September 29, 2022

Current-Account Balance in the U.S.

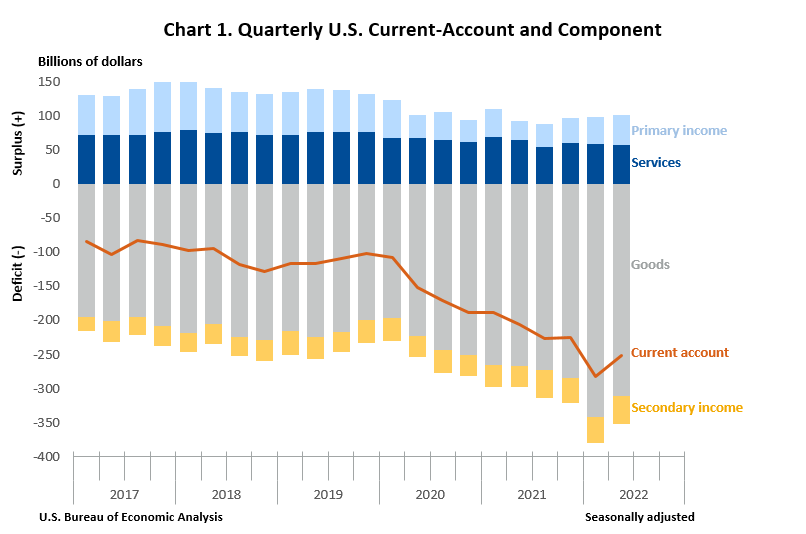

The U.S. current-account deficit, which reflects the combined balances on trade in goods and services and income flows between U.S. residents and residents of other countries, narrowed by $31.5 billion, or 11.1 percent, to $251.1 billion in the second quarter of 2022, according to statistics released by the U.S. Bureau of Economic Analysis. The revised first-quarter deficit was $282.5 billion.

The second-quarter deficit was 4.0 percent of current-dollar gross domestic product, down from 4.6 percent in the first quarter.

The $31.5 billion narrowing of the current-account deficit in the second quarter mostly reflected a decreased deficit on goods.

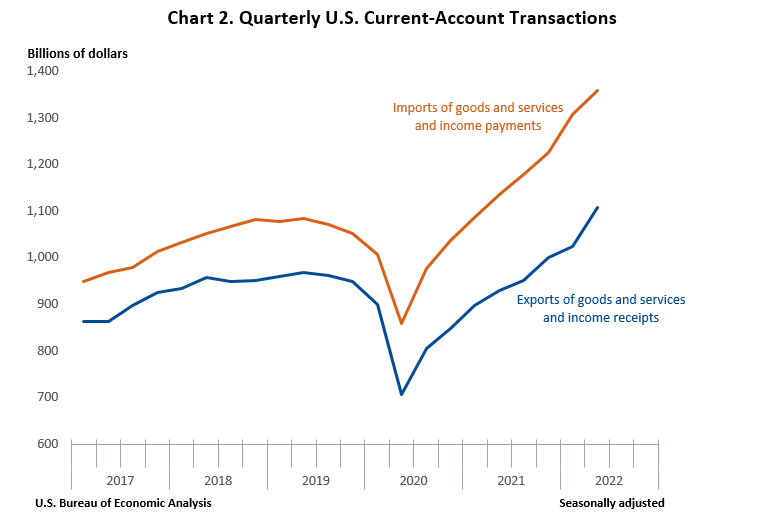

Current-Account Transactions

Exports of goods and services to, and income received from, foreign residents increased $82.8 billion to $1.11 trillion in the second quarter. Imports of goods and services from, and income paid to, foreign residents increased $51.3 billion to $1.36 trillion.

Trade in goods

Exports of goods increased $52.0 billion to $539.9 billion, and imports of goods increased $20.8 billion to $850.4 billion. The increases in both exports and imports mostly reflected an increase in industrial supplies and materials, primarily petroleum and products.

Trade in services

Exports of services increased $8.4 billion to $225.2 billion, and imports of services increased $10.2 billion to $168.2 billion. The increases in both exports and imports mainly reflected increases in travel, mostly other personal travel, and in transport, mostly air passenger transport.

Primary income

Receipts of primary income increased $21.1 billion to $299.1 billion, and payments of primary income increased $16.2 billion to $255.5 billion. The increases in both receipts and payments reflected increases in all major components. The increase in receipts was led by direct investment income, primarily earnings, and the increase in payments was led by other investment income, primarily interest.

Secondary income

Receipts of secondary income increased $1.4 billion to $43.6 billion, mostly reflecting an increase in general government transfers, primarily fines and penalties. Payments of secondary income increased $4.0 billion to $84.9 billion, reflecting increases in general government transfers, mostly international cooperation, and in private transfers, mostly insurance-related transfers.

Capital-Account Transactions

Capital-transfer payments increased $1.9 billion to $3.8 billion in the second quarter, mostly reflecting an increase in U.S. government investment grants.

Financial-Account Transactions

Net financial-account transactions were −$159.5 billion in the second quarter, reflecting net U.S. borrowing from foreign residents.

Financial assets

Second-quarter transactions increased U.S. residents’ foreign financial assets by $386.2 billion. Transactions increased portfolio investment assets, mostly equity, by $279.8 billion; direct investment assets, mostly equity, by $99.1 billion; other investment assets by $6.1 billion, resulting from partly offsetting transactions in loans and deposits; and reserve assets by $1.2 billion.

Liabilities

Second-quarter transactions increased U.S. liabilities to foreign residents by $499.8 billion. Transactions increased portfolio investment liabilities, primarily long-term debt securities and equity, by $433.5 billion, and direct investment liabilities, primarily equity, by $67.0 billion. Transactions decreased other investment liabilities by $0.7 billion, primarily resulting from offsetting transactions in loans, deposits, and trade credit and advances.

Financial derivatives

Net transactions in financial derivatives were –$45.9 billion in the second quarter, reflecting net U.S. borrowing from foreign residents.

Source: U.S. Bureau of Economic Analysis

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.