09.06.2020

ICI Turkish Manufacturing PMI May 2020 Report and Turkish Sectoral PMI Report Were Announced

The results of Istanbul Chamber of Industry Turkey Manufacturing PMI survey (Purchasing Managers Index), the fastest and most reliable reference for the manufacturing industry’s performance that is the leading indicator of economic growth increased to 40,9 in May; however, it showed that the sectoral operation conditions continue to slow down by staying under 50,0, the threshold value because of Covid-19. Both production and new orders recorded a sharp slowdown in May; however, decreases were limited since some firms started to operate again.

The May data of Istanbul Chamber of Industry Turkish Sectoral PMI showed that Covid-19 pandemic continued to affect the whole Turkish manufacturing industry. Apparent slowdown maintained its existence in the 10 sectors followed up. Clothing and leather products sector became the one which experienced the most apparent speed loss. Employment in chemicals, plastics and rubber sector where the production reached to a balancing point increased in the sharpest level since January 2019 when the data series launched.

The results of Istanbul Chamber of Industry Turkey Manufacturing PMI survey (Purchasing Managers Index), the fastest and most reliable reference for the manufacturing industry’s performance that is the leading indicator of economic growth were announced for the term of May 2020.

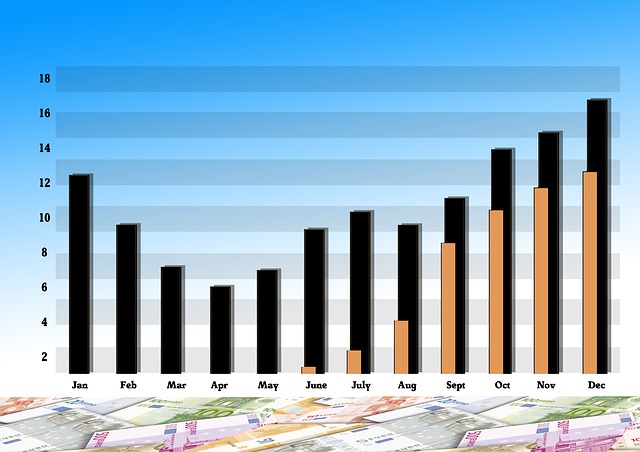

Based on the survey results where all figures measured over 50,0, the threshold value point out to sectoral improvement, PMI which was measured as 33,4 in April increased to 40,9 in May. Besides,it stayed under 50,0, the threshold value pointed out that sectoral operation conditions continued to slow down.

Since Covid-19 continued to harm the operations and limit the demand, both production and new orders recorded a sharp slowdown in May. However, some firms announced that they started their operations in May and decreases realized in a limited level. Manufacturers reduced the production for the second month in a row. However, because majority of the companies didn’t make any change on the number of their personnel, it lost speed and production realized in a more moderate level compared to the new orders. Deficiency in new orders caused firms to slow down their purchasing operations and reduce their both input and final product stocks.

Based on the Covid-19 restrictions, delays experienced in transportation resulted in sharp increases in delivery durations for suppliers. Especially, it was stated that difficulties were experienced in international product purchases. Value loss of Turkish Lira to Dollar resulted in sharp and fast increase in input costs. Inflation of input costs recorded in the highest rate of the last one year. As the reflection of this situation, manufacturers increased their sales prices in a higher level compared to the April and average of series.

Andrew Harker, Economy Director of IHS Markit who evaluated the Istanbul Chamber of Industry Turkish Manufacturing PMI Data expressed that: “Based on the last PMI data, Turkish manufacturing sector continued to fight against the impacts of Covid-19 pandemic in May. Such impacts prevented activity from realizing a strong revival in May following the sharp slowdown in April. On the other hand, moderate nature of the slowdown pointed out that sector is on the way of recovery. If the process of taking virus under control continues, activity might be able to enter into the growth area in the following periods.”

Apparent slowdown maintained its existence in the most of the sectors.

The May data of Istanbul Chamber of Industry Turkish Sectoral PMI showed that Covid-19 pandemic continued to affect the whole Turkish manufacturing industry. Apparent slowdown maintained its existence in the 10 sectors followed up. However, operation conditions showed a ligt speed loss in general compared to the April. Clothing and leather products sector where sharp slowdown maintained its existence became the one which experienced the most apparent speed loss. On the other hand, production in chemicals, plastics and rubber sector approached to the balancing point and it encouraged firms to realize additional recruitment. Labor force increased strongly in the sector and this increase was realized in the strongest level since January 2016 when the data series was launched. All of the other sectors continued to decrease the number of their personnel. All of the 10 sectors followed up showed slow down in new orders.

Andrew Harker, Economy Director of IHS Markit who evaluated the results of May survey stated that: “The scene of May which was not as weak as that of April pointed out that the worst stage in slowdown in the growth was left behind. There are various positive developments in May that caught attention. While the operation conditions in chemicals, plastics and rubber sector improved, balancing indications in business volume encouraged firms to increase their employment volumes. Besides, since the production expectations for 12 months of majority of the sectors are positive, it pointed out that a higher number of sectors might enter into the growth area in the following months.”

Source: Istanbul Chamber of Industry

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.