December 6, 2022

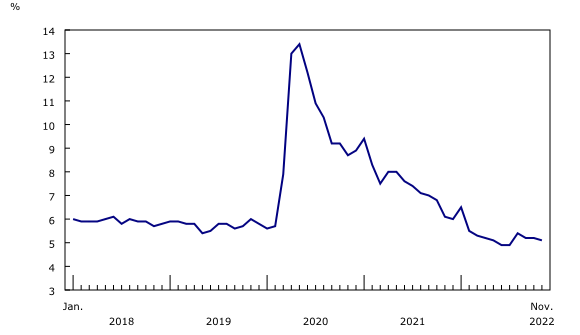

Employment in Canada was little changed (+10,000) in November, and the unemployment rate declined by 0.1 percentage points to 5.1%.

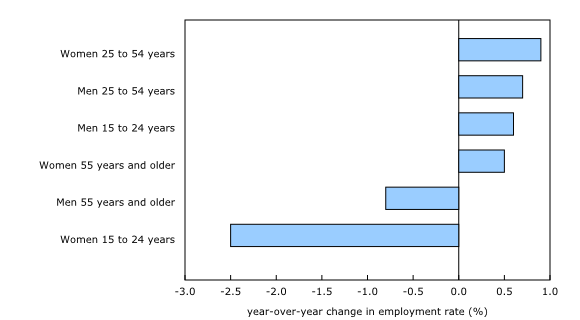

Employment was up among women in the core working ages of 25 to 54, and declined among young men aged 15 to 24. It was little changed among the other main demographic groups. The employment rate among core-aged women reached a new record high of 81.6% in November.

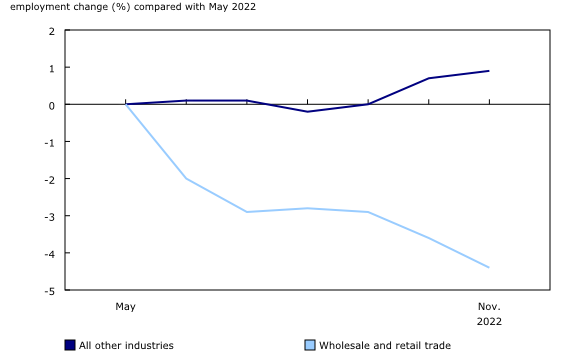

Employment rose in finance, insurance, real estate, rental and leasing; manufacturing; as well as in information, culture, and recreation. At the same time, it fell in several industries, including construction and wholesale and retail trade.

While employment increased in Quebec, it declined in five provinces, including Alberta and British Columbia.

Year-over-year growth in the average hourly wages of employees remained above 5% for a sixth consecutive month in November, up 5.6% (+$1.71 to $32.11) compared with November 2021 (not seasonally adjusted).

After increasing 0.7% in October, total hours worked were little changed in November. Compared with 12 months earlier, total hours worked were up 1.8%.

In November 2022, more than 1 in 10 (11.2%) workers were employed in the retail trade industry (not seasonally adjusted).

One-third (33.5%) of workers aged 25 to 54 in Canada engaged in some form of training outside of the formal education system over the last 12 months, by participating in courses, seminars, conferences, or private lessons (not seasonally adjusted).

Employment little changed in November

Employment was little changed in November (+10,000), following an increase of 108,000 (+0.6%) in October. The stability in overall total employment was the result of offsetting movements across multiple industries. Similarly, employment growth in Quebec (+28,000; +0.6%) was offset by declines in five other provinces, including Alberta and British Columbia.

Record high employment rate for core-aged women

Employment among people in the core working ages of 25 to 54 rose by 38,000 (+0.3%) in November, the third consecutive monthly increase. Most of the November increase was attributable to core-aged women (+25,000; +0.4%).

The core-aged employment rate—the proportion of the population who are employed—rose by 0.8 percentage points to 84.7% on a year-over-year basis in November 2022. This rise was led by core-aged women, whose employment rate reached 81.6% in November, up 0.9 percentage points from 12 months earlier. This was the highest rate for core-aged women since comparable data became available in 1976, and similar to the previous high of 81.4% recorded in May 2022.

Record-high employment rates were widespread across different groups of core-aged women. The employment rate of core-aged First Nations women living off-reserve was 70.0%, the highest rate for the month of November since data became available in 2006, and similar to those recorded in November 2021 (67.7%) and November 2019 (68.1%). The employment rate of core-aged Métis women (83.5%) was also at a record high for the month of November (three-month moving averages, not seasonally adjusted).

