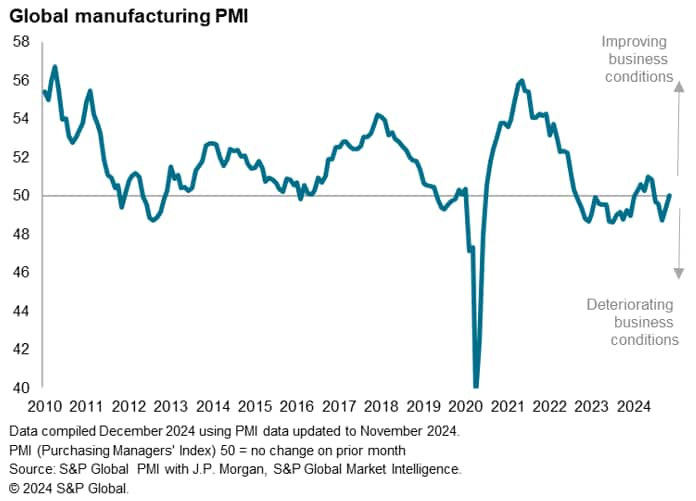

Improved business conditions in mainland China (with a five-month high PMI reading of 51.5) and the rest of Asia (where the PMI rose to 51.1) contrasted with a deepening downturn in the Eurozone (whose PMI sank to 45.2), though conditions came close to stabilising in the United States (PMI at a five-month high of 49.7).

Here are our top five takeaways from November’s manufacturing PMI surveys sub-indices, which provide a deeper insight into manufacturing business conditions by analysing varying trends of output, demand, inventories, supply chains, employment and prices.

1. Asian output rise offset by falls in Europe and North America

The PMI survey’s sub-index of production, which tracks actual month-on-month changes in factory output, reached a five-month high in November, signaling a second monthly marginal rise in production volumes after output had fallen in September.

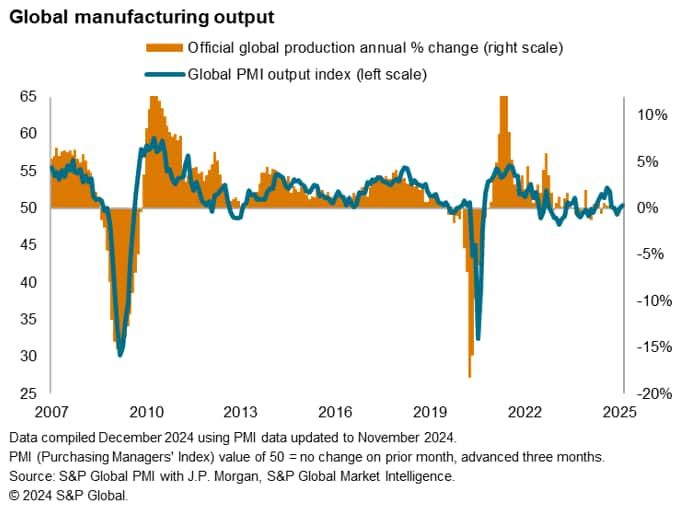

The survey data exhibit a correlation of 75% with the official annual rate of change in global production, with the survey data acting with a three-month lead. Using a simple regression-based model, the latest PMI data indicated that worldwide manufacturing output has risen marginally so far in the fourth quarter after a flat picture over the third quarter as a whole.

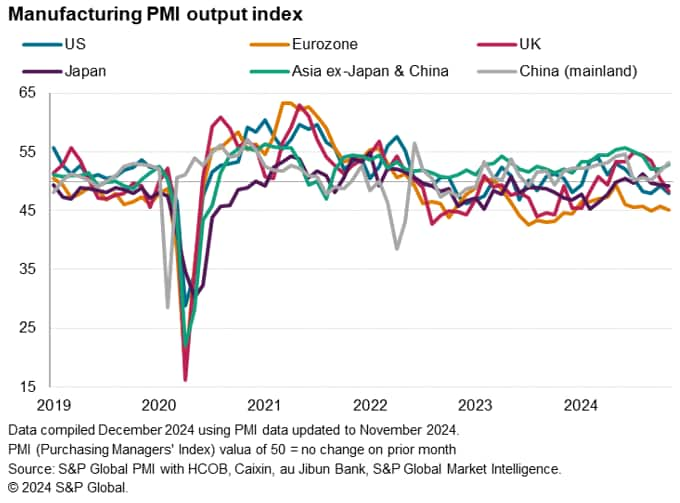

However, marked variations in production trends around the world persisted into November, characterised by faster output growth in Asia offset by falling production in Europe and North America.

