April 22, 2024

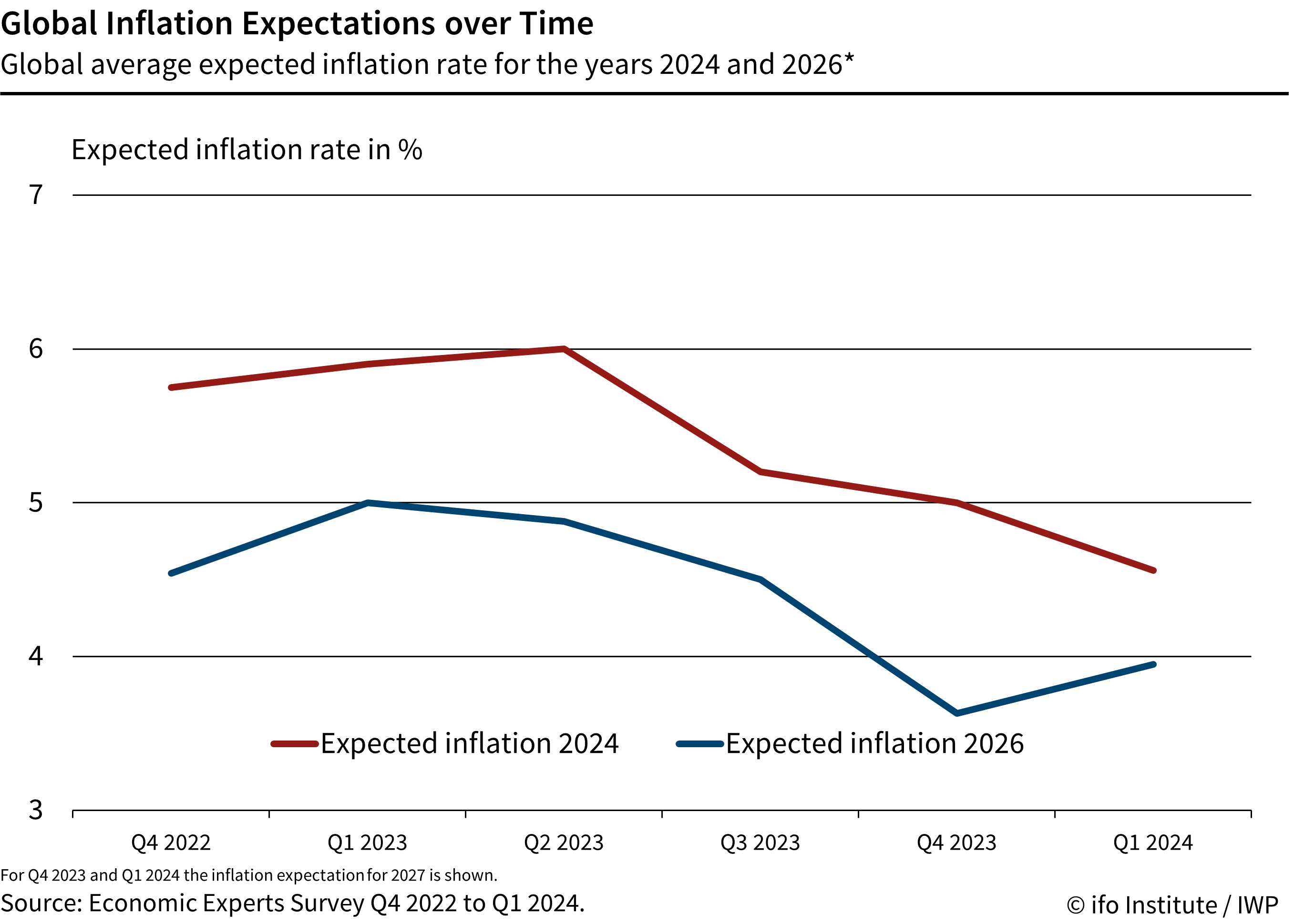

How are economists’ expectations for future price developments evolving worldwide? Can we observe a decline in inflation expectations? The latest wave of the Economic Expert Survey (EES) by the ifo Institute and the Institute for Swiss Economic Policy examines economists’ inflation expectations at a global level. The result: although inflation expectations worldwide remain well above central banks’ inflation target, there is a further decline in the expected inflation rate for 2024 compared to previous quarters. However, long-term inflation expectations show a stagnating or rising trend.

