August 31, 2022

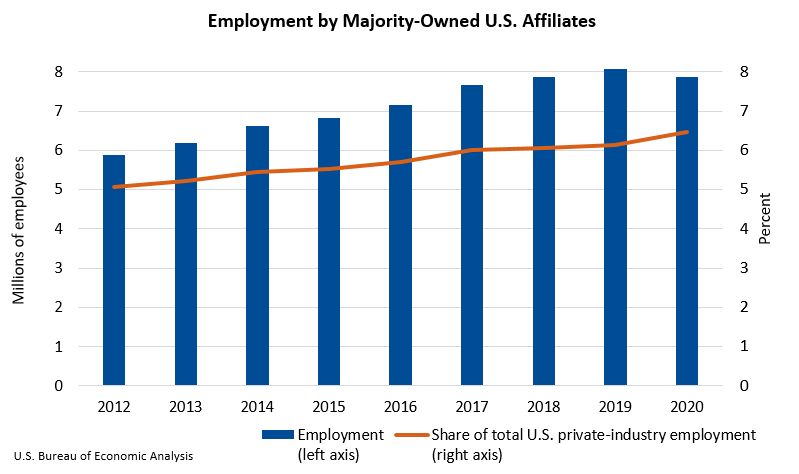

Majority-owned U.S. affiliates (MOUSAs) of foreign multinational enterprises (MNEs) employed 7.86 million workers in the United States in 2020, a 2.8 percent decrease from 8.08 million workers in 2019, according to statistics on MOUSA operations and finances released today by the U.S. Bureau of Economic Analysis (BEA).

MOUSAs accounted for 6.4 percent of total private-industry employment in the United States in 2020, up from 6.1 percent in 2019, as total private-industry employment fell more than MOUSA employment. By industry, employment by MOUSAs was largest in manufacturing and in retail trade. MOUSAs with ultimate owners in the United Kingdom, Japan, and Germany were the largest contributors to total MOUSA employment. (See the section “Additional Information” for definitions of MOUSAs and other terminology used in this release.)

Current-dollar value added of MOUSAs, a measure of their direct contribution to U.S. gross domestic product, decreased 7.0 percent to $1.1 trillion in 2020. MOUSAs accounted for 6.8 percent of total U.S. business-sector value added, down from 7.0 percent in 2019.

Expenditures for property, plant, and equipment by MOUSAs decreased 4.7 percent to $281.8 billion. MOUSAs accounted for 17.6 percent of total U.S. private business capital expenditures. Research and development (R&D) performed by MOUSAs increased 3.0 percent to $71.4 billion. MOUSAs accounted for 14.1 percent of total U.S. business R&D in 2019, the latest year for which all-U.S. business R&D data are available.

By state, private-industry employment accounted for by MOUSAs was highest in South Carolina (9.4 percent), Hawaii (9.4 percent), and Michigan (9.1 percent). In South Carolina and Michigan, MOUSAs in the manufacturing sector employed the most workers, while “other industries,” primarily accommodation and food services, employed the most MOUSA workers in Hawaii.

Source: Bureau of Economic Analysis

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.