May 11, 2024

Gold exports down following a record high in February

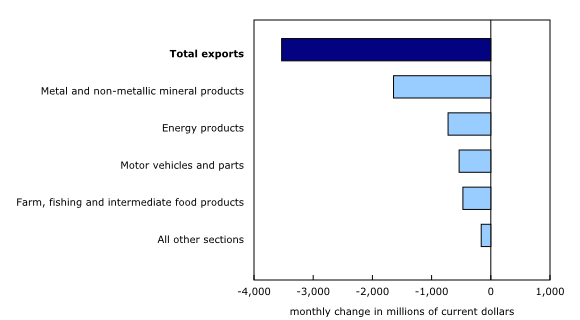

Following an increase of 5.3% in February, total exports fell back 5.3% in March, erasing the gains made in the previous month. Overall, decreases were observed in 9 of the 11 product sections. As was the case in February, exports of unwrought gold were the main contributor to the monthly variation in total exports. Excluding the product group for unwrought gold, exports were up 2.2% in February and down 3.2% in March. In real (or volume) terms, total exports fell 4.7% for the month.

Exports of metal and non-metallic mineral products decreased 17.4% in March. Following a 69.9% surge in February, exports of unwrought gold, silver, and platinum group metals and their alloys—a category largely composed of unwrought gold—contributed the most to the decline, falling $1.6 billion or 32.5% in March. A large number of high-value shipments of unwrought gold to the United Kingdom and Switzerland were observed in February and this level of activity did not repeat in March. Despite the strong monthly decrease, March values were 14.7% higher compared with January values, and 39.4% higher on a year-over-year basis.

Exports of energy products decreased 4.9% in March, mainly on lower exports of crude oil and bitumen (-6.6%). This was the fifth decrease in six months for exports of crude oil. This decline coincided with unplanned shutdowns at refineries in the US Midwest, an important destination for Canadian crude oil. Marine shipments of crude oil to the United Kingdom were also lower in March compared with the previous month.

Following an increase of 3.7% in February, exports of motor vehicles and parts fell 6.3% in March. Exports of passenger cars and light trucks decreased 8.0% to $5.0 billion, their lowest level since December 2022. Following a strong and steady year in 2023, production of passenger cars and light trucks in Canada entered a transition phase in 2024, as several manufacturing plants have begun retooling work on assembly lines to produce new vehicle models. This situation has recently led to larger monthly fluctuations in the exports of these products.

Exports of farm, fishing and intermediate food products (-9.2%) also declined in March. This follows a strong increase in February (+10.3%). Exports of other crop products (-20.7%), wheat (-19.2%) and fresh fruit, nuts and vegetables, and pulse crops (-17.5%) all contributed to the monthly decrease.

Imports down in March, but sustain most of the gains made in February

After increasing 5.2% in February, total imports were down 1.2% in March. Overall, 7 of the 11 product sections decreased. In real (or volume) terms, total imports also decreased 1.2%.

Following an 11.3% increase in February, imports of electronic and electrical equipment and parts were down 8.1% in March. Imports of computers and computer peripherals (-23.0%) contributed the most to the decline, as imports of high-value data processing units (servers) in February did not repeat in March. Imports of communication, and audio and video equipment (-10.9%) also decreased, mainly because of lower imports of cellphones from China.

Imports of metal ores and non-metallic minerals were down 29.2% to $1.3 billion in March, their lowest level since September 2021. Imports of other metal ores and concentrates (-27.9%) decreased the most in March 2024, mainly on lower imports of alumina (a material used to produce aluminum) from Australia and Brazil. Imports of copper ores and concentrates (-79.9%) also declined, in part because of lower imports from Brazil and Peru.

Partially offsetting these declines, imports of metal and non-metallic mineral products rose 10.8% in March. Imports of unwrought gold, silver, and platinum group metals, and their alloys (+77.2%) posted the largest increase, in part because of higher prices.

Exports and imports decrease with both the United States and other countries

Exports to countries other than the United States were down 6.5% in March, in large part because of lower exports to Switzerland (unwrought gold), France (nuclear fuel), and the United Kingdom (unwrought gold and crude oil). Imports from countries other than the United States (-1.3%) also fell, in part due to lower imports from Mexico (passenger cars and light and medium trucks) and Japan (light trucks).

Canada’s trade deficit with countries other than the United States widened from $8.0 billion in February to $8.8 billion in March.

Exports to the United States fell 5.0% in March, while imports decreased 1.1%. As a result, Canada’s merchandise trade surplus with the United States narrowed from $8.5 billion in February to $6.5 billion in March.

Quarterly imports increase, while exports decrease

After an increase of 0.2% in the fourth quarter of 2023, imports were up 0.4% in the first quarter of 2024. Higher imports of electronic and electrical equipment and parts (+3.3%), consumer goods (+1.4%), and energy products (+4.3%) were partially offset by lower imports of motor vehicles and parts (-3.3%).

Following two consecutive quarterly increases, exports fell 1.4% in the first quarter of 2024. Exports of energy products (-4.9%) drove the quarterly decrease, in large part because of lower prices. Lower exports of aircraft and other transportation equipment and parts (-12.4%), motor vehicles and parts (-3.0%), and metal ores and non-metallic minerals (-9.2%) also contributed to the quarterly decline. The overall decrease in exports was partially offset by a strong quarterly increase in exports of metal and non-metallic mineral products, which were up because of higher shipments of unwrought gold.

In real terms, quarterly imports rise, while exports are flat

In real terms (calculated using chained 2017 dollars), imports increased 0.6% in the first quarter. Regarding products, the same contributors to the nominal movement were observed in real terms. Meanwhile, real exports were essentially unchanged in the first quarter. Declines observed in many product sections were offset by higher exports of metal and non-metallic mineral products.

Revisions to February merchandise export and import data

Imports in February, originally reported at $65.2 billion in the previous release, were revised to $65.6 billion in the current reference month’s release. Exports in February, originally reported at $66.6 billion in the previous release, were revised to $66.1 billion in the current reference month’s release.

Monthly trade in services

In March, monthly service exports were down 2.0% to $16.9 billion. Meanwhile, imports of services fell 1.4% to $17.9 billion.

When international trade in goods and services are combined, exports decreased 4.6% to $79.5 billion in March, while imports decreased 1.2% to $82.7 billion. As a result, Canada’s total trade deficit with the world went from $431 million in February to $3.3 billion in March.

Source: Statistics Canada

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.