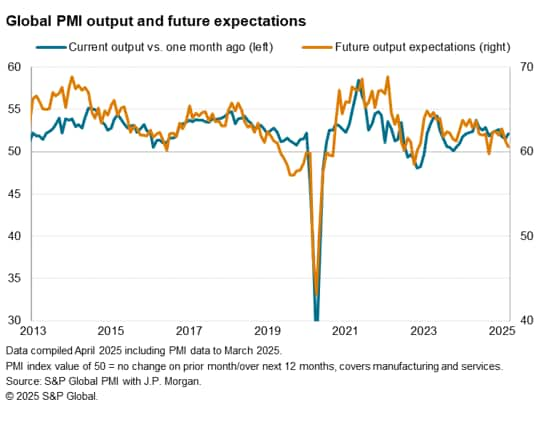

The worldwide PMI surveys – produced S&P Global in association with ISM and IFPSM for J.P.Morgan – recorded faster global output growth in March, but a deterioration in business expectations about the year ahead suggested that the improvement may be short lived.

Stronger current output growth was also in part fuelled by temporary factors, notably a weather-related upturn in the US services sector and additional manufacturing production in Europe ahead of US tariffs.

Business confidence meanwhile deteriorated across the board in the major developed and emerging markets bar only Russia, leaving global optimism at one of its lowest ebbs seen over the past two years. Tariffs were cited as the main cause of concern in relation to the business outlook, affecting confidence among both manufacturing and service sector companies.

Global PMI rises in March but rounds off worst quarter since 2023

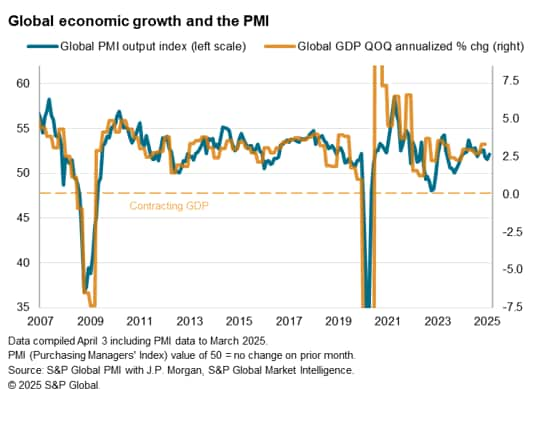

S&P Global Market Intelligence’s PMI surveys indicated that global business activity expanded for a 26th successive month in March, with the growth rate lifting from February’s 14-month low to the fastest recorded in the year-to-date.

The headline J.P. Morgan Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, rose from 51.5 in February to 52.1 in March.

Despite the improvement in March, the average PMI reading for the first quarter was the weakest since the fourth quarter of 2023.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.5% in March (and 2.3% in the first quarter). This compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic and an estimated 3.3% rate in the fourth quarter of last year.

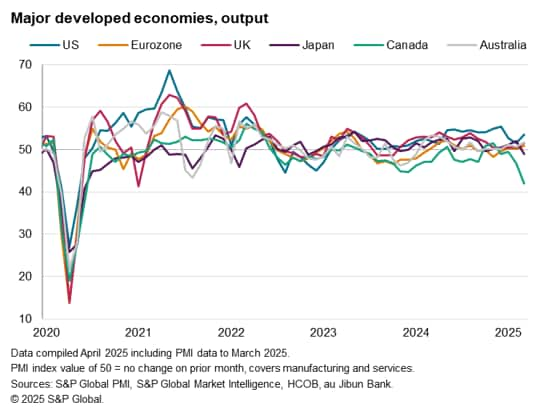

US loses steam to no longer outpace other developed economies, Canada’s downturn deepens

US growth perked up from a 10-month low in February, reaching the highest seen so far this year. But average growth in Q1 is still down markedly on that seen in Q4 of last year, signalling a slowing of annualised GDP growth to around 1.5%.

The US expansion outpaced the further modest gains seen in the eurozone, UK and Australia, all of which have seen the PMIs signal only marginal GDP expansions over the first quarter.

By far the worst performer was again Canada, where output fell at its steepest rate since the height of the pandemic downturn in June 2020. Output in Canada has now contracted for four successive months, with the rate of decline accelerating sharply in the past two months.

Japan moved into decline, with output dropping for the first time since last October and at the joint-sharpest rate for just over three years.

