According to the Income Tax Law No.193, incomes of real persons are

subject to the income tax. Income items subject to the income tax are

commercial incomes, agricultural incomes, salaries / wages, incomes

from independent personal services, incomes from immovable property

and rights (rental incomes), incomes from capital investment and other

income and gains.

Non-resident taxpayers are real persons who are not settled in Türkiye in

other words who do not have their residences in Türkiye and who do not

reside in Türkiye for a continuous period of more than six months within

one calendar year. Non- resident taxpayers shall be taxed only on income

and gains which they have obtained in Türkiye, they do not file a tax return

in Türkiye for income and gains which they have obtained in foreign

countries.

On the other hand, Turkish nationals who live abroad with a residence or

work permit are also considered within the scope of the non-resident

taxpayer. According to explanations made in the Communique Serial No.

210 of the Income Tax Law, Turkish nationals who live abroad for more

than six months with a residence or work permit shall be taxed on the

basis of limited liability in terms of income and gains which they have

obtained in Türkiye, except for Turkish nationals residing in foreign

countries due to their works affiliated with private enterprises whose

headquarters are located in Türkiye or public institutions.

The guidebook has been prepared to present explanations and samples

about the property and rights which are subject to the rental income,

amount of exception for rental income from house, limit for declaration in

workplace rental income, equivalent rental value implementation,

expenses which shall be deducted from declared rental income, tax

withholding in rental payments, taxation of rental income in terms of

Double Tax Prevention Agreements, time and form of rental income

declaration, tax schedule, calculation of income tax payable, payment

ways in terms of the taxation of those who rent out their property and

rights in 2021.

The guıdebook on rental ıncomes for non-resıdent taxpayers

In addition, explanations have made on how to file a tax return swiftly,

easily and safely via the Pre-filled Tax Return System serving 24/7, where

tax returns on rental incomes are prepared in advance and submitted for

the approval of taxpayers.

1. RENTAL INCOME

Incomes obtained from renting of the property and rights which are stated

in the Income Tax Law No.193 is defined as “income from immovable

property and rights” and are subject to the income tax in certain

conditions.

The liable persons of immovable property’s income are the owners,

tenants (persons having the rights to use actually), possessors,

servitudes and usufruct right owners of the property and their tenants in

the event of leasing of a rented property and rights.

2. PROPERTY AND RIGHTS WHICH ARE SUBJECT TO RENTAL

INCOME

Property and rights which are subject to the rental income are defined in

Article 70 of the Income Tax Law. They are mentioned as;

-Land, building, mineral water and underground water sources, mines,

stone pits, production places of sand and gravel, brick and tile fields,

saltworks and their component parts,

– Large fishing net fields and fishponds,

-Component parts of immovable properties leased separately and all

their installations, inventory stock and flooring,

-Rights registered as immovable property,

-Searching, operating and franchise rights and their licenses, patent

right, trademark, commerce title, any kind of technical drawing, design,

model, plan and cinema and television films, audiotapes and

videotapes, a secret formula belonging to an experience acquired in

industry, commerce and science or rights as right of usage or privilege

of usage on a production method,

-Copyrights,

-Ships and shares of ship and all the motorized shipment and unloading

vehicles,

-Motorized transfer and draw-frame vehicles, any kind of motorized

vehicle, machine and installation and their appurtenance.

3. OBTAINING OF RENTAL INCOME

Obtaining of rental income is bound to collection principle. In order to tax

the rental income in accordance with the collection principle, it should be

collected in cash or in kind.

3.1. Collection of Rental Income in Cash

Collection of rental income in cash states that the payment of rent in

Turkish Liras or in foreign currency. Received cheques are also taken into

account as collection in cash.

Rental income collected by the taxpayers relating to that year or

previous years is taken into account as the income of the year which it

is collected in.

Example, if 2018, 2019 and 2020 rental incomes are collected in 2021,

these incomes will be taken into account as the income of the year 2021.

Rental income relating to prospective years which is collected in

advance is not taken into account as the income of the year which it is

collected in but as the income of the years which the income is related to.

Example, if 2021, 2022 and 2023 rental incomes are collected in 2021,

each year’s rental incomes will be taken into account as the income of the

related year.

In terms of renting transactions in foreign currency, gross revenues in rental

incomes are determined according to the exchange rate announced by the

Central Bank of Republic of Türkiye on the collection date.

3.2. Collection of Rental Income in-kind

If the rental payment is collected in-kind (property, ware etc.), payments

are valued according to the Tax Procedure Law No. 213

3.3. Collection and Payment of Leasing by Means of Banks or Postal

Administration

According to the Income Tax General Communiqué Serial No. 268 and

298 which are published for the authentication with documents issued by

banks or postal administrations of the collections and payments that are

made in connection with the transactions regarding workplace and

residential rentals;

-For residence, 500 TL or over per month for each house; in case of

weekly, daily or similar short-term housing rental regardless of the

amount for those who obtain a rental income,

-For workplace, without a limitation of amount for those who lease out

their workplaces and their tenants

need to make the payments and collection of the leasing by means of

banks, financial institutions or postal administrations and are obliged to

authenticate their payments and collections through documents issued by

these institutions.