Among very recent immigrants—those admitted to Canada within the previous five years—the employment rate of core-aged women was 69.7%, the highest for the month of November for this group since comparable data became available in 2006 (three-month moving averages, not seasonally adjusted). This is consistent with results from the 2021 Census of Population showing that recent immigrants had higher levels of education and more pre-admission experience in Canada than previous cohorts—both factors that may support labour market integration.

Across racialized groups, core-aged Filipino women continued to have the highest employment rate among core-aged women, at 84.5% in November (three-month moving averages, not seasonally adjusted).

Employment among core-aged men was little changed in November, following an increase in October. Compared with 12 months earlier, the employment rate for this group was up 0.7 percentage points to 87.8%.

Employment rate down year over year among female youth

Total employment among youth aged 15 to 24 was little changed on both a monthly and a year-over-year basis in November. However, trends over the last 12 months have differed for young men and young women. Among young men, employment fell by 23,000 (-1.7%) on a monthly basis in November, but on a year-over-year basis both employment and the employment rate (56.4%) were little changed.

Among young women, employment was down by 38,000 (-2.9%) on a year-over-year basis in November, and their employment rate declined 2.5 percentage points to 57.8%. The employment decline over this 12-month period was almost entirely due to losses in August and September 2022. Across industries, the largest year-over-year decline was in retail trade (-45,000; -11.7%), an industry where employers continue to report an elevated level of job vacancies (not seasonally adjusted).

Following an increase in October, employment among people aged 55 and older was virtually unchanged in November. On a year-over-year basis, employment was up by 69,000 (+1.7%) in November. In contrast, the employment rate—which is influenced by both employment and population changes—was little changed (34.4%) compared with 12 months earlier, with an increase among women (+0.5 percentage points to 29.6%) being offset by a decrease among men (-0.8 percentage points to 39.6%).

Full-time work up in November

The number of people employed on a full-time basis increased by 51,000 (+0.3%) in November. Since November 2021, when full-time employment first surpassed its pre-COVID-19 pandemic level, full-time work has grown by 460,000 (+2.9%), concentrated among core-aged men (+212,000; +3.5%) and women (+169,000; +3.4%). Notable year-over-year gains in full-time work were also seen among young men aged 15 to 24 (+49,000; +6.8%). Overall, the share of workers employed on a full-time basis increased by 0.8 percentage points to 81.9% in the 12 months to November.

In contrast, part-time employment was little changed for a sixth consecutive month in November and down by 91,000 (-2.5%) on a year-over-year basis. Declines in part-time work since November 2021 were primarily seen among core-aged men (-48,000; -11.8%) and young men (-25,000; -4.4%). Across industries, the decreases were concentrated in wholesale and retail trade (-50,000; -5.6%) and transportation and warehousing (-44,000; -26.1%) (not seasonally adjusted).

Little change in number of employees and self-employed

The number of employees in the public and private sectors were both little changed in November. Over the past 12 months, the number of employees has grown at a similar pace in the public (+2.2%; +91,000) and private (+2.0%; +255,000) sectors.

The number of self-employed was also little changed in November. Self-employment had been on a slight upward trend from October 2021 to May 2022, but has shown little net growth in recent months.

Absences due to illness or disability elevated in November

Total hours worked were little changed in November, and were up 1.8% compared with 12 months earlier.

In the context of elevated cases of influenza and other respiratory viruses in many parts of the country, 6.8% of employees were absent due to illness or disability during the November reference week. This was slightly higher than the pre-pandemic average of 5.8% in the month of November from 2017 to 2019, but below the record high set in January 2022, when absences due to illness or disability affected 10.0% of employees (not seasonally adjusted).

Specifically among employed core-aged parents with a child under six, 3.5% reported being absent from work to care for children in November, 1.3 percentage points higher than the average for the month of November from 2017 to 2019 (2.2%), but below the record set in March 2020 and December 2021 (4.6%) (not seasonally adjusted).

Average hourly wage growth holds steady in November

Growth in the average hourly wages of employees remained above 5% for a sixth consecutive month, rising 5.6% (+$1.71 to $32.11) on a year-over-year basis in November. June 2022 was the first month in which Labour Force Survey (LFS) year-over-year wage growth exceeded 5% since comparable data became available in 1997, other than during parts of 2020 and 2021, when average wages were impacted by large pandemic-related changes in the composition of employment (not seasonally adjusted).

