Flash PMIs show an accelerating but uneven developed world expansion in August

The flash PMI data from S&P Global signaled a strengthening of growth for the world’s major developed economies in August, with improving trends seen across the board. However, the expansion was skewed towards services as manufacturing contracted at a steepening pace. Moreover, even the current pace of services growth in the four economies looks unstainable in the face of weakening order book trends and reduced business optimism.

Sustained expansions in the major economies may therefore be dependent on lower interest rates. Encouragingly, the door to lower rates was opened further by moderating selling price inflation in the services economy, which has been the main area of concern for policymakers in the US and Europe.

G4 economic growth accelerates

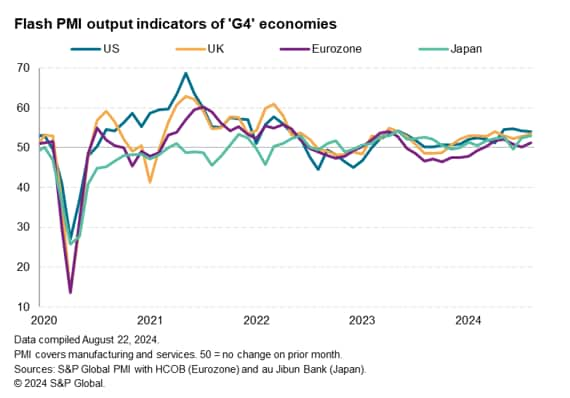

Flash PMI data for August from S&P Global Market Intelligence brought some encouraging news on developed world economic growth midway through the third quarter. A sustained robust expansion was seen the US, with growth also accelerating to solid rates in both the UK and Japan. Even the struggling eurozone reported an improved rate of growth, albeit still lagging behind.

Although US growth slowed slightly compared to the prior three months, it was still stronger than the majority of the rates seen in the prior two years. UK growth meanwhile accelerated to the second-fastest seen over the past 15 months, and Japan’s rate of expansion hit a 15-month high. While modest in comparison, eurozone growth was the best seen for three months.

Measured across the G4 largest developed economies, output growth accelerated to the second fastest seen over the past 15 months to signal a solid GDP expansion in the third quarter providing September’s data remains close to levels seen in recent months.

Cracks beneath the surface?

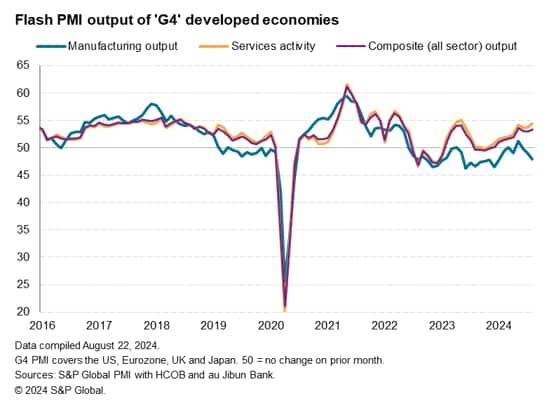

Beneath the surface, however, the PMI data send some warning signals that growth is not as healthy as it seems. First, manufacturing is looking increasingly weak, as output fell sharply across the G4 as a whole amid slumping trade flows to leave growth dependent on the services economy. Factory production fell across the G4 for a third month, dropping at the sharpest rate since January to hint that the all-too-brief upturn seen in May has faltered. At the same time, new export orders fell across G4 manufacturers for a twenty-eighth consecutive month, dropping at a rate not seen since last October.

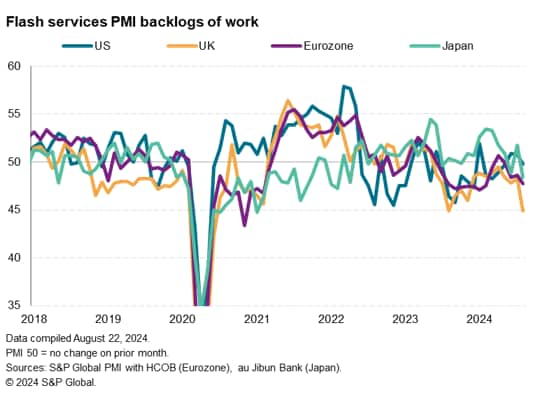

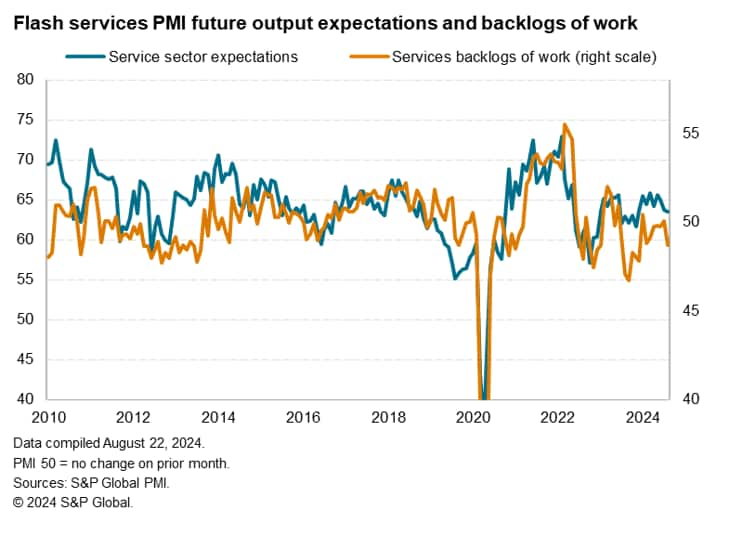

While services growth meanwhile accelerated to the fastest recorded for 15 months in August, the expansion was flattered in part by increased activity around the Olympics in France. Furthermore, although service growth did also tick marginally higher in the US, UK and Japan, forward-looking indicators disappointed in all cases. Worryingly, backlogs of orders in the service sector -a key gauge of how much work is in hand to keep companies busy in the months ahead – fell across the G4 at the sharpest rate for eight months, with trends deteriorating in all four economies.

Future output expectations also deteriorated in the G4 services economies, dropping to a nine-month low.

Assessing the growth trajectory

It’s possible therefore that weakness from manufacturing will spread to services, though there is hope that lower interest rates will spur demand to help support the expansion. In this respect, the flash PMIs generally brought encouraging news, especially in relation to service sector inflation, the stickiness of which has been the greatest concern to policy hawks. Across the G4 economies, average prices charged for services rose at the slowest rate since January 2021.

The rate of services sector selling price increase most notably cooled in the US to the second-lowest since prices began to rise after the initial 2020 lockdowns, helping open the door further for the FOMC to start cutting interest rates. However, the rate of increase also fell to the second-lowest in over three years in the UK and remained low by recent standards in the eurozone, the latter in line with the ECB’s 2% inflation target. In short, cooler services inflation should add to the case for lower interest rates in Europe as well as the US.

Source: S&P GLOBAL – by Chris Williamson

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.