-Since receipt or monthly statement is issued for the payment and

collection while using mediums like depositing money, money order,

cheque or credit cart by means of banks, financial institutions or postal

administrations, these documents shall be accepted as certifying

documents. Payment and collection carried out via internet banking are

also evaluated in the same scope.

-The fine which shall be applied to persons who do not comply with the

aforesaid obligations is 5% of each transaction’s amount and it should be

no lower than the amount of special irregularity fine determined for that

year in accordance with the Repeating Article 355 of the Tax Procedure

Law

4. LOW OR NO VALUE FOR RENTAL INCOME

“The equivalent rental value” is taken as bases in case of low or no value

for rental income. According to this basis, equivalent rental income

principle shall be applied on the conditions of;

leaving the immovable property to the usage of other persons for free,

lower value of rental income of rented immovable property than the

equivalent rental value.

The equivalent rental value in rented buildings and lands is the rental

value determined by authorized specific authorities or courts.

If there is no renting determination or judgment for the aforementioned

building or land, the equivalent rental value is 5% of its real estate

tax value

The equivalent rental value in property and rights for other than buildings

or lands is 10% of their cost price. If this cost is not known, it is 10% of

determined values of them calculated in accordance with valuation of

property provisions of Tax Procedure Law.

Example: Taxpayer (A) gave up a flat valued 900.000 TL to one of his/her

friends without charge in 2021.

In this case, taxpayer (A) need to calculate his/her rental income on the

equivalent rental value.

The equivalent rental value: 900.000 x 5% = 45.000 TL. This amount

should be considered as income to be declared.

The equivalent rental value principle is not applied under the

following conditions:

-Leaving empty immovable properties to other person’s residence in

order to protect the immovable,

-Allocating the buildings to the residence of the property owner’s

mother, father, grandmother, grandmother, children, grand kid or

siblings (But, if more than one house allocated to the residences of

each of these persons, equivalent rental value is not calculated only for

one of these houses. Example, if owner of property has allocated two

houses to the residence of his/her child, it will not be calculated

equivalent rental value for one house and for the second one it will be

calculated.)

-Accommodating of relatives with the property owner in the same house

or flat,

-Leasing done by General Budget and by Annex Budget Offices, by

provincial administrations and municipalities and by other public

institutions and organizations.

5. EXCEPTION FOR RENTAL INCOME FROM HOUSE

The amount of 7.000 TL for rental income from house for the year 2021

(the exception amount of 9.500 TL for the year 2022) is exempted from

the income tax. If persons, who gain a rental income from house, obtain

an income less than the amount of exception that is determined annually

(the exception amount of 7.000 TL for the year 2021), they are not

required to file a tax return.

Example: Taxpayer (B) rented his/her house from 550 TL per month and

obtained 6.600 TL annually in 2021. In this case, since the rental income

from house is less than the exemption amount of 7.000 TL, it will not be

declared by the taxpayer (B).

In the case the rental income is not declared between the dates in time or

the rental income is understated, it will not be able to benefit from the

exception amount of 7.000 TL for the year 2021. However, those who

submit returns, before any determination is made by the administration,

on their own accord for their rental income which they did not declare or

include in their returns on time, will benefit from the related exception.

In case the rental income from house exceeds the amount determined for

exception, the amount of exception must be deducted from the rental

income to be declared in the annual tax return.

The exception applies only to rental income from properties that have

been rented as house. Taxpayers whose rental income from house

under 7.000 TL in 2021 do not file a tax return for these incomes

If there is a rental income obtained and declared at the same time both

from house and workplace, the exception applies only to the rental

income obtained from house, the exception does not apply to the rental

income from workplace.

Those who have to declare their income from commercial,

agriculture or independent personal services,

Regardless of whether a declaration is required or not,

those who obtain a rental income from a residence above

7.000 TL, of whose gross total amount of their income

including wage, income from capital investment, rental

incomes, other income and gains jointly or severally

exceeding the amount of 190.000 TL (the amount of the

third income bracket in Article 103 of the Income Tax Law

for the wages) for the year 2021,

cannot benefit from the exception amount of 7.000 TL in incomes

from immovable property and rights (rental incomes).

Example: In 2021, taxpayer (C) obtained the rental income of 26.400 TL

from his/her property that she/he leased out as a residence and the rental

income from his/her workplace of 66.000 TL which are taxed wholly by the

withholding and the wage of 132.000 TL.

Whether the exception will be applied or not for taxpayer (C)’s rental

income from his/her residence will be determined on the basis of whether

the total income obtained by taxpayer (C) in 2021 exceeds 190.000 TL or

not.