Proportion of workers with hybrid work arrangements continues upward trend

The proportion of workers who have hybrid arrangements—that is, who usually work both at home and in a location other than home—rose by 0.4 percentage points to 9.4% in November, continuing a gradual upward trend since the beginning of 2022. The proportion of workers who usually work exclusively at home (15.6%) was little changed in November (population aged 15 to 69, not seasonally adjusted).

Both the unemployment rate and the participation rate decline in November

The unemployment rate declined by 0.1 percentage points to 5.1% in November. This was the second decrease in three months, edging the rate closer to the record low of 4.9% observed in June and July. The adjusted unemployment rate—which includes people who wanted a job but did not look for one—was little changed at 7.0% in November.

The participation rate fell 0.1 percentage points to 64.8% in November. The rate has hovered around the same level since July, and the November rate was 0.6 percentage points below the most recent high of 65.4% reached in February and March.

Unemployment rate declines among female youth and older men

Among core-aged people, the unemployment rate of both men (4.3%) and women (4.1%) was little changed in November.

The unemployment rate among young women aged 15 to 24 fell 1.2 percentage points to 9.3% in November, the first decline since June. The rate was 2.2 percentage points above its June low of 7.1%.

Among young men, the unemployment rate was little changed in November at 11.2%. Following declines in February and March 2022, the unemployment rate for this group has hovered around the same level since April.

Among men aged 55 and older, the unemployment rate declined 0.4 percentage points to 4.2% in November. The unemployment rate for this group has followed a long-term downward trend since June 2021, falling by 3.9 percentage points over this period.

Women aged 55 and older saw little change in their unemployment rate in November (4.5%), with the rate remaining above the recent low of 3.6% observed in June.

Long-term unemployment little changed for a third consecutive month

Long-term unemployment—the number of people who have been continuously unemployed for 27 weeks or more—was little changed for a third consecutive month in November (174,000). This marked the sixth consecutive month in which long-term unemployment was either at or below pre-pandemic February 2020 levels. Expressed as a proportion of the total labour force, long-term unemployment held steady at 0.8% for a third consecutive month.

Participation rate declines among youth, reaches new record high among core-aged women

The participation rate of women aged 25 to 54 increased by 0.3 percentage points to 85.1% in November. The monthly gain pushed up the participation rate of core-aged women to its highest level since the beginning of the data series in 1976, and similar to the level recorded in May 2022 (85.0%). Among core-aged men, the participation rate was little changed at 91.7% in November, 0.6 percentage points below the March peak of 92.3%.

The labour force participation rate among youth aged 15 to 24 fell by 0.8 percentage points to 63.6% in November, with declines seen among both men and women in this age group. Despite job vacancies remaining near record highs during the summer and early fall, the youth labour force participation rate has remained on par with or slightly below its 2017-2019 average of 64.6% since June. The percentage of youth enrolled in school in November 2022 was similar to the average observed for the month of November from 2017 to 2019 among both young men (58.4%) and young women (68.2%) (not seasonally adjusted).

The labour force participation rate of people aged 55 and older declined by 0.2 percentage points to 36.0% in November. It has hovered around this level since June 2022, after following a downward trend from June 2021. Specifically among people aged 55 to 64, the participation rate declined by 0.5 percentage points to 66.1% in November 2022. After decreasing from September 2021 to June 2022, the participation rate of this age group has been hovering around its 2019 level in recent months.

Employment increases in finance, insurance, real estate, rental and leasing

The number of people working in finance, insurance, real estate, rental and leasing rose by 21,000 (+1.6%) in November, with the increase widespread across provinces. This followed a period of virtually no net employment gains from February to October and brought year-over-year gains in the industry to 34,000 (+2.5%).

Employment also rose in manufacturing (+19,000; +1.1%) in November, building on the gain of 24,000 (+1.4%) recorded in October. On a year-over-year basis, employment in the industry was little changed. The monthly increase was concentrated in Quebec (+10,000; +2.1%) and Alberta (+5,900; +4.7%).

The information, culture and recreation industry saw employment gains of 16,000 (+1.9%) in November. This was the first increase in the industry since public health restrictions were eased in February 2022, following the fifth wave of the pandemic. Compared with 12 months earlier, employment in the industry was up 35,000 (+4.5%).