Global Inflation Expectations Fall

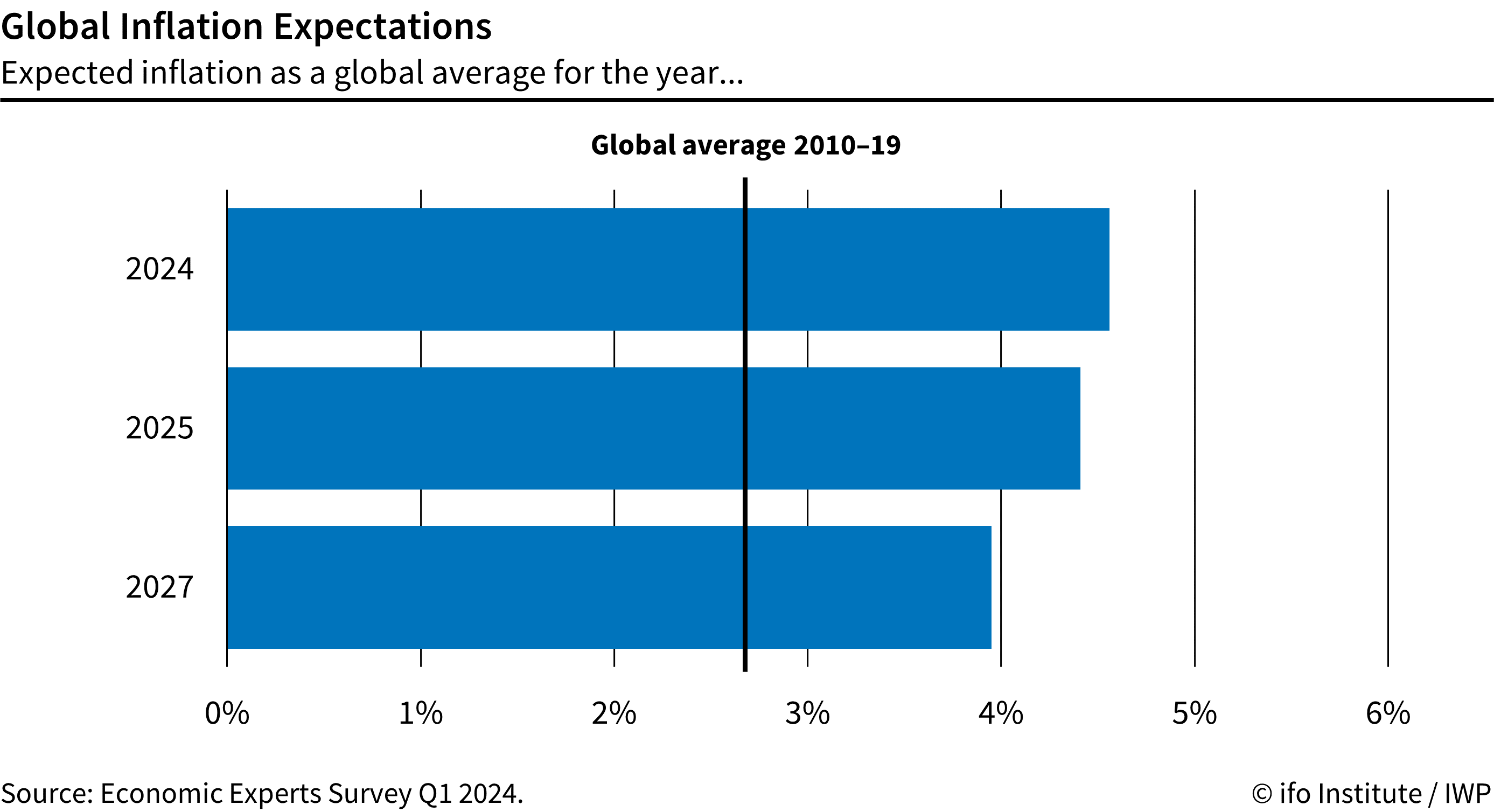

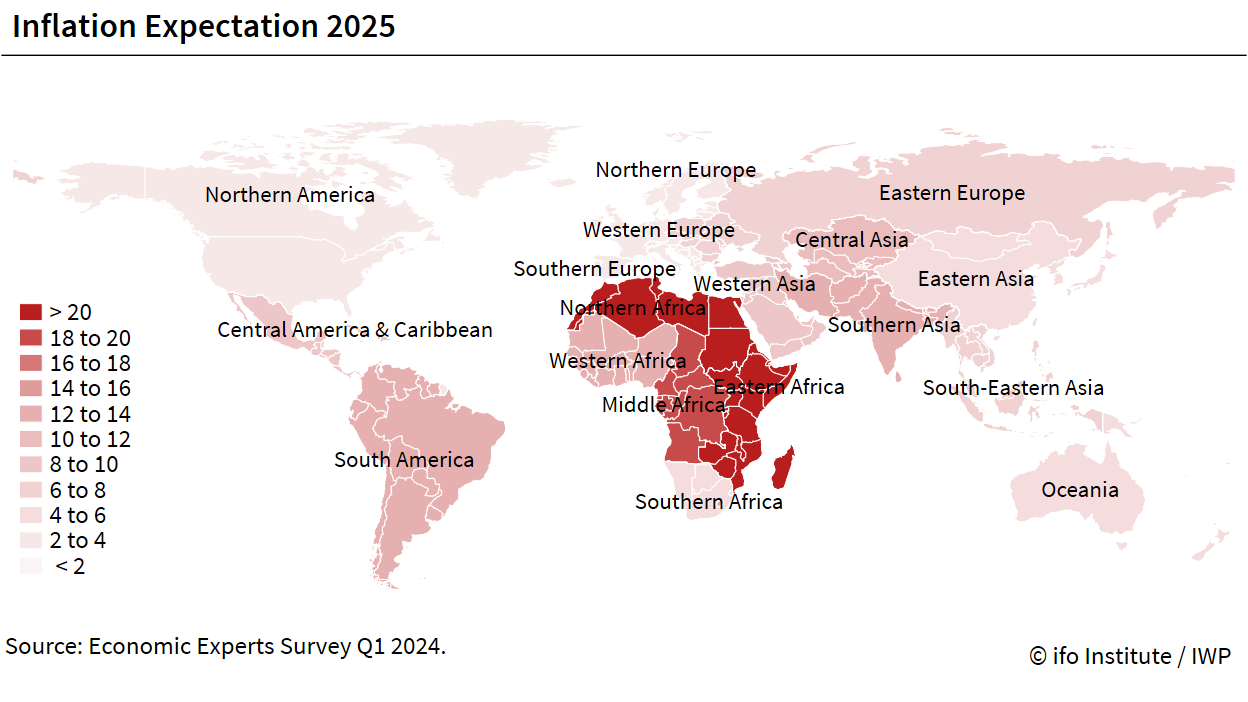

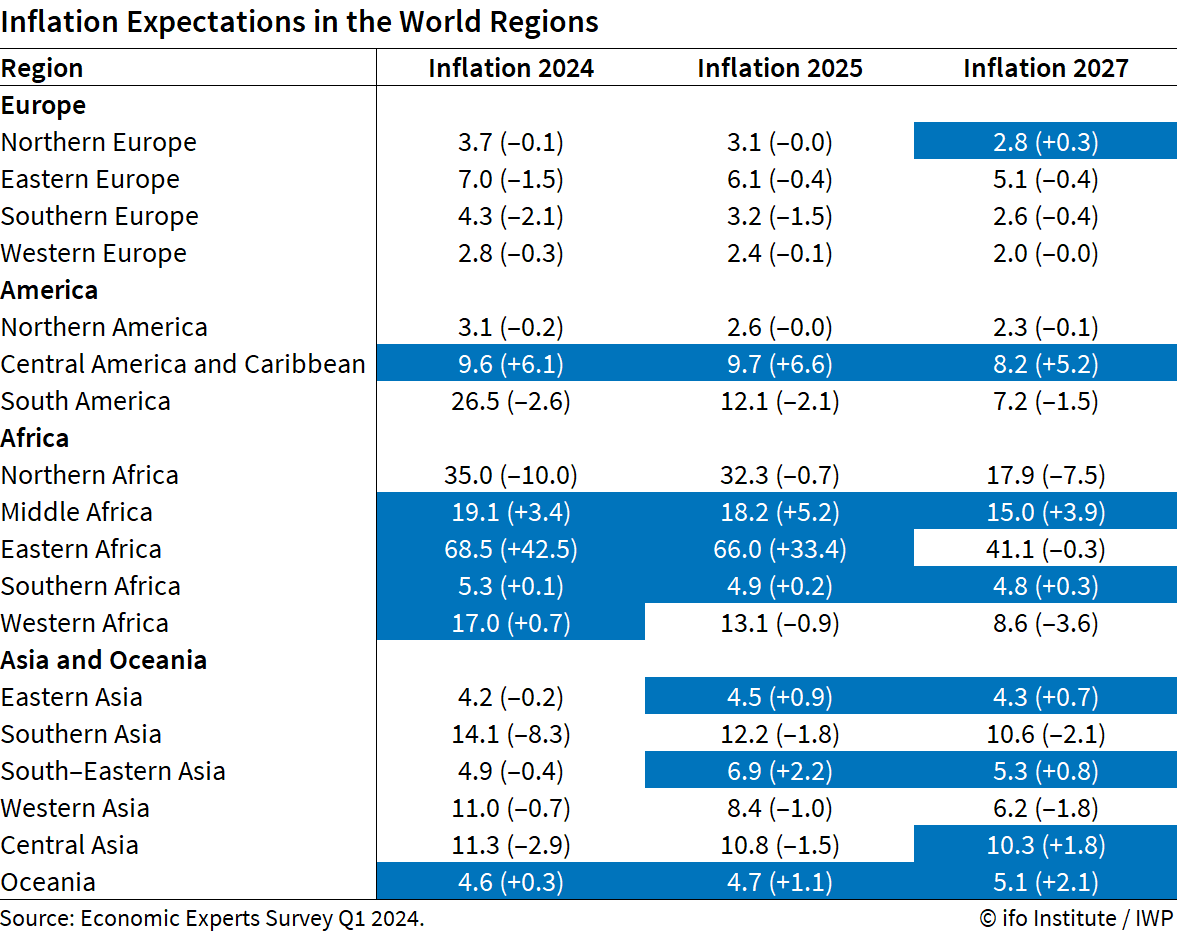

For 2024, the expected global average inflation rate is 4.6%. This is the median of average expected inflation rates at the country level. The median is used because the expected inflation rates vary greatly from region to region, with some dramatically higher in individual countries and regions such as Africa than in the rest of the world.

The average rate of 4.6% expected in the current quarter is significantly lower than the expected rate of 6% in the second quarter of 2023. This means short-term inflation expectations are still falling, but remain at a high level worldwide. Experts also expect high inflation rates worldwide in the years ahead. With an average expected inflation rate of 4.4% for 2025, a slight decline is also expected on average compared with 2024.

In the long term up to 2027, inflation expectations continue to be high at 4.0%. Long-term inflation expectations have even risen again compared to the results of the previous quarter (3.6%).

Inflation Expectations Falling in the Long Term, but in Some Cases an Increase in Short-Term Inflation Expectations