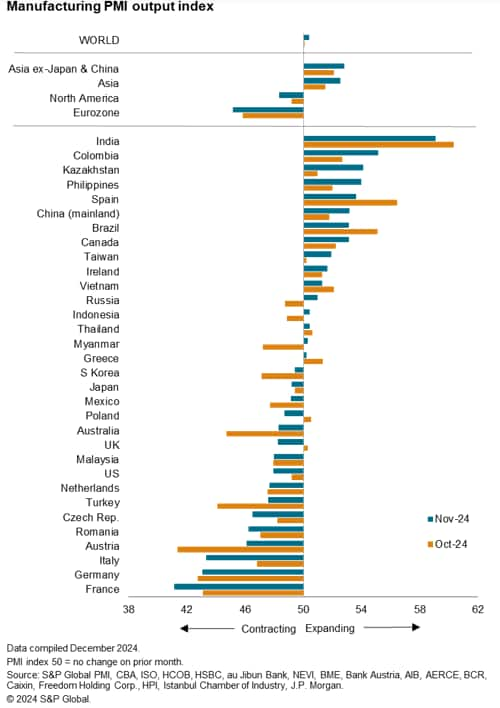

In total, output rose in 16 of the 32 individual economies for which PMI data are available but fell in the remaining 16. India continued to report the strongest expansion of production by a wide margin. However, among the major economies, especially robust expansions were also reported in the Philippines, Spain, mainland China, Brazil, Canada and Taiwan. Of these, growth rates accelerated in all bar Spain and Brazil. Canada’s production growth notably hit a two-and-a-half year high while a five-month high was seen in mainland China.

At the other end of the scale, the four steepest rates of decline were all seen among eurozone member states, led by France, Germany, Italy and Austria, with neighboring Czech Republic reporting the fifth-fastest decline. EU-neighboring Turkey reported the sixth-steepest fall, followed by the Netherlands, another eurozone member state.

The eurozone as a whole consequently once again recorded the sharpest contraction of production on a regional basis, followed by North America, where Canada’s production gain was offset by declines in the US and Mexico. In contrast, growth in Asia accelerated to a five-month high, albeit curbed by modest falls in output in Japan, South Korea and Malaysia.

One other notable substantial change seen in November was the first fall in output for seven months in the UK, where the production decline was the sharpest since February.

