December 6, 2022

LOW OR NO VALUE FOR RENTAL INCOME IN TÜRKİYE

“The equivalent rental value” is taken as bases in case of low or no value for rental income. According to this basis, equivalent rental income principle shall be applied on the conditions of; leaving the immovable property to the usage of other persons for free, lower value of rental income of rented immovable property than the equivalent rental value.

The equivalent rental value in rented buildings and lands is the rental value determined by authorized specific authorities or courts.

If there is no renting determination or judgment for the aforementioned building or land, the equivalent rental value is 5% of its real estate tax value.

The equivalent rental value in property and rights for other than buildings or lands is 10% of their cost price. If this cost is not known, it is 10% of determined values of them calculated in accordance with valuation of property provisions of Tax Procedure Law. Example: Taxpayer (A) gave up a flat valued 900.000 TL to one of his/her friends without charge in 2021.

In this case, taxpayer (A) need to calculate his/her rental income on the equivalent rental value. The equivalent rental value: 900.000 x 5% = 45.000 TL. This amount should be considered as income to be declared.

The equivalent rental value principle is not applied under the following conditions:

- Leaving empty immovable properties to other person’s residence in order to protect the immovable,

- Allocating the buildings to the residence of the property owner’s mother, father, grandmother, grandmother, children, grand kid or siblings (But, if more than one house allocated to the residences of each of these persons, equivalent rental value is not calculated only for one of these houses. Example, if owner of property has allocated two houses to the residence of his/her child, it will not be calculated equivalent rental value for one house and for the second one it will be calculated.)

- Accommodating of relatives with the property owner in the same house or flat,

- Leasing done by General Budget and by Annex Budget Offices, by provincial administrations and municipalities and by other public institutions and organizations.

EXCEPTION FOR RENTAL INCOME FROM HOUSE

The amount of 7.000 TL for rental income from house for the year 2021 (the exception amount of 9.500 TL for the year 2022) is exempted from the income tax. If persons, who gain a rental income from house, obtain an income less than the amount of exception that is determined annually (the exception amount of 7.000 TL for the year 2021), they are not required to file a tax return.

Example: Taxpayer (B) rented his/her house from 550 TL per month and obtained 6.600 TL annually in 2021. In this case, since the rental income from house is less than the exemption amount of 7.000 TL, it will not be declared by the taxpayer (B).

In the case the rental income is not declared between the dates in time or the rental income is understated, it will not be able to benefit from the exception amount of 7.000 TL for the year 2021. However, those who submit returns, before any determination is made by the administration, on their own accord for their rental income which they did not declare or include in their returns on time, will benefit from the related exception. In case the rental income from house exceeds the amount determined for exception, the amount of exception must be deducted from the rental income to be declared in the annual tax return.

The exception applies only to rental income from properties that have been rented as house. Taxpayers whose rental income from house under 7.000 TL in 2021 do not file a tax return for these incomes.

If there is a rental income obtained and declared at the same time both from house and workplace, the exception applies only to the rental income obtained from house, the exception does not apply to the rental income from workplace.

- Those who have to declare their income from commercial, agriculture or independent personal services,

- Regardless of whether a declaration is required or not, those who obtain a rental income from a residence above 7.000 TL, of whose gross total amount of their income including wage, income from capital investment, rental incomes, other income and gains jointly or severally exceeding the amount of 190.000 TL (the amount of the third income bracket in Article 103 of the Income Tax Law for the wages) for the year 2021,

cannot benefit from the exception amount of 7.000 TL in incomes from immovable property and rights (rental incomes).

Example: In 2021, taxpayer (C) obtained the rental income of 26.400 TL from his/her property that she/he leased out as a residence and the rental income from his/her workplace of 66.000 TL which are taxed wholly by the withholding and the wage of 132.000 TL.

Whether the exception will be applied or not for taxpayer (C)’s rental income from his/her residence will be determined on the basis of whether the total income obtained by taxpayer (C) in 2021 exceeds 190.000 TL or not.

Since the total amount of income (24.600 + 66.000 + 132.000) exceeds 190.000 TL determined for the year 2021, it will not be possible to benefit from the exception of 7.000 TL for the rental income from the residence of 26.400 TL.

In case more than one person has the ownership of a house, the taxation of the rental income obtained from such house will be subject to 7.000 TL (for the year 2021) of the exception separately for each proprietor. Thus, if the inheritance is not shared, every inheritor will benefit from the exception separately.