The number of people working in construction fell by 25,000 (-1.6%) in November, fully offsetting the increase recorded in October. Most of the declines were in Alberta (-13,000; -5.5%) and British Columbia (-9,200; -3.8%). On a year-over-year basis, employment in construction was up by 84,000 (+5.9%), entirely due to gains from December 2021 to March 2022. According to the latest data from Statistics Canada, investment in building construction declined 0.6% in September, largely the result of a drop in the residential sector.

Employment in wholesale and retail trade fell 23,000 (-0.8%) in November, the fourth decrease in six months. Since May 2022, when it reached a peak, employment in the industry has fallen by a total of 131,000 (-4.4%), with the losses concentrated in Ontario (-62,000; -5.4%) and Alberta (-32,000; -8.1%). Wholesale and retail trade is the only industry to have seen a net decline in employment over this period.

The number of people working in professional, scientific and technical services fell by 15,000 (-0.8%) in November, the first decline since October 2021. Despite this decrease, the industry accounted for more than half (+282,000) of the net employment gains (+523,000) recorded since February 2020. Sustained growth has been due in part to the ability of employers and workers to operate remotely over the course the pandemic. In November 2022, 64.3% of workers in the industry usually worked either exclusively or partially from home (population aged 15 to 69, not seasonally adjusted).

Employment rises in Quebec, falls in five provinces in November

Employment increased in Quebec in November, while it declined in Prince Edward Island, Newfoundland and Labrador, Manitoba, Alberta, and British Columbia. There was little change in the remaining provinces. For further information on key province and industry level labour market indicators, see “Labour Force Survey in brief: Interactive app.”

In Quebec, employment grew by 28,000 (+0.6%) in November, the third increase in four months. The unemployment rate reached a new record low of 3.8%, similar to the previous low of 3.9% recorded in April 2022. November employment gains were concentrated in the census metropolitan area (CMA) of Montréal, where employment rose 25,000 (+1.1%) and the unemployment rate was unchanged at 4.2%. Among Quebec’s other CMAs, the unemployment rate ranged from a low of 2.7% in Sherbrooke to a high of 5.4% in Saguenay (three-month moving averages).

In Prince Edward Island, employment fell by 1,500 (-1.7%) in November, the third decline in five months. The province’s unemployment rate increased by 1.4 percentage points to 6.8%.

Employment declined in Newfoundland and Labrador (-3,500; -1.5%) in November, offsetting gains seen in October. The unemployment rate was little changed at 10.7%.

Employment in Manitoba was down by 5,400 (-0.8%) in November, following two consecutive months of growth. The province’s unemployment rate held steady at 4.4%.

In Alberta, employment fell by 15,000 (-0.6%) in November, the first decrease since October 2021. The province’s unemployment rate rose 0.6 percentage points to 5.8%, while the labour force participation rate remained on par with October. Employment losses were recorded across wholesale and retail trade; construction; and accommodation and food services. Among Alberta’s CMAs, the unemployment rate ranged from 3.5% in Lethbridge to 6.0% in Calgary (three-month moving averages).

Following an increase in September and little change in October, employment in British Columbia declined by 14,000 (-0.5%) in November, with all losses concentrated in part-time work. The unemployment rate (4.4%) in the province remained virtually unchanged. In the Vancouver CMA, there was little change in both employment and the unemployment rate in November. The unemployment rate in the rest of British Columbia’s CMAs ranged from 3.5% in Victoria to 4.9% in Kelowna (three-month moving averages).

Following an increase in October, employment in Ontario was little changed in November. The unemployment rate declined by 0.4 percentage points to 5.5%.

In the Spotlight: training, retail workers, and tech hubs

One-third of core-aged workers engaged in training in the past 12 months

Increasing the supply of skilled workers has been identified by many commentators as essential to ensuring Canada’s future economic growth. For individual workers, investing in skills training, including formal training arrangements as well as more informal training opportunities, can be an important means of reducing vulnerability to future economic downturns or restructuring.

New data from the LFS show that, in November 2022, one-third (33.5%) of workers aged 25 to 54 in Canada reported that they had engaged in some form of training outside of the formal education system over the previous 12 months. This included participating in courses, seminars, conferences, or private lessons, such as through an employer, a private firm, or an online platform. Overall, the vast majority of core-aged workers who engaged in training participated in job-specific training (81.1%). Other common types of training involved personal development (17.2%) and computer-based skills (8.7%).