Since the total amount of income (24.600 + 66.000 + 132.000) exceeds

190.000 TL determined for the year 2021, it will not be possible to benefit

from the exception of 7.000 TL for the rental income from the residence of

26.400 TL.

In case more than one person has the ownership of a house, the taxation

of the rental income obtained from such house will be subject to 7.000 TL

(for the year 2021) of the exception separately for each proprietor.

Thus, if the inheritance is not shared, every inheritor will benefit from the

exception separately.

In case, a taxpayer obtains rental income from more than one house,

the exception shall be applied at once to the total amount of rental

income.

6. EXPENSES TO BE DEDUCTED WHEN DETERMINING RENTAL

INCOME

In the taxation of rental income, the net amount of the income obtained is

determined in two different ways as follows:

-Actual expenses method,

– Lump-sum expenses method (for other than those who lease out

rights).

-The selection of the actual expenses or the lump-sum method must cover

all immovable property, which means that it is not possible to choose the

actual expenses method for some part and the lump-sum expenses

method for the remaining part.

-Taxpayers opting for the lump-sum expenses method cannot return to the

actual expenses method unless two years have passed.

6.1. Deduction of Expenses in Actual Expenses Method

If the actual expenses method is chosen, following actual expenses can

be deducted from the gross amount of the rental income:

– Lighting, heating, water and elevator expenses paid by lessor for

rented property,

– Management costs which are measured according to the importance of

property and related with the administration of the rented property,

– Insurance expenses relating to the rented property and rights

– Interest of debts relating to the rented property and rights

– 5% of acquisition value of one rented house for 5 years beginning from

the date of acquisition (This deduction applies only to rental income of

the rented house; non-deductible part is not evaluated as

expenditure surplus. This deduction is not valid for houses acquired

before 2017),

The discount of 5% of the acquisition value will only be applied to

one real estate rented as a residence. If the rental income is obtained

from more than one real estate, this discount will not be

used for other real estates. Also, real estates rented as workplaces

will not benefit from the 5% expense deduction.

– Taxes, duties and fees paid for the rented property and rights and rates

paid to municipalities for expenses by lessor,

– Depreciation setting aside for rented property and rights, and heat

insulation and energy saving expenditures which are made by the

lessor and that increase the economic value of the real estate. (These

expenditures can be considered as cost if it exceeds 1.500 TL for the

year 2021.)

– Repair and maintenance expenses incurred by lessor for the rented

property,

– Rents and other actual expenses paid by sub-lessors,

– Rent of the house accommodated by the lessors who rent their own

property, (non-deductible part is not evaluated as expenditure surplus),

It is not allowed for taxpayers not residing in Türkiye, (including Turkish

nationals who reside abroad for a continuous period of more than six

months with a residence or work permit) to deduct the amount of rents

they pay in a foreign country from their rental income obtained in Türkiye.

-Cost of loss, detriments and compensations paid for rented property

and rights based on a contract, law or court decree.

Non-residents who have opted for the actual expenditure method

should keep the documents showing the expenses incurred

for a period of 5 years and submit to the tax office when required.

6.1.1. Calculation of Deductible Expenses in Case of Exception in

Actual Expenses Method

In case, a taxpayer chooses the actual expenses method and benefits

from the exception applied to rental income from house, the part of actual

expenses corresponding to the exception shall not be deducted from

gross revenues.

The part of deductible expenses corresponding to the taxable revenue will

be calculated using the following formula:

Deductible expenses = Total Expenses x Taxable Revenue*

Total Revenue

(*) Taxable Revenue = Total Revenue – Amount of Exception for Rental Income from House

Example: Taxpayer (D) rented his/her house in 2021 and obtained

66.000 TL of rental income. Taxpayer, who has no any other income,

incurred 16.500 TL of expenditure for his/her property and chooses the

actual expenses method.

The amount that taxpayer can deduct as actual expenses will be the

amount that corresponds to the taxable revenue of the total expense for

16.500 TL.

Taxable revenue = 66.000 – 7.000 = 59.000 TL

Deductible expense = (16.500 x 59.000) / 66.000 = 14.750 TL

In case, the amount of actual expense to be deducted from the rental

income is 14.750 TL.

6.2. Deduction of Expenses in Lump-sum Expenses Method

Taxpayers opting for the lump-sum expenses method can deduct the

lump-sum expense at the rate of 15% from their revenue against actual

expenses. The lump sum expense, for taxpayers who obtain a rental

income and who will be able to benefit from the residence exemption, will

be calculated over the remaining amount after deducting the exception

amount.

It is not possible to opt for lump-sum expenses method in the case of

renting rights. For example, taxpayers, who gain a rental income from

workplace and income from renting rights, must choose actual expenses

method in their income tax return.

Taxpayers who have opted for the lump-sum method can deduct

as a lump- sum expenses at 15% of their revenue. The lump-sum

expenses rate is determined at 15% of the revenue to be applied to

rental income from the date of January 1st, 2017.

