June 20, 2023

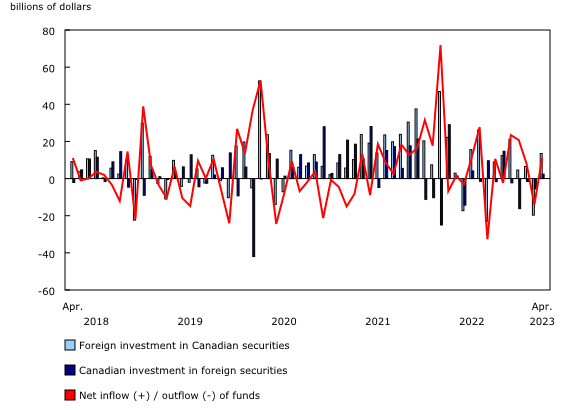

Foreign investors acquired $13.5 billion of Canadian securities in April, following a significant divestment in March. Meanwhile, Canadian investors added $2.4 billion of foreign securities to their holdings, after four consecutive months of reductions. As a result, international transactions in securities generated a net inflow of funds of $11.2 billion into the Canadian economy in April.

Foreign investment in Canadian securities resumes

Foreign investors resumed their acquisitions of Canadian securities as they purchased $13.5 billion in April after divesting $19.7 billion in March. In April, investments from abroad targeted the Canadian bond market and was moderated by a reduction in foreign holdings of equity securities.

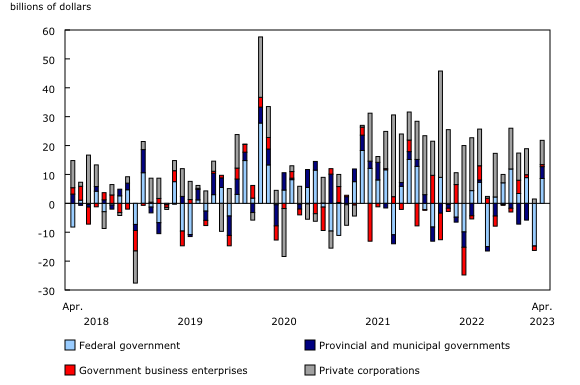

Foreign investors acquired $10.4 billion of Canadian private corporate bonds in April, largely as new issuances of foreign currency instruments by chartered banks. Furthermore, they increased their exposure to federal government bonds by $8.1 billion, after a reduction of $11.1 billion in March. They also acquired $3.2 billion of provincial bonds, their largest investment since January 2022. In April 2023, Canadian long-term interest rates edged down, and the Canadian dollar depreciated against the US dollar.

On the other hand, foreign holdings of Canadian equity securities were down by $8.2 billion in April. The decline was due to the retirement of shares of Canadian firms involved in merger and acquisition activities. Foreign purchases of Canadian shares on the secondary market moderated the overall reduction observed in April. Canadian share prices, as measured by the Standard and Poor’s/Toronto Stock Exchange composite index, were up in April to reach the highest levels since January 2023.

Canadian investors acquire foreign shares

Canadian investors acquired $2.4 billion of foreign securities in April, the first monthly investment in 2023. Investors added $3.5 billion of foreign shares to their holdings, mostly US shares. This activity followed four consecutive months of divestment, totalling $28.2 billion. US share prices, as measured by the Standard and Poor’s 500 composite index, were up by 1.5% in April. The overall investment in foreign securities was moderated by sales of US government bonds (-$2.4 billion). In April, US long-term interest rates fell to the lowest levels since August 2022.

Source: Statistics Canada

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.