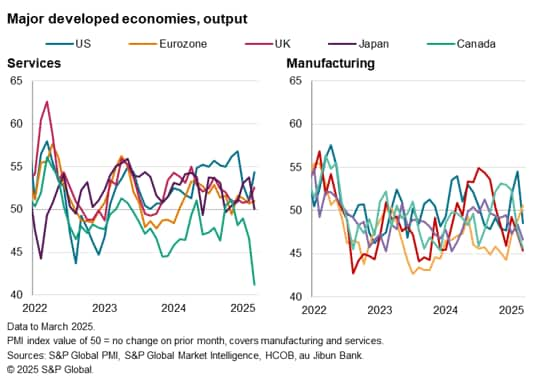

Markedly divergent trends were seen for service sector growth among the major developed economies. While US service providers reported a rebound in March thanks in part to more clement weather, services activity contracted in Canada at the sharpest rate since early pandemic lockdowns in 2020. Services growth also stalled in Japan, in part due to labour shortages. Faster expansions were meanwhile seen in the service sectors of the UK and eurozone.

In manufacturing, only the eurozone eked out any output growth among the major developed economies in March, reporting the first production rise in two years. However, the rise in part reflected the front-running of US tariffs. The steepest manufacturing declines were meanwhile seen in the UK and Canda, with a sharp fall also seen in Japan. US factory production meanwhile fell after two months of growth.

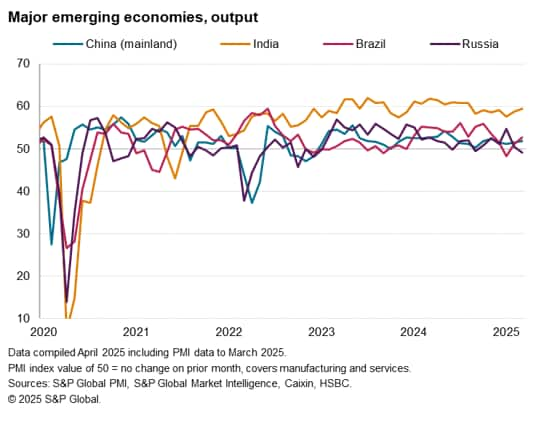

Russian contraction bucks wider emerging market upturn

Output fell in Russia during March for the first time since last September, dropping at the sharpest rate for 27 months as a steep decline in the manufacturing sector was accompanied by a near-stalling of services output.

All other BRIC “emerging” economies reported faster expansions, led once again by India, which continued the outperformance seen since July 2022. Growth in India hit the highest since last August as a jump in manufacturing output offset a slight slowing of the service sector’s recent strong expansion.

Brazil’s output meanwhile rose for a second month after the brief decline seen in January, expanding at the sharpest pace since November. Reviving service sector growth accompanied another solid gain in manufacturing output.

Mainland China’s expansion continued at a modest pace, the rate of growth lifting slightly higher to the fastest since last November on the back of small accelerations in manufacturing and services growth.

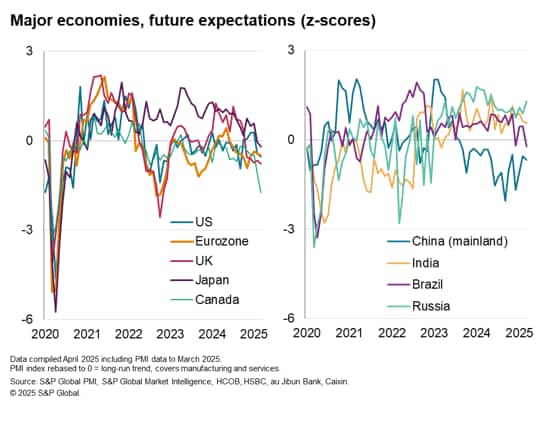

Global business confidence at second-lowest since late-2022

Looking for clues as to the outlook, the global PMI surveys saw worldwide order books continue to expand as new order inflows rose at a slightly faster rate than in February. But a more worrying picture was presented by the future output expectations index. Globally, optimism about the year ahead sank in March to its lowest since last September (in the lead up to the US election), and prior to that the lowest since November 2022. Confidence fell in both manufacturing and services.

Optimism plunges in Canada but also falls in all other major economies bar Russia

The weakening of sentiment reflected intensifying concern over US tariffs, the economic impact of which was also anticipated beyond the goods-producing sector via lower consumer and business spending on services. Additionally, US companies often cited concern over federal government spending cuts and the associated impact on household confidence. Elsewhere, some support to confidence was seen to allay some of the tariff-related worries, notably in Europe in relation to higher fiscal spending.

Confidence fell in all major developed economies, though sentiment was by far lowest in Canada when compared to long-run averages. Canadian business expectations hit their lowest since May 2020, hitting a 13-year survey record low in manufacturing but also slumping services amid concerns over tariff-spillover effects.

Future expectations in the UK and Japan meanwhile fell to their lowest since December 2022 and January 2021 respectively, while US sentiment hit a six-month low and a three-month low was recorded in the eurozone. In all cases, these developed world sentiment gauges fell further below their long-run averages.

In the major emerging markets, sentiment also fell deeper below long-run averages in mainland China and Brazil, the latter now down to a near-four-year low. Future sentiment meanwhile slipped to a five-month low in India but perked up to a ten-month high in Russia.

Source: S&P GLOBAL – by Chris Williamson

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.