In case, a taxpayer obtains rental income from more than one house, the exception shall be applied at once to the total amount of rental income.

EXPENSES TO BE DEDUCTED WHEN DETERMINING RENTAL INCOME

In the taxation of rental income, the net amount of the income obtained is determined in two different ways as follows:

Actual expenses method,

Lump-sum expenses method (for other than those who lease out rights).

The selection of the actual expenses or the lump-sum method must cover all immovable property, which means that it is not possible to choose the actual expenses method for some part and the lump-sum expenses method for the remaining part.

Taxpayers opting for the lump-sum expenses method cannot return to the actual expenses method unless two years have passed.

Deduction of Expenses in Actual Expenses Method

If the actual expenses method is chosen, following actual expenses can be deducted from the gross amount of the rental income:

- Lighting, heating, water and elevator expenses paid by lessor for rented property,

- Management costs which are measured according to the importance of property and related with the administration of the rented property,

- Insurance expenses relating to the rented property and rights,

- Interest of debts relating to the rented property and rights,

- 5% of acquisition value of one rented house for 5 years beginning from the date of acquisition (This deduction applies only to rental income of the rented house; non-deductible part is not evaluated as expenditure surplus. This deduction is not valid for houses acquired before 2017),

The discount of 5% of the acquisition value will only be applied to one real estate rented as a residence. If the rental income is obtained from more than one real estate, this discount will not be

used for other real estates. Also, real estates rented as workplaces will not benefit from the 5% expense deduction.

- Taxes, duties and fees paid for the rented property and rights and rates paid to municipalities for expenses by lessor,

- Depreciation setting aside for rented property and rights, and heat insulation and energy saving expenditures which are made by the lessor and that increase the economic value of the real estate.

- (These expenditures can be considered as cost if it exceeds 1.500 TL for the year 2021.)

- Repair and maintenance expenses incurred by lessor for the rented property,

- Rents and other actual expenses paid by sub-lessors,

- Rent of the house accommodated by the lessors who rent their own property, (non-deductible part is not evaluated as expenditure surplus),

It is not allowed for taxpayers not residing in Türkiye, (including Turkish nationals who reside abroad for a continuous period of more than six months with a residence or work permit) to deduct the amount of rents they pay in a foreign country from their rental income obtained in Türkiye.

Cost of loss, detriments and compensations paid for rented property and rights based on a contract, law or court decree.

Non-residents who have opted for the actual expenditure method should keep the documents showing the expenses incurred for a period of 5 years and submit to the tax office when required.

Calculation of Deductible Expenses in Case of Exception in Actual Expenses Method

In case, a taxpayer chooses the actual expenses method and benefits from the exception applied to rental income from house, the part of actual expenses corresponding to the exception shall not be deducted from gross revenues.

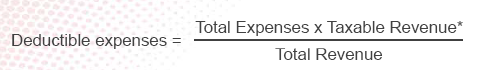

The part of deductible expenses corresponding to the taxable revenue will be calculated using the following formula:

(*) Taxable Revenue = Total Revenue – Amount of Exception for Rental Income from House

Example: Taxpayer (D) rented his/her house in 2021 and obtained 66.000 TL of rental income. Taxpayer, who has no any other income, incurred 16.500 TL of expenditure for his/her property and chooses the actual expenses method.

The amount that taxpayer can deduct as actual expenses will be the amount that corresponds to the taxable revenue of the total expense for 16.500 TL.

Taxable revenue = 66.000 – 7.000 = 59.000 TL

Deductible expense = (16.500 x 59.000) / 66.000 = 14.750 TL

In case, the amount of actual expense to be deducted from the rental income is 14.750 TL.

Deduction of Expenses in Lump-sum Expenses Method

Taxpayers opting for the lump-sum expenses method can deduct the lump-sum expense at the rate of 15% from their revenue against actual expenses. The lump sum expense, for taxpayers who obtain a rental income and who will be able to benefit from the residence exemption, will be calculated over the remaining amount after deducting the exception amount.

It is not possible to opt for lump-sum expenses method in the case of renting rights. For example, taxpayers, who gain a rental income from workplace and income from renting rights, must choose actual expenses method in their income tax return.

Taxpayers who have opted for the lump-sum method can deduct as a lump- sum expenses at 15% of their revenue. The lump-sum expenses rate is determined at 15% of the revenue to be applied to

rental income from the date of January 1st, 2017.

Source: Revenue Administration of Republic of Türkiye

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.