The swathe of announcements regarding trade policy in recent months has begun to impact business performance across North America, as shown by S&P Global PMI data for February. The impact has been particularly widely reported in Canada, but also in Mexico and the US. While some of the announced tariff changes have yet to be implemented, the PMI data highlight the extent to which the associated uncertainty has already impacted business decisions and could therefore continue to do so again in the months ahead. Here we look specifically at manufacturing production, new export orders, inflation and business confidence across the North American surveys that we conduct to bring out some of the key messages so far.

Production scaled back amid trade uncertainty

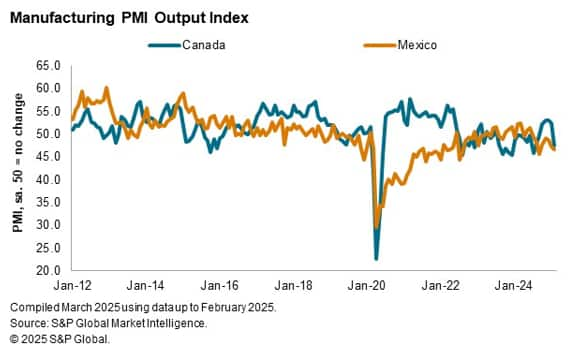

Firms in both the Canadian and Mexican manufacturing sectors reported that the potential imposition of tariffs on their exports to the US had contributed to a reduction in their production volumes in February. The decline was particularly stark in Canada, where output decreased for the first time in five months and to the greatest extent since July last year. Meanwhile, production in Mexico fell for an eighth consecutive month, with the rate of contraction the most pronounced since last September. At the same time, US manufacturing output increased at the fastest pace since May 2022 during February.

As we also publish data broken down by market group, we are able to dig deeper into the industries driving the overall trends. The February data showed that the overall reduction in Canadian output was centred on the intermediate and investment goods categories, while consumer goods firms remained in expansion mode. Moreover, investment goods new orders decreased to the largest extent on record if the opening wave of the COVID-19 pandemic is excluded.

Tariff concerns weigh on Canadian, Mexican and US exports

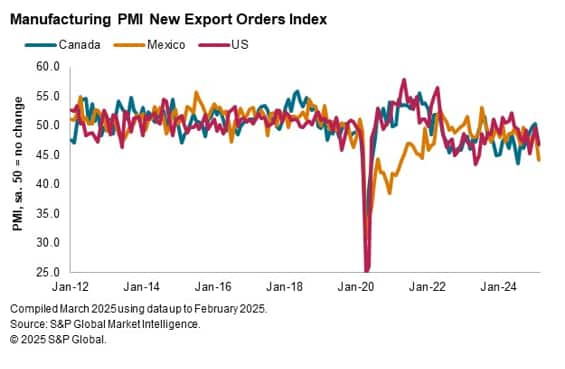

The PMI data for February also revealed significant declines in international orders for goods producers in Canada and Mexico. Survey participants predominantly attributed the downturn to reduced sales to the US market. Many firms observed that clients have grown increasingly cautious regarding tariffs, in turn often reflecting concerns about rising costs. The potential introduction of tariffs could substantially inflate input prices by the time goods are processed through customs, further dampening demand.

The reduction in Canadian manufacturing exports was the quickest since last September, and contrasted with growth at the start of 2025. Meanwhile, Mexico experienced its twelfth consecutive export decline, which was the steepest in nearly four years.

Granular data for Canada revealed widespread contractions in new export orders across all three broad categories of the manufacturing industry. Producers of consumer and intermediate goods signalled the first fall since last October, while the investment goods category faced its ninth consecutive decline and one that was the sharpest since mid-2024.

Across the US manufacturing industry, new export orders decreased for the ninth consecutive month in February and at the second-fastest rate since mid-2023. Qualitative data provided by PMI survey participants showed that concerns over tariffs had contributed to this trend.