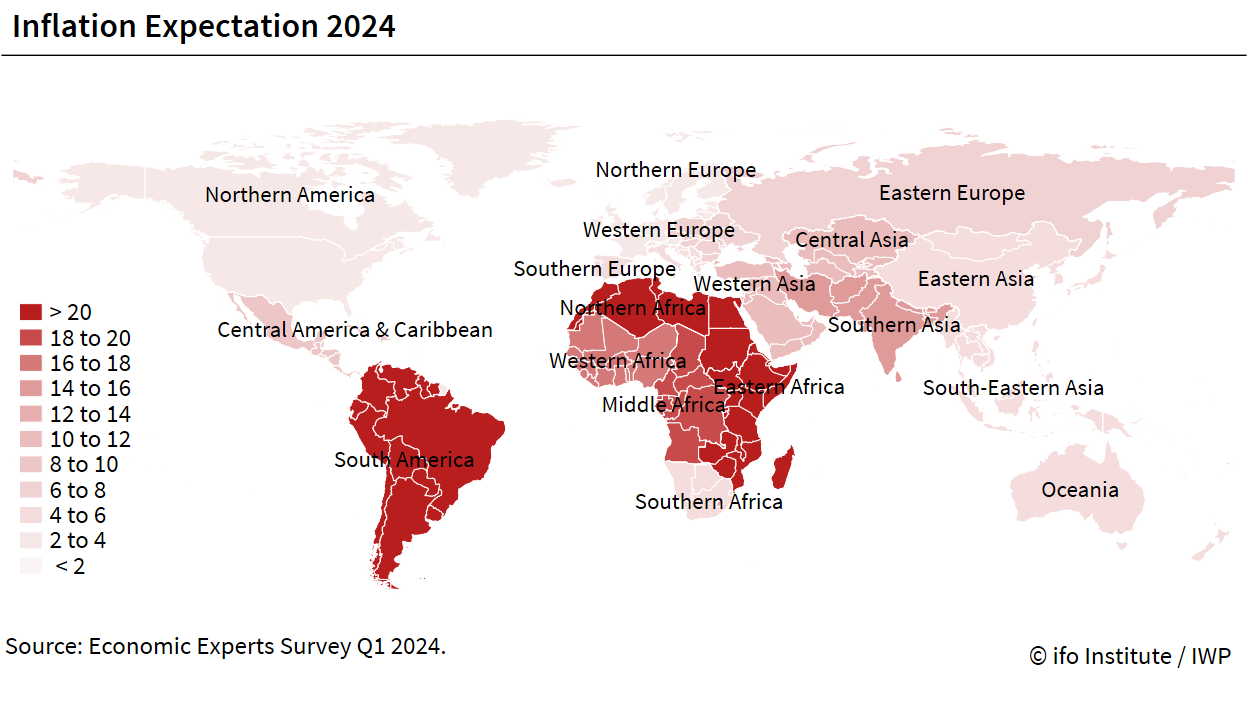

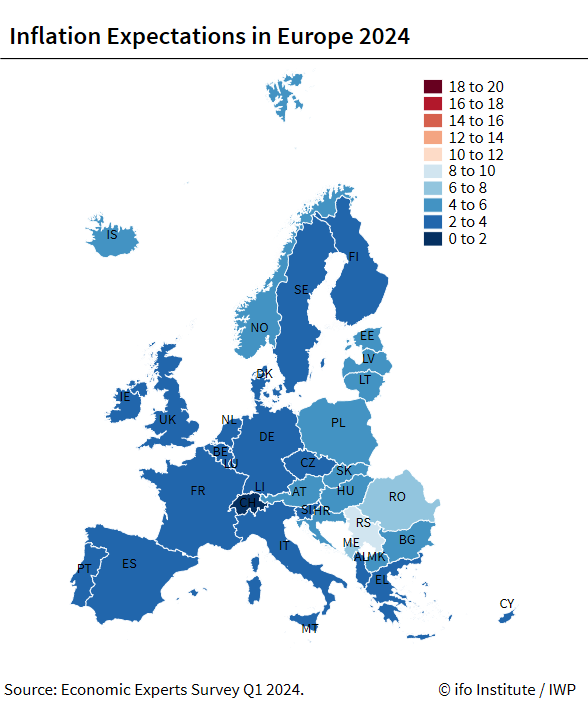

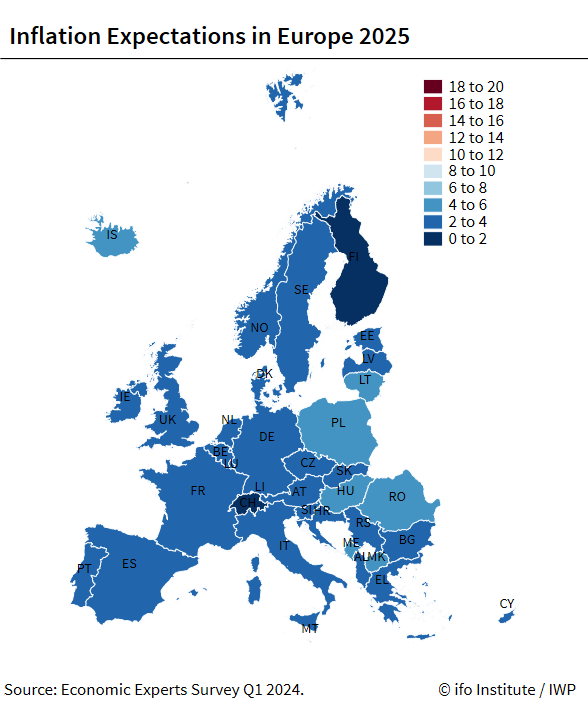

Inflation expectations vary widely among the world’s regions. For 2024, experts expect the lowest inflation rates in Western Europe (2.8%). Expectations in North America and Northern Europe are comparable (3.1–3.7%). In contrast, experts in regions such as East Africa (35%) and South America (26%) expect inflation rates to be well above average in the short term. While short-term expectations have remained stable over several quarters, the expected inflation rates in this quarter represent a decline in expectations for most regions compared to the previous quarter.