7. IN CASE OF OCCURRING LOSS

At the adding up income, losses arising from part of the sources of

income (except those arising from other income and gains written in

Article 80 of the Income Tax Law) are deducted from the gains and losses

of other sources.

Any decrease occurring in the capital itself which is subject to income

from immovable property is not considered as loss and is not accepted as

expense when determining the gross income amount.

Losses arising from the expenditure surplus in the calculation of the net

amount of income from immovable property can be deducted from

income to be declared in the following years not for more than 5 years.

There are two exceptions for this rule

– In the event of any loss resulting from deducting the amount of the rent

of the house or lodging paid by the lessor from the rental income of

their house, such loss cannot be subject to deduction from the income

from immovable property to be obtained in the following years.

-Non-deductible part of the amount corresponding to 5% of the

acquisition value which has been subject to deduction of income from

the one immovable rented as house is not considered as an

expenditure surplus.

Accordingly, it is not possible to consider an expenditure surplus as loss

in these situation.

8. TAX WITHHOLDING IN RENTAL PAYMENTS

Persons, corporations and entities who rented property and rights in

accordance with Article 94 of Income Tax Law are obliged to withhold

income tax on the gross amount of payments made for rent.

Persons, corporations and entities in question that are tenants have to

withhold income tax from the gross amount of their rental payments at the

rate of 20%.

Pursuant to the President of the Republic of Türkiye Decision No. 2813

and dated July 30th, 2020; the withholding rate applied in accordance

with the Income Tax Law on rental payments made in cash or account

between the dates of July, 31st 2020 – December, 31st 2020 has been

determined as 10% and the effective date of the withholding rate, which

has been determined by various President Decisions issued later for a

provisional period, has been extended until September, 30th 2021

(including this date). Thus, the withholding rate will be applied as 10% for

rent payments made between the dates of July, 31st 2020 -September,

30th 2021.

This withholding tax will also be made from the rent paid in advance for

the upcoming months and years.

If tenants are taxpayers whose earnings are determined

in the simple earning basis; Since they have not obligation to

withhold taxes, they will not withhold on rent payments.

In case the immovable property leased out is used both as house and

workplace; the total rent is subject to the withholding tax as long as it is

used as workplace partially or in whole.

9. DECLARATION OF RENTAL INCOME

Non-resident taxpayers do not submit annual returns for their incomes

from immovable property which are taxed wholly by the withholding in

Türkiye. Also, in case they submit the annual return for other incomes,

they do not include their incomes which are subject to the withholding in

their returns.

Taxpayers whose income subject to declaration consists only of the rental

income will submit the annual tax return, if;

– their rental income from house exceeds the tax exception amount

(7.000 TL for the year 2021) and,

– their rental incomes, which are not subject to the withholding, obtained

from leasing of the properties and rights within a calendar year.

On other saying, rental incomes that are not subject to the withholding

and the exception must be declared the annual tax return regardless of

the amount.

Every member of a family has to submit a return on their own behalf for

the rental income they obtained from the property and rights belonging to

them.

On the occasion that minor and restricted persons are taxpayers; the

annual return to be submitted on behalf of them is signed by their parents,

guardians or curators.

In case of having property and rights with shares, every partner need to

declare the rental income corresponding to his/her own shares.

10. DEDUCTIONS TO BE MADE FROM INCOME INCLUDED IN

ANNUAL TAX DECLARATION

Deductions with respect to income to be declared by an annual tax return

are specified in Income Tax Law and in other relevant laws. In order to

make the following deductions from the income to be declared in income

tax return while income tax base is being determined, there must be an

income to be declared in an annual tax return and deductions to be made

should satisfy the requirements specified in the relevant legislation.

The revenue that is declared at the annual tax return before the other

deductions and the revenue loss of former years are deducted would be

taken as the base revenue to calculate the amount that would be

deducted.

Accordingly, here are some of the matter that may be made subject to the

discount;

10.1. Life / Individual Insurance Premiums

The 15% of life / individual insurance premiums paid, can be deducted for

determining the tax base in the annual tax returns.

The premiums that should be taken into account for determining the tax

base are as follows:

– 50% of life insurance payments of the taxpayers’, their spouses and

children,

– 100% of death, accident, health, disability, maternity, child birth and

education individual insurance premiums.

The total amount that would be deducted cannot exceed the 15% of total

revenue and annual amount of minimum wage. (The gross annual

minimum wage for 2021 is 42.930,00 TL.)

The premiums paid to the individual retirement insurance cannot be

deducted.

10.2. Education and Health Care Expenses

The education and health care expenses done as stated below would be

deducted from the annual revenue declared in tax return in condition not

to exceed the 10% of total revenue:

– The education and health care expenses should be performed in

Türkiye.

– The expenses should be verified by the documents received from the

individual or legal personalities who are personal or corporate income

taxpayers.

-The expenses should be regarding the taxpayers’ oneself or their

spouse and small children.

