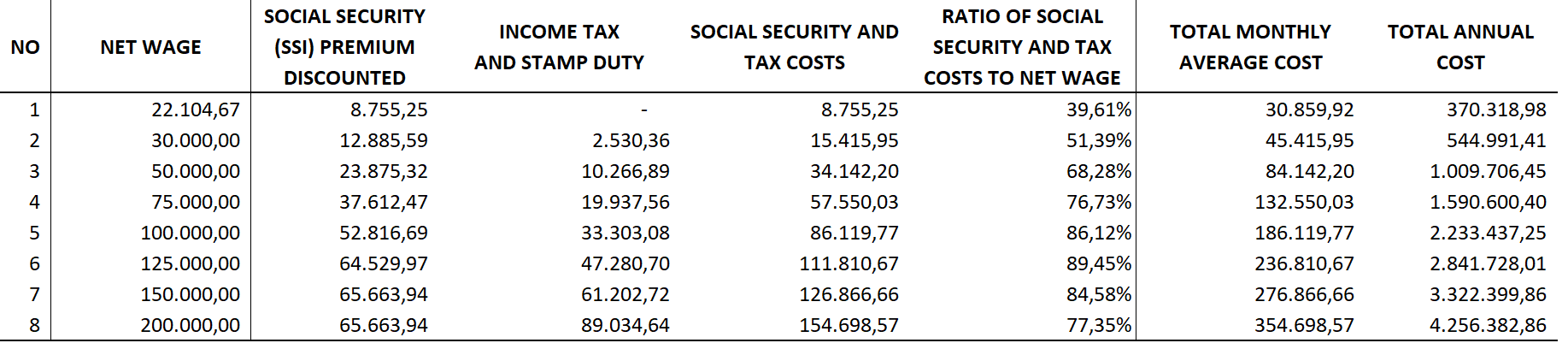

To give a clearer picture of how wage costs vary, we prepared a sample table reflecting the employer’s cost for different net salary levels throughout the year 2025. This table assumes uninterrupted employment from January to December and does not account for potential tax or social security incentives. It’s important to note that Türkiye offers various exemptions and incentives based on factors such as region, sector, and type of investment.

For example, the calculation in the first row of the table is based on the minimum wage valid in 2025. This wage level is exempt from income and stamp taxes, which keeps the employer’s cost relatively low compared to higher wage levels.

In contrast, a person earning a net salary of 30,000 TL per month will generate an additional tax and SSI cost of approximately 15,415 TL, equating to 51.39% of the net salary. For a net monthly salary of 100,000 TL, the corresponding tax and SSI cost rises to 86,119 TL—86.12% of the net amount. At the highest level shown, a net monthly wage of 200,000 TL results in an additional monthly cost of around 154,698 TL, or 77.35%. Interestingly, once a certain salary threshold is passed, the relative burden of taxes and premiums may begin to decrease slightly.

If you’re planning to invest in Türkiye, it’s crucial to simulate your projected wage expenses in advance—considering the number of employees, their net or gross wages, and the year’s current payroll parameters.

Additionally, the taxes and premiums paid on net wages can be recorded as business expenses when determining a company’s taxable profit. As a result, the total wage-related costs reduce the tax base and can ultimately decrease the net cost to the business.

In summary, a clear understanding of payroll costs is vital for any foreign investor planning to hire staff in Türkiye. It allows for better budgeting, efficient tax planning, and more accurate financial projections.

For tailored support or further guidance, feel free to contact our expert team. 👉 info@karenaudit.com

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.