Average Renewable Energy Certificate (REC) prices are expected to drop by 76% from US$46/MWh to US$11/MWh between 2023 and 2050 due to an oversupply in the REC market driven by a fourfold increase in renewable power generation over the same period, according to a new report by Wood Mackenzie.

The report titled ‘Price outlook for Renewable Energy Certificates in Asia’ studied the impact of increasing renewable energy generation on REC prices in six markets (Taiwan Region, South Korea, Australia, India, China and Japan) in the Asia Pacific region.

According to the report, the share of renewable power in the energy mix is expected to increase significantly in the six markets, rising from 14% to 55% between 2023 and 2050. Meanwhile, the cost of producing electricity from new solar and onshore wind projects is projected to decrease by at least 40% on average over the same period, leading to lower REC prices overall.

“RECs play a crucial role in supporting new investments in renewable energy by providing incentive mechanisms and enabling end users to purchase green energy credits. In the Asia Pacific, RECs can account for 21-31% of total merchant revenues across utility-scale solar, onshore, and offshore wind markets,” said Ken Lee, Head of Asia Pacific Power Research at Wood Mackenzie.

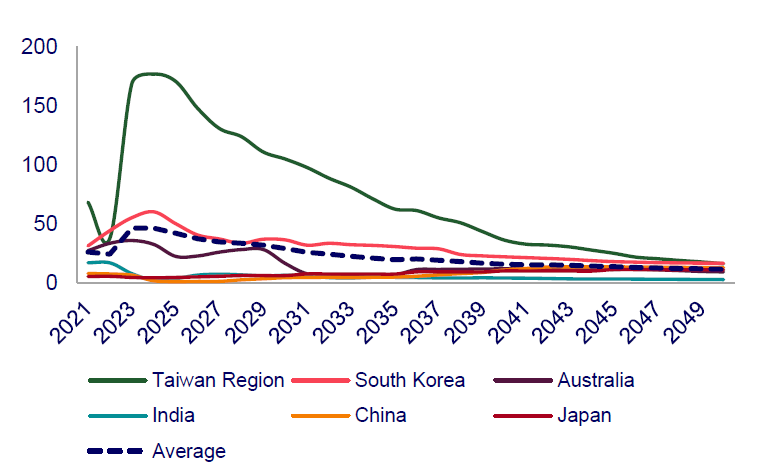

REC price outlook in six Asia Pacific markets (US$/MWh)

Source: Wood Mackenzie

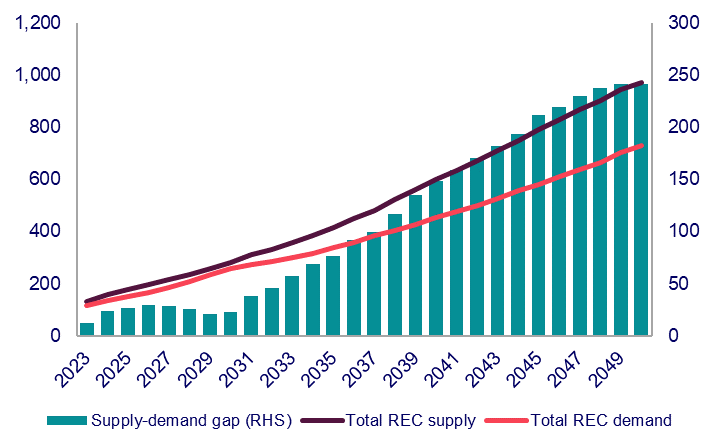

The supply of RECs is expected to exceed demand until 2050, leading to an oversupply and causing REC prices to drop. According to Wood Mackenzie, the reduction in fossil fuel generation also leads to a slowdown of policy-mandated REC demand in some markets in the region, as REC requirements are often placed upon fossil fuel generators. Ken added that the total excess REC supply in the five markets outside China is projected to increase from 13 Terawatt hours (TWh) in 2023 to 241 TWh by 2050.

REC supply and demand outlook for Taiwan Region, South Korea, Australia, India, and Japan (GWh)

Source: Wood Mackenzie

Currently, Taiwan and South Korea have the highest REC prices, but these prices are expected to decrease by at least 70% between 2023 and 2050. On average, REC prices among the six markets are projected to fall by 76% from US$46/ megawatt hour (MWh) to US$11/MWh during the same period, according to Wood Mackenzie.

China, on the other hand, is an exception where REC prices are expected to increase. Wood Mackenzie expects the REC oversupply situation to ease starting from the late 2020s due to state-mandated policies that raise REC purchase requirements from power and non-power industries alike.

In Japan, low REC prices (US$4-5/MWh in 2023 and 2024) are not sufficient to economically support the development of new merchant solar or wind projects. Developers may find feed-in tariff (FiT) or premium (FiP) programs, as well as corporate power purchase agreements (PPAs), more attractive options.

Source: Wood Mackenzie

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.