October 24, 2022

- Current account recorded €26 billion deficit in August 2022, increasing from €20 billion in previous month

- Current account recorded deficit of €19 billion (0.1% of euro area GDP) in 12 months to August 2022, after surplus of €338 billion (2.8%) one year earlier

- In financial account, euro area residents’ net acquisitions of non-euro area portfolio investment securities totalled €38 billion and non-residents’ net acquisitions of euro area portfolio investment securities totalled €42 billion in 12 months to August 2022

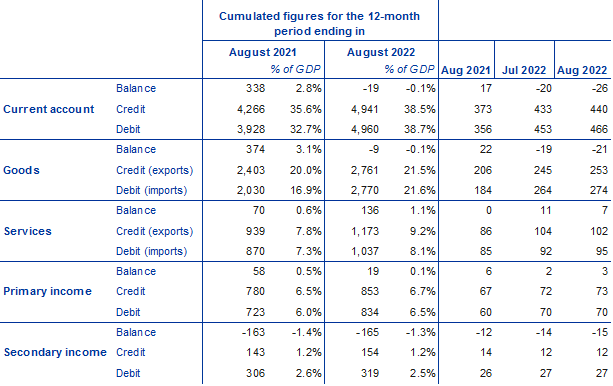

The current account deficit of the euro area amounted to €26 billion in August 2022, an increase of €6 billion from the previous month (Chart 1 and Table 1). Deficits were recorded for goods (€21 billion) and secondary income (€15 billion). These were partly offset by surpluses for services (€7 billion) and primary income (€3 billion).

Table 1

Current account of the euro area

(EUR billions unless otherwise indicated; transactions; working day and seasonally adjusted data)

Source: ECB. Note: Discrepancies between totals and their components may be due to rounding.

Data for the current account of the euro area

In the 12 months to August 2022, the current account recorded a deficit of €19 billion (0.1% of euro area GDP), compared with a surplus of €338 billion (2.8% of euro area GDP) in the 12 months to August 2021. This change in the balance was mainly driven by a switch from a surplus (€374 billion) to a deficit (€9 billion) for goods and, to a lesser extent, by a reduction in the surplus for primary income (down from €58 billion to €19 billion) and a slightly larger deficit for secondary income (up from €163 billion to €165 billion). These developments were partly offset by a larger surplus for services (up from €70 billion to €136 billion).

Chart 2

Selected items of the euro area financial account

(EUR billions; 12-month cumulated data)

Source: ECB. Notes: For assets, a positive (negative) number indicates net purchases (sales) of non-euro area instruments by euro area investors. For liabilities, a positive (negative) number indicates net sales (purchases) of euro area instruments by non-euro area investors.

In direct investment, euro area residents made net investments of €186 billion in non-euro area assets in the 12-month period to August 2022, following net investments of €24 billion in the 12 months to August 2021 (Chart 2 and Table 2). Non-residents disinvested €3 billion in net terms from euro area assets in the 12-month period to August 2022, following net disinvestments of €63 billion in the 12 months to August 2021.

In portfolio investment, euro area residents’ net sales of non-euro area equity amounted to €56 billion in the 12 months to August 2022, following net purchases of €540 billion in the 12 months to August 2021. In the 12 months to August 2022, net purchases of non-euro area debt securities by euro area residents decreased to €94 billion, down from €425 billion in the 12 months to August 2021. Non-residents’ net purchases of euro area equity decreased to €203 billion in the 12-month period to August 2022, down from €435 billion in the 12 months to August 2021. Over the same period non-residents made net sales of euro area debt securities amounting to €161 billion, following net sales of €277 billion in the 12 months to August 2021.

Table 2

Financial account of the euro area

(EUR billions unless otherwise indicated; transactions; non-working day and non-seasonally adjusted data)

Source: ECB. Notes: Decreases in assets and liabilities are shown with a minus sign. Net financial derivatives are reported under assets. “MFIs” stands for monetary financial institutions. Discrepancies between totals and their components may be due to rounding.

Data for the financial account of the euro area

In other investment, euro area residents recorded net acquisitions of non-euro area assets amounting to €467 billion in the 12 months to August 2022 (following net acquisitions of €86 billion in the 12 months to August 2021), while their net incurrence of liabilities increased to €674 billion (up from €616 billion in the 12 months to August 2021).

Chart 3

Monetary presentation of the balance of payments

(EUR billions; 12-month cumulated data)

Source: ECB. Notes: “MFI net external assets (enhanced)” incorporates an adjustment to the MFI net external assets (as reported in the consolidated MFI balance sheet items statistics) based on information on MFI long-term liabilities held by non-residents, available in b.o.p. statistics. B.o.p. transactions refer only to transactions of non-MFI residents of the euro area. Financial transactions are shown as liabilities net of assets. “Other” includes financial derivatives and statistical discrepancies.

The monetary presentation of the balance of payments (Chart 3) shows that the net external assets (enhanced) of euro area MFIs decreased by €159 billion in the 12-month period to August 2022. This decrease was driven by euro area non-MFIs’ net outflows in direct investment, other investment, portfolio investment debt and other flows. These developments were partly offset by the current and capital accounts surplus and by euro area non-MFIs’ net inflows in portfolio investment equity.

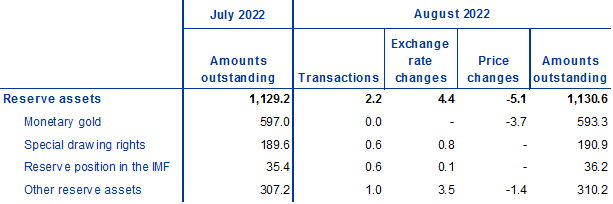

In August 2022 the Eurosystem’s stock of reserve assets increased to €1,130.6 billion, up from €1,129.2 billion in the previous month (Table 3). This increase was driven by positive exchange rate changes (€4.4 billion) and, to a lesser extent, by net acquisitions of assets (€2.2 billion), which were partly offset by negative price changes (€5.1 billion).

Table 3

Reserve assets of the euro area

(EUR billions; amounts outstanding at the end of the period, flows during the period; non-working day and non-seasonally adjusted data)

Source: ECB. Notes: “Other reserve assets” comprises currency and deposits, securities, financial derivatives (net) and other claims. Discrepancies between totals and their components may be due to rounding.

Source: European Central Bank (ECB)

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.