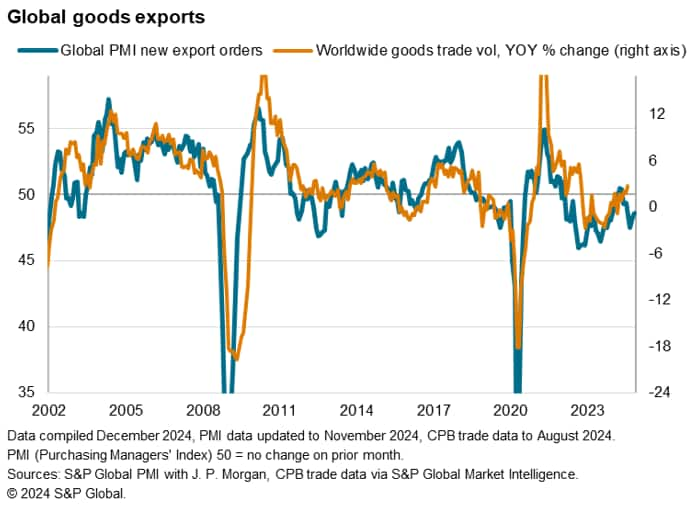

2. Global goods trade remains firmly in decline as firms cut inventories

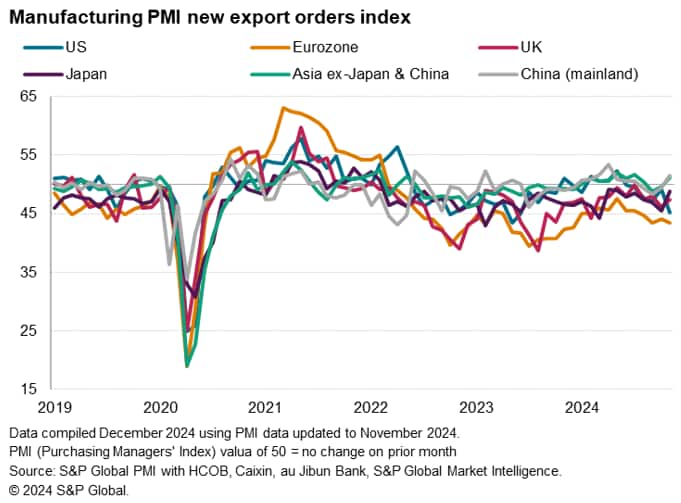

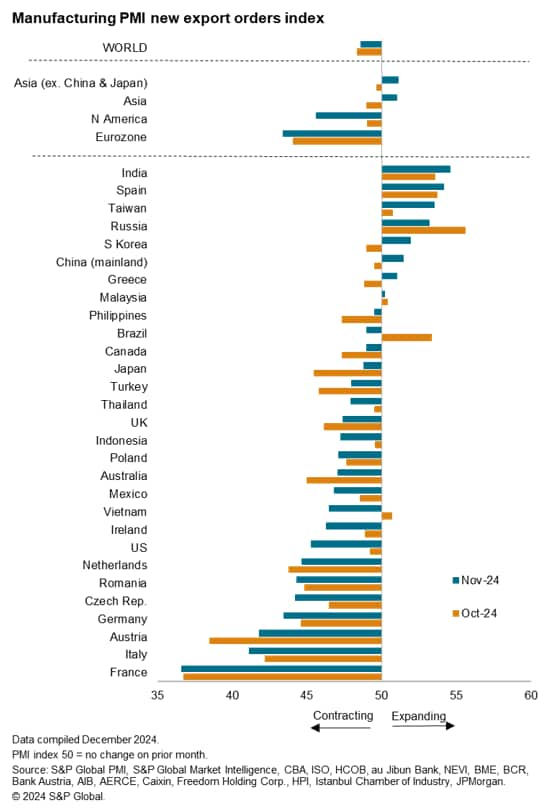

Global manufacturing new orders rose marginally, buoyed by rising domestic demand and a moderating rate of decline in global trade flows. New export orders fell for a sixth straight month in November, but at the slowest rate seen over the past four months.

The PMI data point to global trade volumes falling 2% in year-on-year terms so far in the fourth quarter of 2024.

Among the major economies, an especially marked export decline in the eurozone was accompanied by steepening trade losses in the US but with moderating declines recorded in Japan and the UK. Exports from mainland China meanwhile rose at the fastest rate for seven months, contrasting with declines seen in the prior three months, and the rest of Asia also saw its first export gain since July.

Export gains were in fact limited to just eight countries, led by India with Spain notably following close behind in second place to buck the broader trade malaise reported out of the eurozone. Strong export gains were also seen in Taiwan and South Korea, as well as Russia. Mainland China’s export improvement lifted it to sixth place in the rankings.

The bottom of the export rankings was dominated by European economies, with France reporting the sharpest decline.

3. Stockpiling on the rise

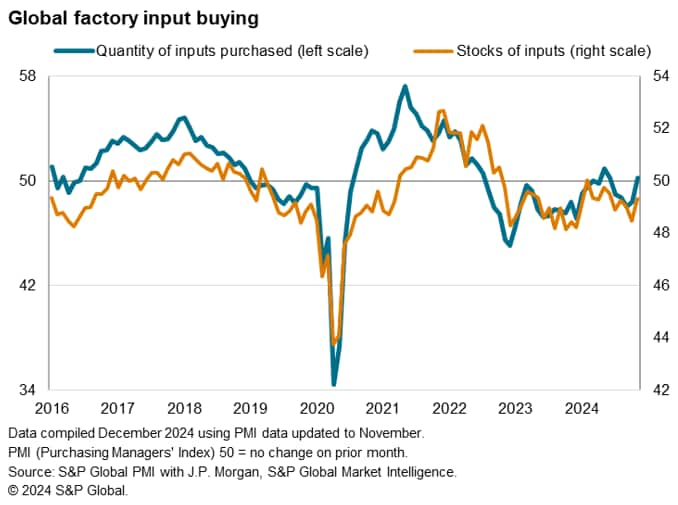

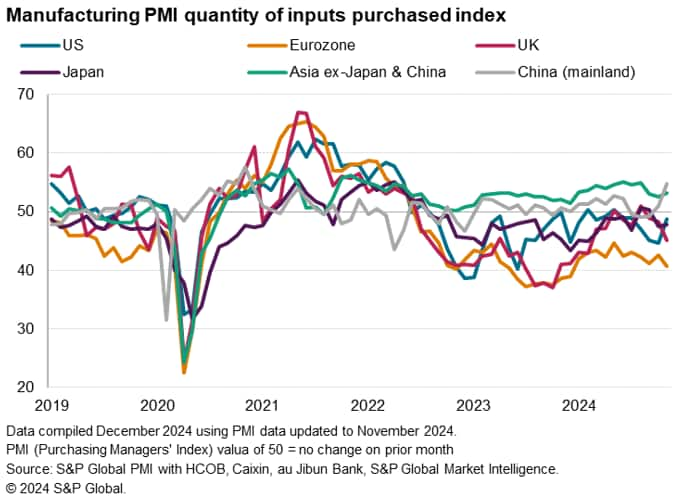

Global goods exports have now fallen almost continually since early 2022 amid the post-pandemic shift in demand from goods to services and a sustained trend toward inventory reduction. The amount of inputs purchased by manufacturers has likewise fallen almost continually since mid-2022, but rose marginally for the first time in five months.

