Euro area bank interest rate statistics: September 2024

- Composite cost-of-borrowing indicator for new loans to corporations decreased by 21 basis points to 4.80%, driven by interest rate effect; indicator for new loans to households for house purchase decreased by 10 basis points to 3.63%, driven by interest rate effect

- Composite interest rate for new deposits with agreed maturity from corporations decreased by 13 basis points to 3.28%, driven by interest rate effect; interest rate for overnight deposits from corporations broadly unchanged at 0.88%

- Composite interest rate for new deposits with agreed maturity from households broadly unchanged at 2.98%; interest rate for overnight deposits from households broadly unchanged at 0.37%

Bank interest rates for corporations

Chart 1

Bank interest rates on new loans to, and deposits from, euro area corporations

(percentages per annum)

Data for cost of borrowing and deposit interest rates for corporations (Chart 1)

The composite cost-of-borrowing indicator, which combines interest rates on all loans to corporations, decreased in September 2024. The interest rate on new loans of over €1 million with a floating rate and an initial rate fixation period of up to three months decreased by 31 basis points to 4.72%, driven by the interest rate effect. The rate on new loans of the same size with an initial rate fixation period of over three months and up to one year fell by 31 basis points to 4.47%, driven by the interest rate effect. The interest rate on new loans of over €1 million with an initial rate fixation period of over ten years decreased by 22 basis points to 3.58%. In the case of new loans of up to €250,000 with a floating rate and an initial rate fixation period of up to three months, the average rate charged fell by 12 basis points to 5.02%.

As regards new deposit agreements, the interest rate on deposits from corporations with an agreed maturity of up to one year fell by 14 basis points to 3.28% in September 2024. The interest rate on overnight deposits from corporations stayed almost constant at 0.88%.

The interest rate on new loans to sole proprietors and unincorporated partnerships with a floating rate and an initial rate fixation period of up to one year decreased by 22 basis points to 5.19%, driven by the interest rate effect.

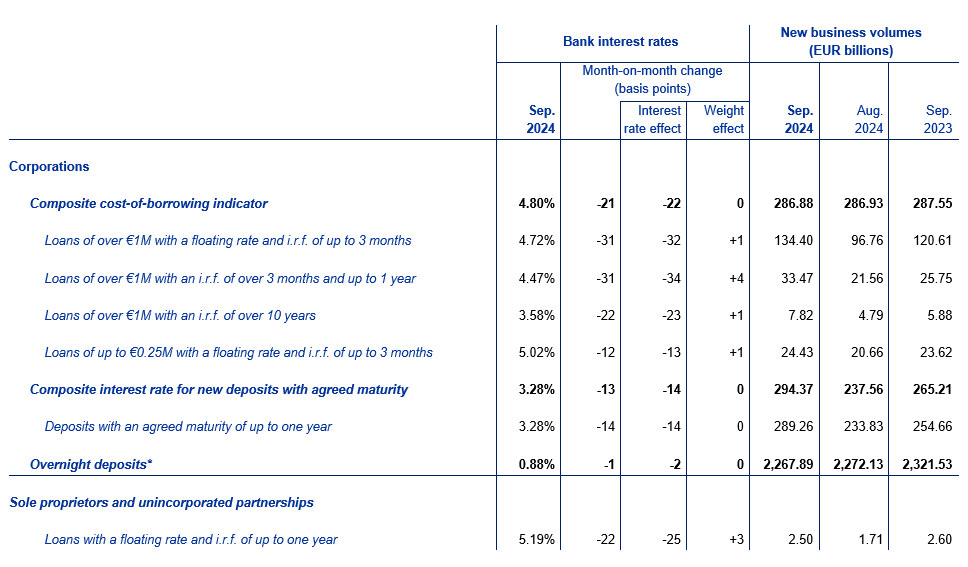

Table 1

Bank interest rates for corporations

i.r.f. = initial rate fixation

* For this instrument category, the concept of new business is extended to the whole outstanding amounts and therefore the business volumes are not comparable with those of the other categories. Outstanding amounts data are derived from the ECB’s monetary financial institutions balance sheet statistics.

Data for bank interest rates for corporations (Table 1)