The share of core-aged workers participating in training was slightly higher among women (35.9%) than among men (31.3%)—although a slightly higher proportion of employed men (10.1%) than employed women (7.4%) invested in their digital skills through computer skills training.

Training offers a particularly important avenue for unemployed Canadians to increase their prospects of finding a job and to increase their potential future wages. Just over one-fifth (22.0%) of unemployed Canadians aged 25 to 54 reported participating in training over the previous 12 months, with little difference between unemployed men (22.7%) and women (21.1%). The share of unemployed Canadians who completed training was more than twice as high among unemployed people with a bachelor’s degree or higher (29.6%) compared with those with a high school degree or less (12.5%). Among core-age unemployed Canadians who participated in training, the most common types of training were job-specific training (48.8%)—mirroring the trend among employed Canadians—followed by personal development (16.5%), personal interest (15.9%) and job search training (15.8%).

Among core-aged unemployed Canadians who did not participate in any training in the previous 12 months, the most cited reason was that they did not need training (51.5%), followed by personal or family responsibilities (24.8%) and high costs (20.0%). Unemployed women (29.6%) were more likely than men (20.4%) to report personal or family responsibilities as a reason for not participating in training.

Retail workers in an evolving industry

Although employment in wholesale and retail trade fell by a total of 131,000 (-4.4%) from May to November, the retail trade sector remains an important source of employment for many Canadians. Retail trade accounted for 11.2% of total employment in November, and an even higher proportion among women (12.6%), part-time workers (21.7%), youth (26.1%) and full-time students (30.1%) (not seasonally adjusted).

With the holiday shopping season underway, labour market conditions in the retail trade sector are of interest to both workers and employers. Since the fall of 2021, retail sales have grown, while payroll employment—as measured by the Survey of Employment, Payrolls and Hours—has remained relatively stable. Meanwhile, job vacancies in the sector have remained elevated, reflecting the recruitment and retention challenges facing many employers.

Recent trends within retail trade have varied across subsectors, partly reflecting how various types of businesses have been affected by public health restrictions during the pandemic. In retail sectors with shopping commonly done in-person, stores were restricted in hours of operation, or had to close. As of September 2022, for example, payroll employment in clothing and clothing accessories stores was 13.7% (-31,000) below its pre-pandemic level. In comparison, payroll employment in non-store retailers—establishments primarily engaged in retailing merchandise outside of physical stores, including electronic shopping—increased 33.6% (+15,000) from February 2020 to September 2022.

While employees in retail trade have hourly wages below the national average, wage gains in the industry have been close to overall wage growth in recent months. The average hourly wage in retail trade was $21.99 in November, with women earning less on average ($20.73) than men ($23.50). In comparison, the average across all industries was $32.11. In November, average hourly wages in retail were up 5.4% on a year-over-year basis, compared with 5.6% across all industries (not seasonally adjusted).

Employment in information and communications technology down in the past year

On November 30, Statistics Canada released the Labour results from the 2021 Census of Population, highlighting some of the factors affecting labour market conditions in local communities across Canada.

One of the sectors with an influential impact on local labour market conditions is the information and communications technology (ICT) sector, a grouping of industries that are central to the growth of the digital economy, including computer systems design and related services, software publishers, and semiconductor and other electronic component manufacturing. Data from the Census of Population show that the ICT sector represented 3.9% of total employment in May 2021, with the largest proportions observed in the tech hub centres of Toronto (6.8%), Kitchener–Cambridge–Waterloo (6.3%), Ottawa–Gatineau (6.0%), Montréal (5.4%), Vancouver (5.3%) and Fredericton (5.2%).

LFS data show that, after increasing markedly from November 2017 to November 2021 (+234,000; +36.1%), employment growth in this sector has eased, with the number of people working in the sector falling by 34,000 (-3.8%) in the 12 months to November 2022 (not seasonally adjusted).

Together, the Census of Population and the LFS—as well as the Survey of Employment, Payrolls and Hours and the Job Vacancy and Wage Survey —provide a complete portrait of labour market conditions in Canada. In the coming months and years, Statistics Canada will continue to provide insights into the trends and events affecting workers and employers in diverse sectors and communities.

Source: Statistics Canada

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.