The term” small child” refers to children under the age of 18 or under the

age of 25 in the education who live with a taxpayer or who are cared for

by a taxpayer (including those who are given alimony, those who have

been adopted and those who live with a taxpayer from grandchildren who

have lost their parents).

10.3. Donations and Aids

10.3.1. Donations and Aids Which Can Be Deducted As Limited to

5% of Income to be Declared

Personal income taxpayers, general and private budgeted public

administrations, provincial administrations, municipalities, villages and

non-profit associations and the foundations that are exempted from tax by

President of the Republic, can deduct the donations and aids against

receipt from their annual income in condition that it would not exceed the

5% of total income. (It would not exceed 10% of total income if donations

are made to the stated organizations, associations and foundations in the

development priority zone.)

10.3.2. Donations and Aids Which Are Completely Deductible

The donated schools, health institutions, the student dormitories and

day care centers which have bed capacity not less than 100 (in

development priority zones not less than 50), orphanages, rest houses,

care and rehabilitation centers to the general and private budgeted

public administrations, provincial administrations, municipalities,

villages and all expenses for the construction of the place of worship

constructed by the permission of authorized public administration and

director, the institutions where there ligious education is given under

inspection of the Directorate of Religious Affairs, youth centers and

youth and scouting camps belong to the Ministry of Youth and Sports

or all donations and aids in kind or in cash made for the construction or

for the maintenance of their activities of these establishments can be

deducted.

-The total cost of food, cleaning supplies, clothing and heating donated

to the foundations and associations established as food banks for

helping poor people in line with the procedures an principles

determined by the Ministry of Treasury and Finance can be deducted

from the income to be declared

-General and private budgeted public administrations, provincial

administrations, municipalities, villages, non-profit associations, the

foundations that are exempted from tax by President of the Republic,

the expenses done by institutions which makes scientific research or

the expenses for the studies that are supported by the Ministry of

Culture and Tourism and all donations and aids made for these

purposes can be deducted.

-The total amount of the donations and aids in kind or in cash against

receipt to the aid campaigns initiated by President of the Republic.

-The total amount of the donations and aids in cash against receipt to

Turkish Association of Crescent and Turkish Green Crescent Society

except their commercial enterprises can be deducted.

10.4. Sponsorship Expenses

According to Article 89/8 of the Income Tax Law the sponsorship

expenses done can be deducted from the income declared at annual tax

return as follows:

-100% of expenses for amateur sports,

-50% of expenses for professional sports.

10.5. Donations and Aids Which Are Completely Deductible in

Accordance with Other Laws

Donations and aids which are completely deductible in accordance with

other laws are as follows:

-Law No. 222 on the Primary Education and Training,

-Law No. 278 on the Establishment of Turkish Scientific and Technical

Research Institution,

-Law No. 2547 on the Higher Education,

-Law No. 2828 on the Social Services,

-Law No. 2876 on the Atatürk High Institution of Culture, Language and

History,

-Law No. 3294 on the Improvement of Social Aid and Solidarity,

-Law No. 3713 on the Anti-Terrorism,

-Law No. 4122 on the National Afforestation and Erosion Control Mobilization,

-Law No. 7174 on the Cappadocia Area (including sponsorship

expenses),

-Law No. 7269 on the Assistance to be Made by Precautions to be

Taken Due to Disasters Affecting Public Life.

In case the donations and aids are not in cash, the equal value of the

donated property or the right; if the equal value is not exist then

the value determined by the Assessment Committee according to

provisions of the Tax Procedure Law shall be taken into account.

11. TIME AND FORM OF RENTAL INCOME DECLARATION

With regard to rental incomes subject to declaration for the period 2021;

non-resident taxpayers need to submit their returns concerning their

incomes from immovable properties between the dates of March

01st–31st, 2022.

-It is possible to file tax returns via the Pre-filled Tax Return System on

the internet.

-If non-resident taxpayers have tax representatives in Türkiye, they will

submit their returns to the authorized tax office of their tax

representatives’ location and if they do not have tax representatives in

Türkiye, they will submit their returns to the authorized tax office of

immovable property location.

-In accordance with the Law No. 3568, returns can also be submitted

via the e-Return System by signing an electronic return mediation

agreement with members of profession who have received a mediation

authority to submit an electronic return.

In the Pre-filled Tax Return System, returns will be deemed

electronically approved. If the return is sent through normal

postal service or private postal distribution companies, it will be

deemed to have been submitted on the date it arrives

on document registration date at tax office, and if it is sent as

registered (First Class Mail etc.), it will be deemed to have been

submitted on the date registered on envelope by PTT.

12. PRE-FILLED TAX RETURN SYSTEM

Taxpayers, whose incomes subject to the declaration composed of only

income from immovable property and right (rental income), wage, income

from capital investment, other income and gains or several of them, can

submit their returns, which the Turkish Revenue Administration has

prepared in advance and submitted for the approval of taxpayers, for

these incomes via the Pre-filled Tax Return System which is an

easy- to- use and a fast system.