Bank interest rates for households

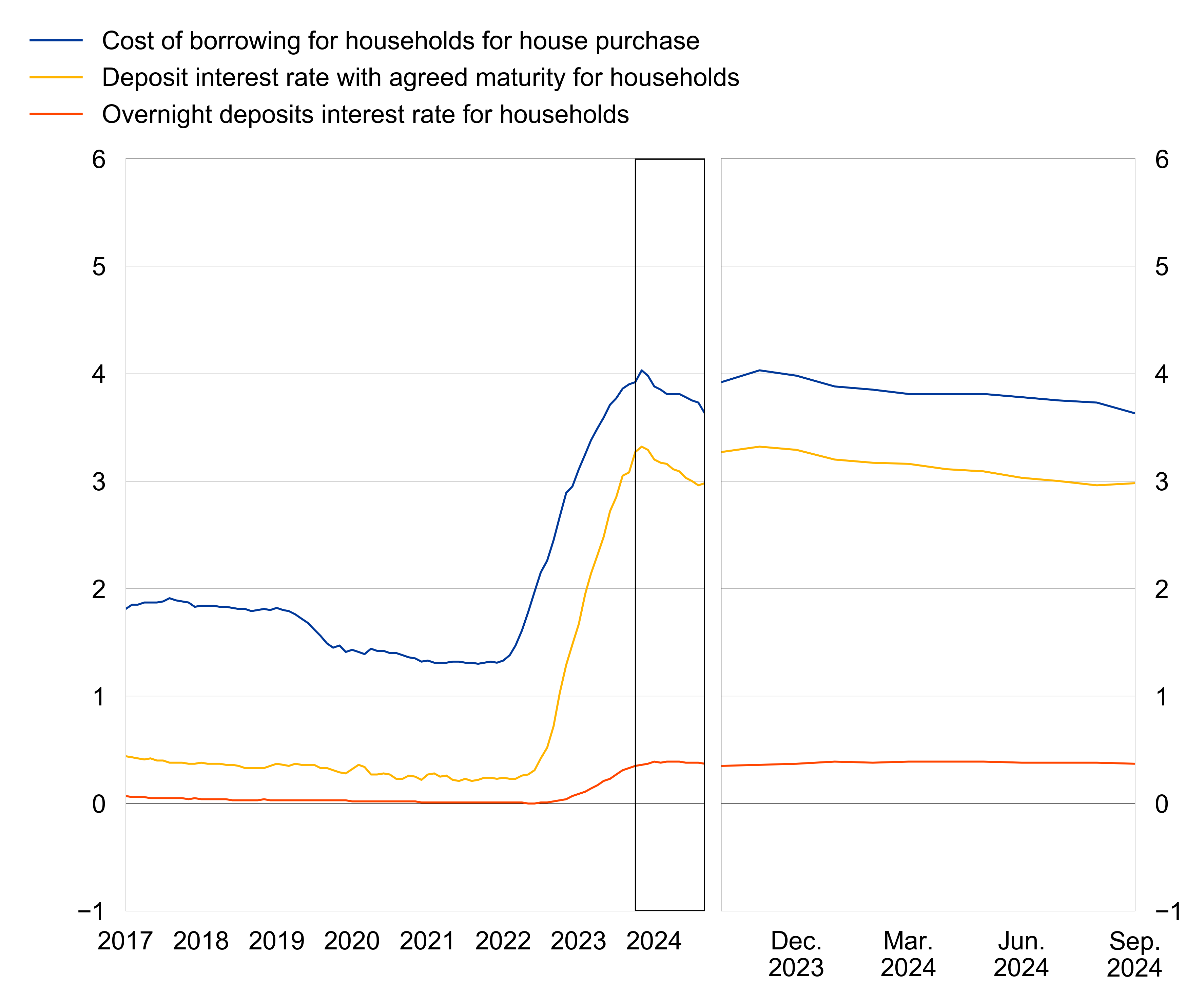

Chart 2

Bank interest rates on new loans to, and deposits from, euro area households

Data for cost of borrowing and deposit interest rate for households (Chart 2)

The composite cost-of-borrowing indicator, which combines interest rates on all loans to households for house purchase, decreased in September 2024. The interest rate on loans for house purchase with a floating rate and an initial rate fixation period of up to one year decreased by 11 basis points to 4.59%. The rate on housing loans with an initial rate fixation period of over one and up to five years fell by 6 basis points to 3.82%. The interest rate on loans for house purchase with an initial rate fixation period of over five and up to ten years decreased by 10 basis points to 3.52%. The rate on housing loans with an initial rate fixation period of over ten years fell by 10 basis points to 3.27%, mainly driven by the interest rate effect. In the same period the interest rate on new loans to households for consumption decreased by 7 basis points to 7.75%.

As regards new deposits from households, the interest rate on deposits with an agreed maturity of up to one year remained broadly unchanged at 2.97%. The rate on deposits redeemable at three months’ notice stayed constant at 1.75%. The interest rate on overnight deposits from households remained broadly unchanged at 0.37%.

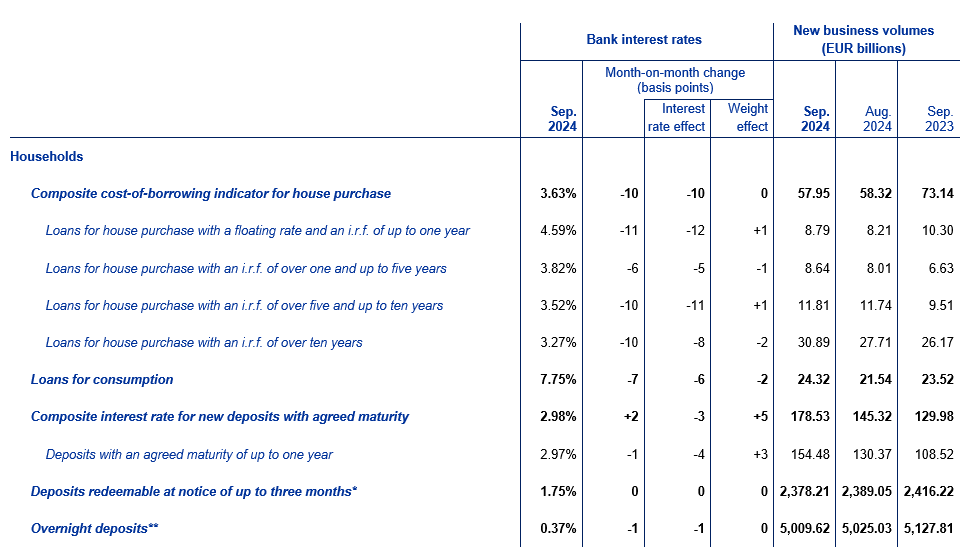

Table 2

Bank interest rates for households

i.r.f. = initial rate fixation

* For this instrument category, the concept of new business is extended to the whole outstanding amounts and therefore the business volumes are not comparable with those of the other categories; deposits placed by households and corporations are allocated to the household sector. Outstanding amounts data are derived from the ECB’s monetary financial institutions balance sheet statistics.

** For this instrument category, the concept of new business is extended to the whole outstanding amounts and therefore the business volumes are not comparable with those of the other categories. Outstanding amounts data are derived from the ECB’s monetary financial institutions balance sheet statistics.

Source: European Central Bank

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.