September 8, 2023

Curbing cross-border illicit proceeds demands a united global effort and innovative approaches

Cross-border financial crime is here to stay. While people everywhere enjoy the convenience of a globally connected financial system, criminals exploit this intricate network to move illicit funds across borders and evade capture. As these criminals protect their ill-gotten wealth derived from tax evasion, corruption, and drug trafficking, among others, financial crimes thrive. No financial institution or country is immune. Money laundering scandals caused bank collapses and shocked countries. Ultimately, society pays the cost through an erosion of trust in the integrity of the financial system, often leading taxpayers to subsidize failing banks and limiting customer access to credit.

Banks, as gatekeepers to the financial system, battle unceasingly against money laundering and terrorist financing. But national anti-money laundering efforts focus primarily on domestic risks, and as a result they often lag. Bank regulators also play a crucial role, but often don’t make the best use of limited resources, and divergent approaches hamper effective global collaboration.

IMF staff partnered with eight Nordic and Baltic countries—Denmark, Estonia, Finland, Iceland, Latvia, Lithuania, Norway, and Sweden—in a first-of-its-kind anti-money laundering technical assistance project. Our findings reveal that combatting money laundering is beyond the capacity of any single nation—and that countries must innovate together to find a solution.

Tracking criminal proceeds

IMF staff is constantly expanding the toolkit to help Fund members focus on cross-border illicit flows. Using machine learning technologies and data analysis, we scrutinize financial movements, gaining insights into the global landscape and identifying indicators of potential macro-critical money laundering scenarios. Our analysis features in the annual health checks of IMF member economies (e.g., Singapore 2022 Article IV consultation) and under the Financial Sector Assessment Program (e.g., UK 2022 FSAP).

Collaborating with the Nordic-Baltic countries, we used these tools to improve countries’ understanding of unusual financial flows warranting scrutiny. These tools enhance countries’ ability to screen potential illicit financial flows and focus on emerging threats. Collaboration also allows countries to identify and connect seemingly disconnected cross-border money laundering and terrorism financing threats.

Following the money also involves considering countries chosen by criminals for cleaning illicit gains. This allows key anti-money laundering agencies to develop measures to enhance scrutiny of unusual transactions passing through their financial systems that originate in high-risk jurisdictions.

Knowing the breaking point

While the Fund’s focus on macroeconomics and the link between financial stability and financial integrity risks is well established across our work our project with the Nordic-Baltic countries further expands our efforts to better quantify the financial stability impact of money laundering shocks.

