Domestic Minimum Corporate Tax Example-4

In case of

- Commercial balance sheet profit,

- Non-tax-deductible expenses,

- Real estate sale gain exemption for debtors to banks,

- R&D deduction,

- Investment deduction

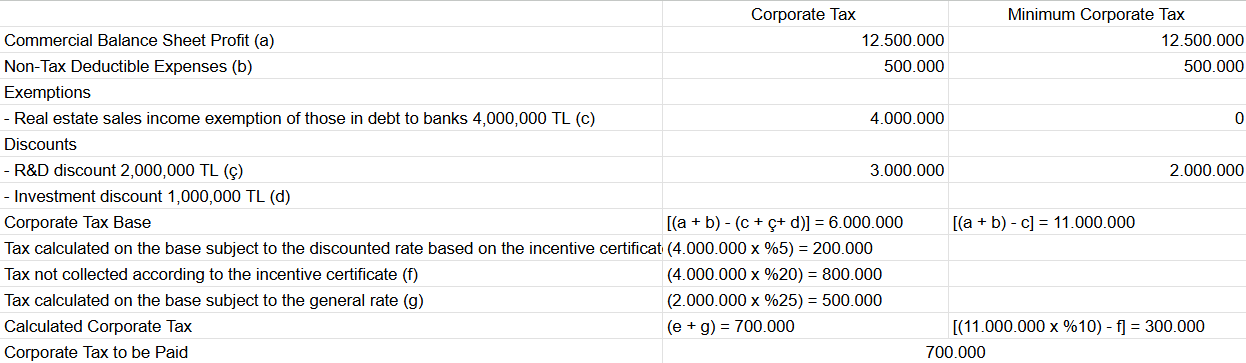

Example 4: The commercial balance sheet profit of (D) A.Ş. for the 2025 fiscal period is 12,500,000 TL, and its non-deductible expenses amount to 500,000 TL.

The company received an investment incentive certificate for the investment it will make in 2021, and completed this investment in 2024.

In its corporate tax return for the 2025 fiscal period, the taxable income subject to reduced corporate tax for this investment is 4,000,000 TL, and the reduced tax rate is 5%.

On the other hand, the corporation’s real estate, which was recorded in the company’s assets, was transferred to (A) Bank due to a debt to the bank, and a gain of 4,000,000 TL was realized from this transaction.

The corporation also claimed a 2,000,000 TL R&D deduction and carried over an investment deduction of 1,000,000 TL from previous periods.

Accordingly, the minimum corporate tax for the mentioned corporation will be calculated as follows:

From the minimum corporate tax of 1,100,000 TL calculated for (D) A.Ş., the tax of 800,000 TL, which is not collected under the investment incentive certificate according to Article 32/A, will be deducted, resulting in a minimum corporate tax of 300,000 TL. Since the corporate tax of 700,000 TL, calculated based on the corporation’s return, is higher than the minimum corporate tax, no additional tax payment will be required under the minimum corporate tax application.

Source: Corporate Tax Law Communiqué No. 23

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.