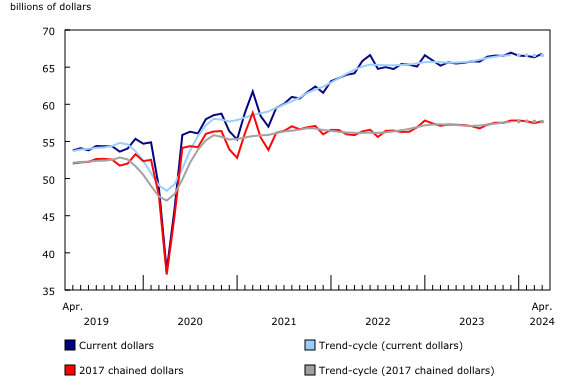

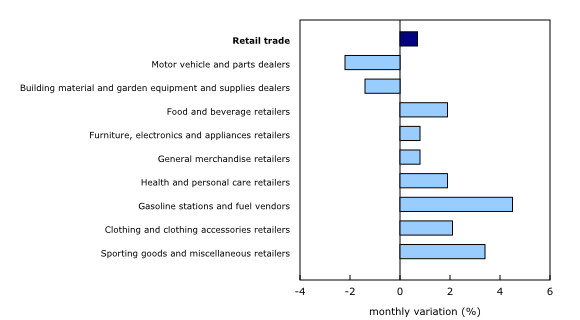

Retail sales increased 0.7% to $66.8 billion in April. Sales were up in seven of nine subsectors and were led by increases at gasoline stations and fuel vendors as well as food and beverage retailers.

Core retail sales—which exclude gasoline stations and fuel vendors and motor vehicle and parts dealers—were up 1.4% in April.

In volume terms, retail sales increased 0.5% in April.

Sales at gasoline stations and fuel vendors rise, while sales at motor vehicle and parts dealers fall

The largest increase in retail sales in April was recorded at gasoline stations and fuel vendors (+4.5%), up for the first time in three months. In volume terms, sales at gasoline stations and fuel vendors increased 1.7% in April.

The largest decline in retail sales in April was posted by motor vehicle and parts dealers (-2.2%) on lower sales at new car dealers (-2.9%). Automotive parts, accessories and tire retailers (+1.6%) were the only store type within this subsector to record an increase in April.

Core retail sales increase on strength at food and beverage retailers

Following a decline of 0.7% in March, core retail sales increased 1.4% in April on higher sales at food and beverage retailers (+1.9%), which were led by gains at supermarkets and other grocery retailers (except convenience retailers) (+1.6%). Higher receipts at beer, wine and liquor retailers (+5.5%), which were up for the first time in four months, also contributed to the increase at food and beverage retailers in April.

Higher sales in April were also reported at sporting goods, hobby, musical instrument, book and miscellaneous store retailers (+3.4%) and health and personal care retailers (+1.9%).

Sales up in eight provinces

Retail sales increased in eight provinces in April. The largest provincial increase was observed in Alberta (+3.1%), led by higher sales at motor vehicle and parts dealers.

The largest provincial decline in April was observed in Ontario (-1.0%) on lower sales at motor vehicle and parts dealers. Meanwhile, in the census metropolitan area of Toronto, sales were down 2.5%.

Retail e-commerce sales in Canada

On a seasonally adjusted basis, retail e-commerce sales were down 0.1% to $4.0 billion in April, accounting for 6.0% of total retail trade.

Advance retail indicator

Statistics Canada is providing an advance estimate of retail sales, which suggests that sales decreased 0.6% in May. Owing to its early nature, this figure will be revised. This unofficial estimate was calculated based on responses received from 47.5% of companies surveyed. The average final response rate for the survey over the previous 12 months was 90.3%.

Source: Canada Statistics

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.