November 22, 2023

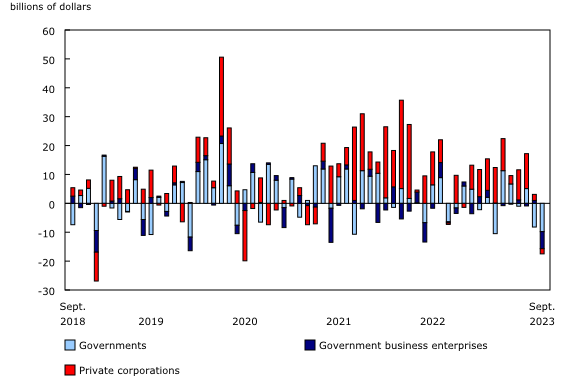

Foreign investors reduced their holdings of Canadian securities by $15.1 billion in September, mainly due to retirements of bonds. Meanwhile, Canadian investors acquired $11.6 billion of foreign securities, ending the third quarter with the largest investment since the fourth quarter of 2021.

As a result, international transactions in securities generated a net outflow of funds of $26.7 billion from the Canadian economy in September 2023. The outflow of funds reached a record $41.4 billion in the third quarter, completely offsetting the inflow of funds of $39.4 billion recorded in the first half of the year.

Largest retirements of Canadian bonds since December 2018

Non-resident investors reduced their exposure to Canadian securities by $15.1 billion in September 2023. Overall, retirements of bonds were moderated by foreign acquisitions of equity securities during the month.

The reduction in foreign holdings of Canadian bonds totalled $17.5 billion in September with retirements totalling $20.4 billion, the highest amount since December 2018. These retirements were in both government and corporate bonds, with the latter mainly composed of instruments backed by mortgages. In September 2023, Canadian long-term interest rates reached the highest level since December 2007.

Non-resident investors acquired $1.6 billion of Canadian shares in September 2023, after nine consecutive months of divestment. Investments in shares of the manufacturing as well as the trade and transportation industries were moderated by a divestment in shares of the banking sector. Canadian share prices, as measured by the S&P/TSX index, fell 3.7% in September.

Strong Canadian investment in foreign bonds

Canadian investors added $11.6 billion of foreign securities to their holdings in September, led by a $10.5 billion investment in foreign bonds. The investment in non-US foreign bonds (+$6.7 billion) reached the highest amount in a year and mainly targeted government bonds. In addition, investors acquired $3.8 billion of US bonds in September, after buying $3.7 billion of US bonds in the previous month. US long-term interest rates rose in September, to the highest level since October 2007.

Canadian acquisitions of foreign shares slowed to $1.7 billion in September 2023. Nonetheless, Canadian investment in foreign shares totalled $20.3 billion in the third quarter, the highest since the fourth quarter of 2021. Share prices in major foreign equity markets decreased in September 2023.

Source: Statistics Canada

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.