Taxpayers who only obtain rental incomes, wages, income from capital

investments and other income and gains jointly and severally will be

able to benefit from the System.

You can access the System and the detailed information on the official

webpage (www.gib.gov.tr) of the Turkish Revenue Administration.

It is possible to log in to the Pre-fılled Tax Return System by means of;

https://hazirbeyan.gib.gov.tr (login by user or e-Devlet method or

foreigner identification number),

Interactive Tax Office,

Internet Tax Office.

Also, you can log in to the System 24/7.

Non-resident taxpayers who do not have the Turkish identification

number, registration in mernis system or do not have rental income

liability record at tax offices, they will submit their returns to the authorized

tax office of their tax representatives’ location if they have tax

representatives in Türkiye; if they do not have tax representatives in

Türkiye, they will use the system after being registered to the authorized

tax office where the immovable property is located.

Accordingly, in case there is not any liability record at tax offices and when

tax returns for rental incomes prepared on the System are approved

electronically, the tax liability registration at tax office and tax accrual

transactions in the name of a taxpayer are carried out automatically.

13. TAX SCHEDULE TO BE APPLIED

According to the Income Tax Law, the income tax is calculated by

applying the following tax schedule for rental incomes obtained in 2021.

On the other hand;

The tax schedule, which will be based on the taxation of incomes for the

calendar year 2022, is determined by the Income Tax General

Communiqué Serial No. 317.

14. TIME AND FORM OF TAX PAYMENT

The income tax calculated on annual income tax returns to be submitted

regarding rental incomes obtained in the year 2021 will be paid in two

equal installments in March and July of 2022.

– The first installment must be paid with the stamp tax until

March 31st, 2022.

– The second installment must be paid until August 1st, 2022. (As the

date of July 31st, 2022 coincides with the public holiday.)

Payments can be made on the official webpage (www.gib.gov.tr) of the

Turkish Revenue Administration (Interactive Tax Office and GİB mobile

application);

– by credit cards of contracted banks

– by bank cards or bank account of contracted banks,

– by credit cards, bank cards and other payment ways of banks

operating in a foreign country

Payments can also be made through;

– branches or alternative payment ways (online banking, phone banking,

mobile banking etc.) of contracted banks,

– PTT branches

– all tax offices.

You can learn your income tax using “Calculations”

section on www.gib.gov.tr

(ivd.gib.gov.tr → Calculations→ Rental Income Calculation)

15. RENTAL INCOMES FROM IMMOVABLE PROPERTY IN TERMS

OF DOUBLE TAXATION AGREEMENTS

Rental income from immovable property is mentioned in Article 6, titled

“Income from Immovable Property” and Article 12, titled “Royalties” of

Double Taxation Agreements that Türkiye concluded.

16. EXAMPLES RELATED TO RENTAL INCOME DECLARATION

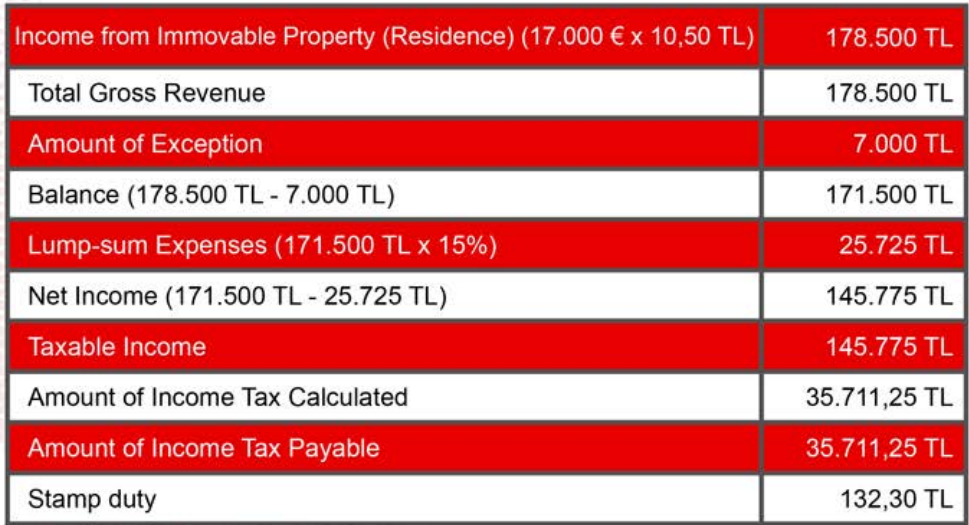

Example 1: Taxpayer (A), living in Germany, leased out his/her flat in

Ankara and obtained 17.000 € as rental income in 2021. Taxpayer (A),

who has no other incomes to declare, preferred the lump-sum expenses

method.

On the date of collection, buying rate for Euro announced by the Central

Bank of Republic of Türkiye is assumed as 10,50 TL.