Signs of inflationary pressures picking up

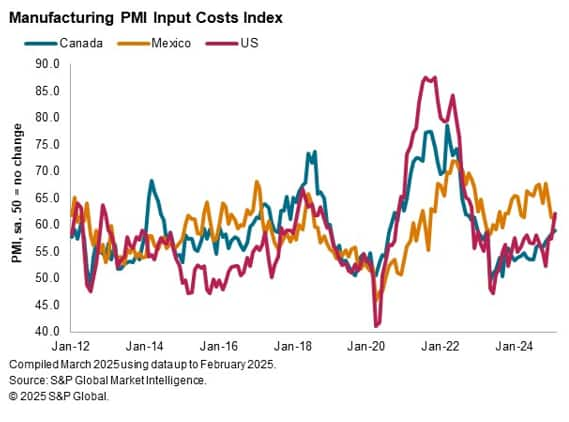

While impacts of tariffs were broadly similar across Canada and Mexico in terms of output and exports, nascent effects on prices were mainly seen in Canada in February. Here, the pace of input cost inflation accelerated to the fastest in almost two years as some firms indicated that their suppliers had already started to raise prices to take account of tariff introductions. The strength of the US dollar also acted to push up costs, with manufacturers raising their selling prices accordingly. The phenomenon of suppliers increasing their prices due to tariffs was also highlighted by respondents to the US manufacturing PMI survey, with the pace of input cost inflation quickening to the fastest since November 2022.

Meanwhile, the strength of the US dollar was also behind the latest sharp rise in input costs in the Mexican manufacturing sector, outweighing the impact of tariffs themselves. Mexican manufacturers actually saw the pace of input price inflation ease to the lowest in almost a year-and-a-half amid a marked reduction in demand for inputs, while output charges (selling prices) were up only marginally.

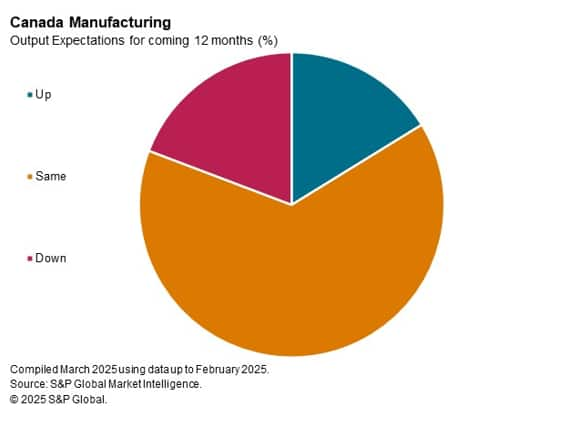

Canadian manufacturers signal sharp decline in business sentiment

Business sentiment in Canada declined markedly in February, with the Future Output Index indicating outright pessimism among manufacturers for the first time in almost five years. The index fell nearly nine points since January and was below the neutral mark of 50.0, indicating that firms on average foresee a reduction in production volumes over the coming 12 months. The only other time that this has been the case was in April 2020 during the opening wave of the COVID-19 pandemic. Concerns over tariffs and trade uncertainty heavily influenced the negative outlook in February, as businesses grapple with challenges such as competition and inflation.

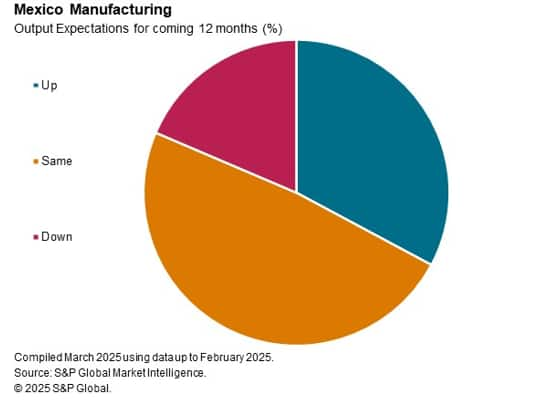

While future sentiment in Mexico also reflected caution, it did not dip to the same extent as in Canada. Mexican panellists were similarly troubled by issues like inflation and tariffs, yet here business confidence remained positive. This suggests that, while both countries face significant challenges in the face of the changing trade environment, Canadian manufacturers forecast a downturn compared to Mexico’s more tempered outlook.

Although confidence among US manufacturers dipped from January’s nearly three-year high, it remained well above its long-run average and consistent with a robust degree of optimism. Respondents were upbeat about potential improvements in the economic and geopolitical landscapes in the coming year, viewing these factors as crucial for driving growth in sales and production.

Weakness in Canada also seen in services

The impact of the uncertainty around tariffs was also seen in the Canadian service sector in February, as a deterioration in market demand fed through to marked reductions in new orders, business activity and employment. Meanwhile, business sentiment dropped to the lowest for just over two-and-a-half years. Meanwhile, US service sector growth eased further in February amid the weakest expansion of new orders in ten months, again often reflecting uncertainty. The weakness we have seen in services illustrates the wide-ranging impacts that changes in trade policy can have, even outside those industries directly affected.

Source: S&P GLOBAL – by Andrew Harker & Pollyanna De Lima

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.