The “Sweden E-Commerce Market – Forecasts from 2024 to 2029” report has been added to ResearchAndMarkets.com’s offering.

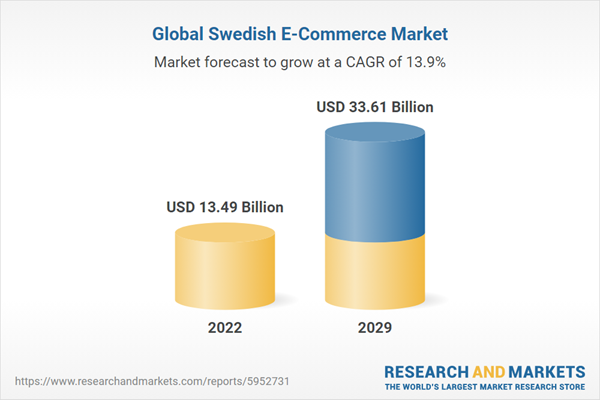

Sweden E-Commerce Market was valued at US$13.491 billion in 2022 and is expected to grow at a CAGR of 13.93% over the forecast period to reach a total market size of US$33.606 billion by 2029

Sweden is one of the most connected societies in the world and consumers have achieved a high position of maturity when it comes to eCommerce. Multinational companies dominate the Swedish consumer goods sector, but Swedish retail giants, such as IKEA and H&M, hold strong positions in the furniture and clothing markets.

The Swedish retail market growth will be primarily driven by innovation and the desire for updated consumer electronics among tech-savvy Swedes. E-commerce is also very mature in the region, supported by good internet availability and a generally mature infrastructure in areas relevant to e-commerce such as logistics.

According to the Riksbank, almost 80% of all consumer payments in Sweden are by card, with an increasing number of Swedes using card or mobile payments rather than cash, particularly among younger people. The most common product categories purchased online in Sweden were pharmaceuticals, clothing, beauty products, groceries, takeaway food including streaming services, insurance, online betting, and tickets to cultural and sporting events.

In Sweden, smartphones are the most frequently used devices for B2C online shopping. Some of the top eCommerce sites in Sweden are NetonNet, Apotea, Zalando, Hjartat, H&M, Ikea, and Apple.

Market Drivers:

Rising demand for cash-less payments is expected to grow the e-commerce market

Swedish consumers make purchases more frequently by using a card or internet banking apps instead of cash. The use of cards as a payment method has increased over time. Several fintech companies have made it easier to shop online by offering easy payment checkout. For instance, SoftBank-backed Swedish fintech giant Klarna offers solutions where one can pay via online bank or through invoice while purchasing online.

Internet banking has expanded very rapidly in Sweden. Furthermore, big tech companies in Sweden, such as Apple and Google, offer digital payment methods like Apple Pay and Google Pay, which are connected to the customer’s credit and debit card. These digital payment methods make it possible to pay using a mobile phone. Thus, increasing payments through cashless methods will drive the e-commerce market growth in upcoming years.

Growing Mobile commerce (M-Commerce) is supporting the e-commerce market

The increasing use of smartphones and tablets has fueled the growth of mobile commerce in Sweden. E-commerce platforms with mobile-friendly interfaces and dedicated apps cater to consumers who prefer shopping on their mobile devices.

Factors contributing to the increasing trend of shopping through online stores are lower prices, better offers, avoiding physical contact, greater product ranges, and good return-exchange policies. According to data from the International Trade Administration In 2021, 17.3 percent of online shopping was spent on services ($3,8 bn), 22.2 percent on travel ($4,9 bn), and 60,5 percent on goods ($13,5 bn).

Efficient logistics and reliable delivery services are crucial aspects of the e-commerce experience in Sweden. Customers often prioritize fast and secure delivery options. Common e-commerce categories in Sweden include fashion and apparel, electronics, home goods, and beauty products. Thus, the increasing preference among Swedish people for buying goods through online mediums rather than from physical stores is driving the growth of the e-commerce market in the region.

Market Restraints:

Regulatory Compliance

E-commerce businesses in Sweden must adhere to various regulations, including consumer protection laws and data privacy regulations. Navigating these regulatory requirements can be complex, and failure to comply may result in legal issues or loss of consumer trust.

Sweden has to abide by the regulations made by the EU for the e-commerce market one of which is The Digital Services Act (DSA) and the Digital Market Act (DMA). DSA made it mandatory for all online platforms to publish their number of active users by 17 February 2023.

DSA coming into effect will add extra operation costs for companies and make the market tough for small companies. Although such compliance will help to generate long-term trust among customers.

Sweden’s e-commerce market is segmented by type into B2B, B2C, C2C, and C2B

Sweden’s e-commerce market is segmented by type into B2B, B2C, C2C, and C2B. B2B e-commerce involves online transactions between businesses, where one business sells products or services to another business.

It is crucial for the procurement of goods and services for businesses. B2C e-commerce involves transactions between businesses and consumers. C2C involves individual consumers who sell products or services directly to other consumers through online marketplaces or platforms. C2B involves individual consumers offering products, services, or information to various businesses.

Key Attributes:

| Report Attribute | Details |

| No. of Pages | 114 |

| Forecast Period | 2022 – 2029 |

| Estimated Market Value (USD) in 2022 | $13.49 Billion |

| Forecasted Market Value (USD) by 2029 | $33.61 Billion |

| Compound Annual Growth Rate | 13.9% |

| Regions Covered | Sweden |

Market Developments:

- November 2023 – According to the press released by Mathem, Sweden’s leading online grocery store, Mathem agreed to merge with Norway’s counterpart Oda. As per the press release, they formed a new Nordic market leader in e-commerce of daily goods with home delivery, with a total turnover of over SEK 5 billion.

- April 2023 – As per the press release from ORTNA, a leading automation and software company announced a partnership with Budbee, a Sweden-based tech company, to develop an enhanced and seamless delivery experience for their customers. The automated parcel system included a new sorting solution that improved speed and accuracy for their new terminal in Jonkoping, Sweden.

Company Products:

- Solestory e-commerce – Solestory is a footwear and apparel company in Sweden. It has positioned itself as a leader in the industry, providing a diverse range of footwear and clothing. Collectively, they cater to a substantial customer base, serving over 2 million clients and collaborating with 800 brands across 24 markets every year. Their product offerings are extensive, categorized by age group, gender, brands, and more, ensuring a comprehensive shopping experience for their diverse customers.

- Crystalline e-commerce – Crystalline is an interior decor company in Sweden. It has established itself as a leader in interior design, providing an elegant and modern collection with quality designs in crystal. They have specialized in exclusive luxury designs of fixtures, candelabras, furnishings, and more, ensuring a comprehensive shopping experience for their diverse customers.

- Mood Company – Mood Company is a Swedish e-commerce company specializing in party decoration products. Their product offerings are extensive comprising of balloons, lights, confetti, and many more ensuring a comprehensive shopping experience for their diverse customers.

Competitive Environment and Analysis

- Major Players and Strategy Analysis

- Market Share Analysis

- Mergers, Acquisition, Agreements, and Collaborations

- Competitive Dashboard

Companies Featured

- Mood Company AB

- Solestory

- Crystalline Sweden AB

- Buyersclub

- Lightboxdeco

Market Segmentation:

By Type

- B2B

- B2C

- C2B

- C2C

By Mode

- Website

- Mobile Application

By Industry

- Consumer Electronics

- Fashion

- Home Care

- Education

- Others

Source: Global News Wire

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.