The income tax payable on the taxpayer’s rental income is calculated as

follows:

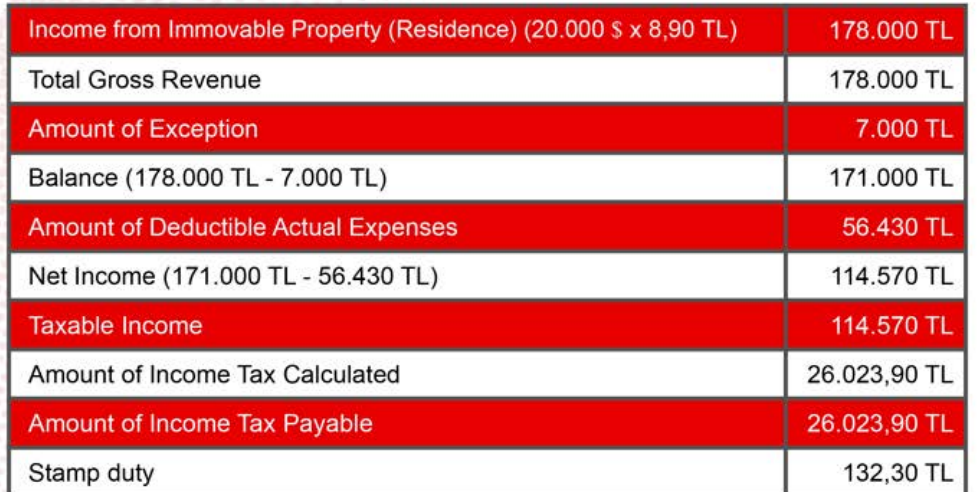

Example 2: Taxpayer (B), living in Poland, leased out his/her flat in

Antalya and obtained 20.000 $ as rental income in 2021. She/he

preferred the actual expenses method and she/ he has no other incomes

to declare. His/her total actual expense for this house is 6.600 $

On the date of collection and expenditure, buying rate for Dollar

announced by the Central Bank of Republic of Türkiye is assumed as

8,90 TL.

Total revenue = 20.000 $ x 8,90 TL = 178.000 TL

Total expenses = 6.600 $ x 8,90 TL = 58.740 TL

Taxpayers who have chosen the actual expenses method will not deduct

as expenses corresponding to the amount subject to the exception from

their income, they will only be able to deduct expenses corresponding to

the taxable revenue. For this, the expense part corresponding to the

taxable revenue must be calculated. Deductible expenses corresponding

to the taxable revenue is calculated as follows:

Deductible expenses = Total Expenses x Taxable Revenue

Total Revenue

*Taxable Revenue = Total Revenue – Amount of Exception for Rental

Income from House

= 178.000 TL – 7.000 TL

= 171.000 TL

Amount of expenses corresponding to taxable revenue (Amount of deductible actual expenses)

= 58.740 TL x 171.000 TL

178.000 TL

= 56.430 TL

The income tax payable on the taxpayer’s rental income is calculated as

follows:

Example 3: Taxpayer (C) who does not reside in Türkiye and lives in

France leased out his/her workplace in Bodrum and obtained 26.625 € as

rental income 2021. It has been withheld 27.562,50 TL (Net monthly rent

is calculated assuming 1.500 €.) on rents paid for the workplace.

At the date that the income is collected and the deduction is made, buying

exchange rate for Euro announced by the Central Bank of Republic of

Türkiye is assumed as 10,50 TL.

Total revenue from workplace (gross) = 20.625 € x 10.50 TL = 216.562,50 TL

The annual tax return will not be declared regardless of the amount for

workplace rental incomes which are taxed wholly by the withholding in Türkiye.