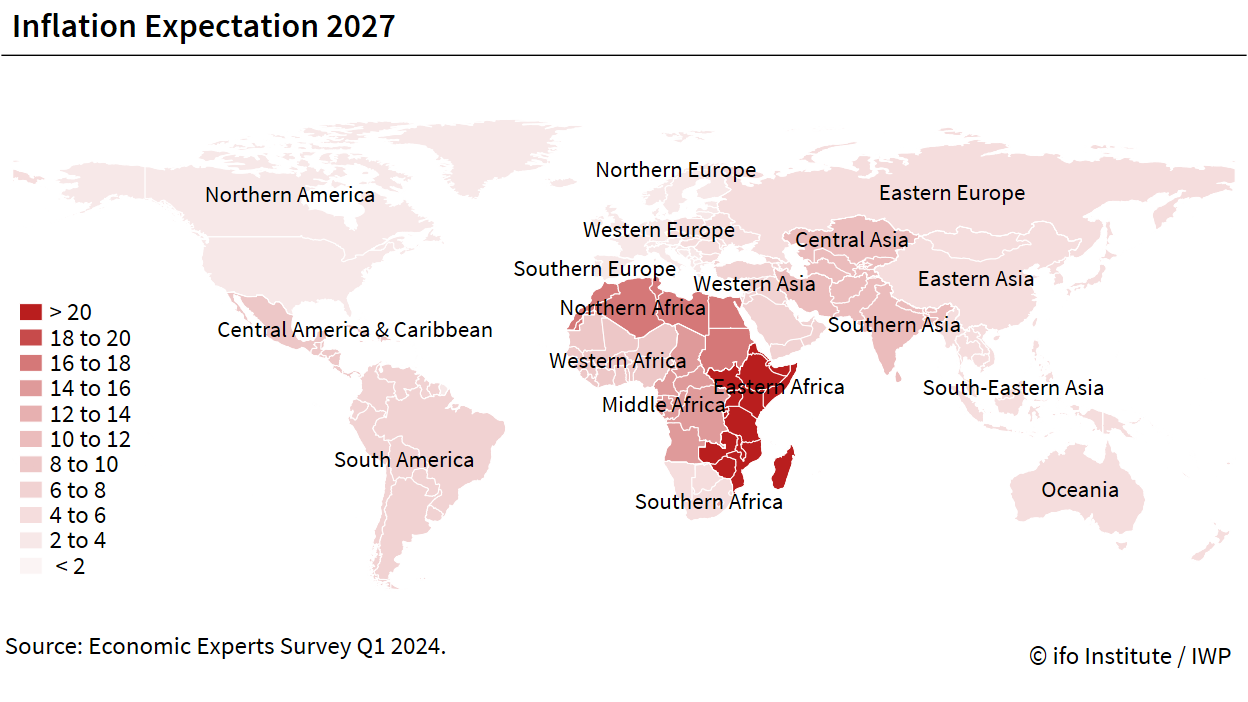

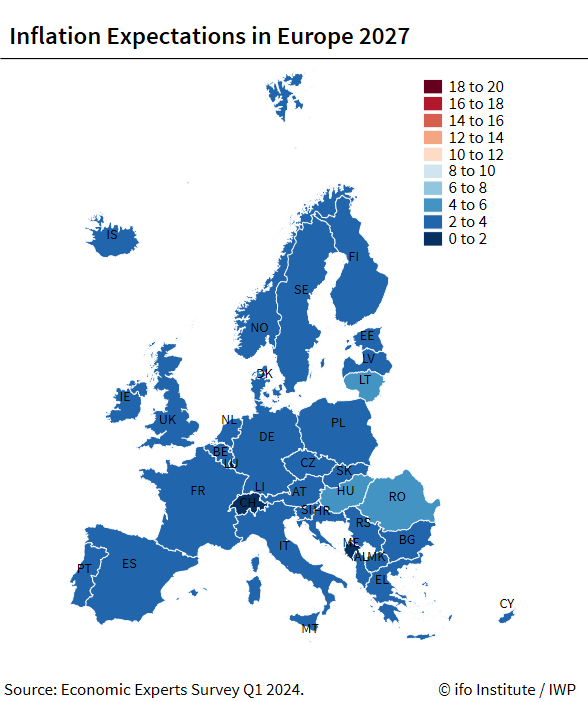

For 2027, experts expect inflation rates in Western Europe (2.0%) and North America (2.3%) as well as in Northern Europe (2.8%) and Southern Europe (2.6%) to almost return to the 2% inflation rate targeted by central banks. The experts expect higher long-term inflation rates in Eastern Europe (5.1%) and in parts of Asia (up to 11%). The highest long-term inflation rates are expected in East Africa (41%) and North Africa (18%).

Source: ifo Institute

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.