Two key developments in purchasing behaviour were evident in November. First, factories in mainland China reported the largest rise in purchases for four years. Only India and Kazakhstan reported a greater rise in purchases than China in November. However, among the major economies, the biggest positive change in purchasing activity was seen in the US, where the rate of decline moderated sharply.

4. Tariffs alter buying behaviour

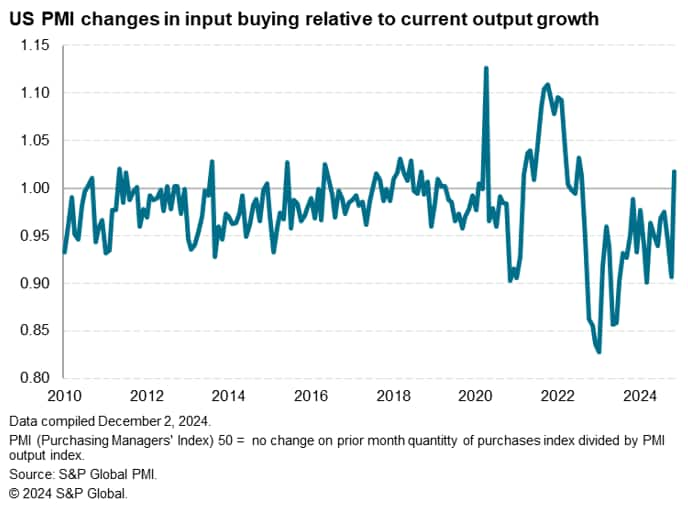

These changes in purchasing behaviour could be in part linked to the threat of US tariffs, notably in relation to exports from China. One-in-four US manufacturers reporting higher purchases attributed this buying to front-running tariffs on imported inputs.

Higher purchases in mainland China were meanwhile likewise often linked to the ramping up of production and exports amid customer stockpiling in advance of tariffs, though increased domestic stimulus measures form the authorities in China were also seen as having boosted near-term production.

The ratio of US input buying to current production rose to the highest seen since the 2018 tariffs barring pandemic-related stockpiling.

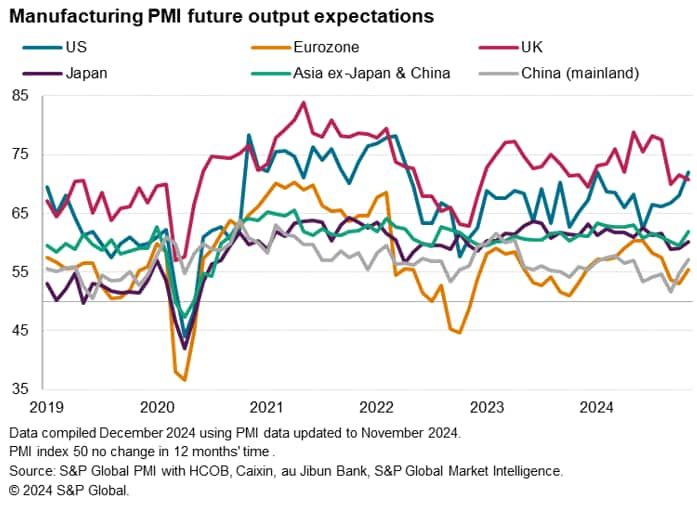

5. Global business confidence hits six-month high, boosted by US production optimism

However, while in part due to the front-running of tariffs, this increase in buying also reflected growing optimism about US production in the year ahead, for which expectations rose in November to the highest for over two and a half years, pushing US manufacturing optimism above that of all other major economies.

However, future expectations also improved in most other major economies bar the UK, the latter having seen sentiment subdued by tax-hiking budgetary changes, often attributed to the prospects of lower interest rates and a moderation of the cost of living crisis that has affected many economies. In mainland China, sentiment hit an eight-month high buoyed also by domestic stimulus. Measured globally, future optimism hit a six-month high in December.

Source: S&P GLOBAL – by Chris Williamson

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.