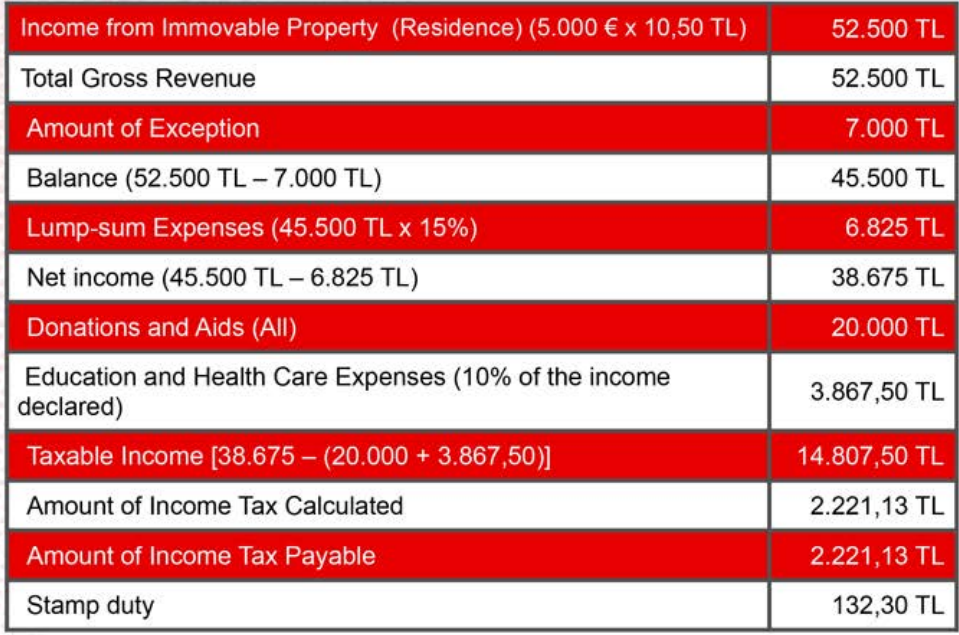

Example 4: Taxpayer (D), residing in Rome, leased out his/her flat in

Ankara and obtained 5.000 € as rental income in 2021. Also she/he

leased out his/her workplace in Ankara and obtained 10.312,50 € as

rental income in 2021. It has been withheld 13.781,25 TL (Net monthly

rent is calculated assuming 750 €.) on rents paid for the workplace.

She/he paid 60.000 TL for an invoice, including the VAT, to a private school

for the education of /his/her 12-year-old child in Türkiye, and

donated 20.000 TL in cash for a receipt to the aid campaign initiated by

the President. Taxpayer (D), who has no other incomes to declare,

preferred the lump-sum expenses method.

At the date that the income is collected and the deduction is made, buying

exchange rate for Euro announced by the Central Bank of Republic of

Türkiye is assumed as 10,50 TL.

Total revenue from workplace (gross) = 10.312,50 € x 10,50 TL = 108.281,25 TL

The workplace rental income which is taxed by the withholding will not be

declared regardless of the amount.

The education and health care expenses done as stated below would be

deducted from the annual revenue declared in tax return in condition not

to exceed the 10% of total revenue:

– The education and health care expenses should be performed in

Türkiye.

– The expenses should be verified by the documents received from the

individual or legal personalities who are personal or corporate income

taxpayers.

-The expenses should be regarding the taxpayers’ oneself or their

spouse and small children.

Therefore, although the expenditure of 60.000 TL on the education has

been spent, the amount of 3.867,50 TL, which is 10% (38.675 X 10/100)

of the income declared, can be deducted. The total amount donated for a

receipt to the aid campaign initiated by the President will be subject to a

discount.

The income tax payable on the taxpayer’s rental income is calculated as

follows:

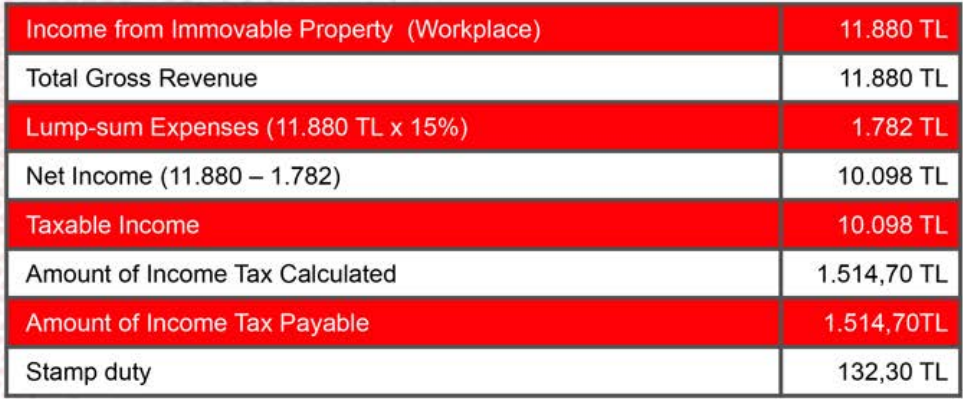

Example 5: Taxpayer (E), living in Madrid, rented out his/her workplace in

Malatya in 2021 to a taxpayer whose income subject to the simple

earning basis and obtained the total amount of 11.880 TL as workplace

rental income annually. Taxpayer (E), who has no other incomes to

declare, preferred the lump-sum expenses method.

The total workplace rental incomes of non-resident taxpayers, which are

derived from taxpayers in the simple earning basis and which are not

subject to the tax deduction and the exemption implementation, will be

declared regardless of the amount.

The income tax payable on the taxpayer’s rental income is calculated as

follows:

Disclaimer: The information in this article is provided for general information purposes only. It is not intended for a professional informational purpose specific to a person or institution. Although it is similar to the subject, each business may have different situations due to its own special conditions. For this reason, it is in your best interest to consult an expert before taking any decision that will affect your business based on the information provided in this article. Karen Audit or any of the persons or institutions it is associated with is not responsible for any loss or damage that may arise as a result of the use of the information contained in this document by private or official, real or legal persons, institutions and organizations.