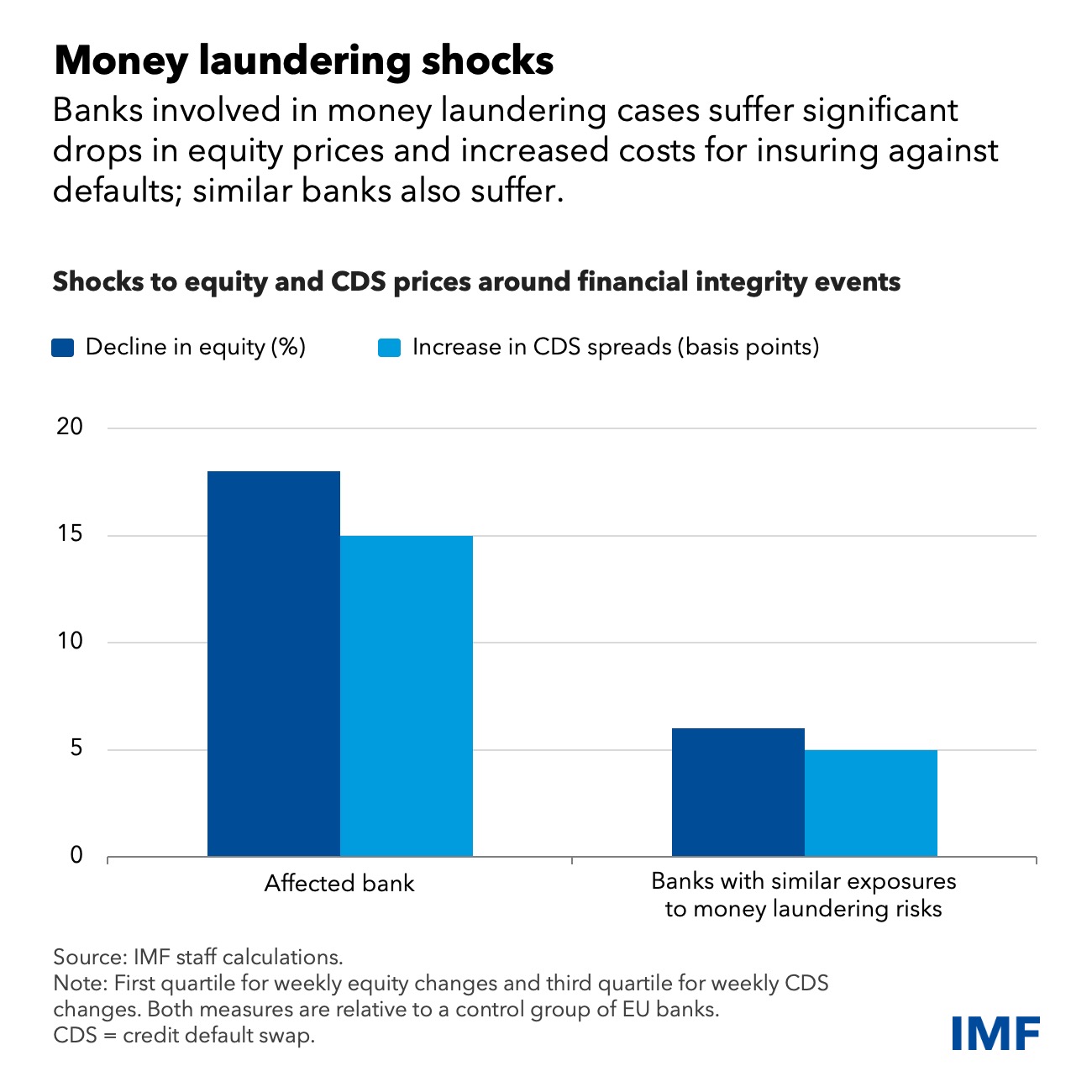

Examining data related to regional money laundering cases reveals a telling pattern: banks grappling with financial integrity concerns suffered sharp stock price drops, elevated perceived credit risks, and declines in deposits affecting their liquidity. Moreover, the money laundering shocks triggered equity price declines and heightened the cost of insuring against a corporate default, as shown by credit default swap prices. And that’s only what happened at an individual bank level. Looking at the regional impact, substantial spillover effects affected other key regional banks, indicating a contagion dynamic between the affected banks and their counterparts.

Helping the gatekeeper

Taking a broader perspective, our study of the supervisory frameworks within the Nordic-Baltic region led to recommendations at both country and regional levels.

As main gatekeepers of the financial system, banks must prevent and detect money laundering. Criminals find banks alluring due to their extensive cross-border networks, interbank ties, and products and services that open themselves up to the risk of money laundering. A parallel borderless trend is the rise of crypto assets, offering speedy global transfers attractive to criminals.

That is why it’s imperative that national regulators who supervise banks’ anti-money laundering efforts are able to look at the bigger picture when overseeing them. With a global supervisory mechanism lacking, supervisors need to broaden their perspective, scrutinizing non-resident risks and inter-border laundering countermeasures. This calls for stronger international collaboration, a point emphasized by IMF staff (e.g., Euro Area Article IV consultation).

Going forward, while good practices are emerging in cross-border transaction data collection and analysis, the integrated banking system calls for greater cross-border data collection to better understand and mitigate these risks. Technological solutions can aid in analyzing this information to create a regional picture for targeted supervisory efforts, including multi-country initiatives. Countries should also exchange data on money laundering incidents, while also delving deeper into the need for banks to bolster capital reserves against associated losses.

Regulators should also vigilantly monitor newer entrants to international finance, such as crypto asset service providers, with risk-adjusted scrutiny. Given the global nature of these providers, cross-border cooperation remains key here as well.

The bottom line is that continued analysis of financial integrity’s impact on stability can fortify the global financial system against money laundering shocks.

Returning to the Nordic-Baltic project, the region’s narrative serves as a cautionary tale: “Invest in preventive and mitigating measures before the scandal is at your doorstep.” Presently, the commitment to prevent money laundering in the region is a priority at the highest levels of the different governments concerned.

Source: IMF BLOG – by Pierre Bardin, Antoine Bouveret, Grace Jackson, Maksym Markevych

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.