December 22, 2022

- The French economy is experiencing a major “external tax” shock of at least 1.5% of GDP, caused mainly by the surge in energy prices in Europe following the Russian war in Ukraine. This is resulting in too-high inflation and is taking a toll on the real income of households and businesses, although this is largely being cushioned by government finances.

- After remaining resilient over the majority of 2022, activity is projected to go through two very distinct phases: a clear slowdown as of this winter, then an easing of the inflationary pressures and a gradual return to expansion in 2024 and especially 2025.

- Although they have faded partially since September, the pressures on global commodity prices have pushed inflation up continuously over 2022, and the annual average rate is expected to come out at 6.0%. In 2023, inflation should remain at the same level in annual average terms, but its year-on-year path should be very different, with a peak in the first half followed by a sharp fall over the rest of the year (to around 4% at the end of the year). In 2024, inflation should continue to subside, although certain food and services prices should show further robust growth. At the end of 2024 and in 2025, inflation is expected to come back towards the European Central Bank’s (ECB’s) 2% target.

- In 2022, annual average GDP growth should come out at 2.6%, buoyed by resilient demand and the rebound in the services sector, and despite the marked slowdown in activity in the second half of the year. Against this backdrop, net job creations have remained high over the year and the unemployment rate has fallen to a historic low for France (7.3% in 2022).

- In 2023, with the full force of the external shock, activity is expected to slow significantly and GDP should only expand by 0.3%. There is still significant uncertainty surrounding this projection, linked notably to risks to the quantity and price of gas supplies: we are therefore giving a range of forecasts of between -0.3% and 0.8% for 2023 growth, which means we cannot rule out the possibility of a recession, albeit a limited and temporary one.

- Once commodity price and energy supply pressures have passed their peak, the economy should enter a recovery phase in 2024. The pick-up is predicted to be moderate at first with annual average GDP growth of 1.2%. This trend should then continue over 2025, with annual average growth of 1.8%.

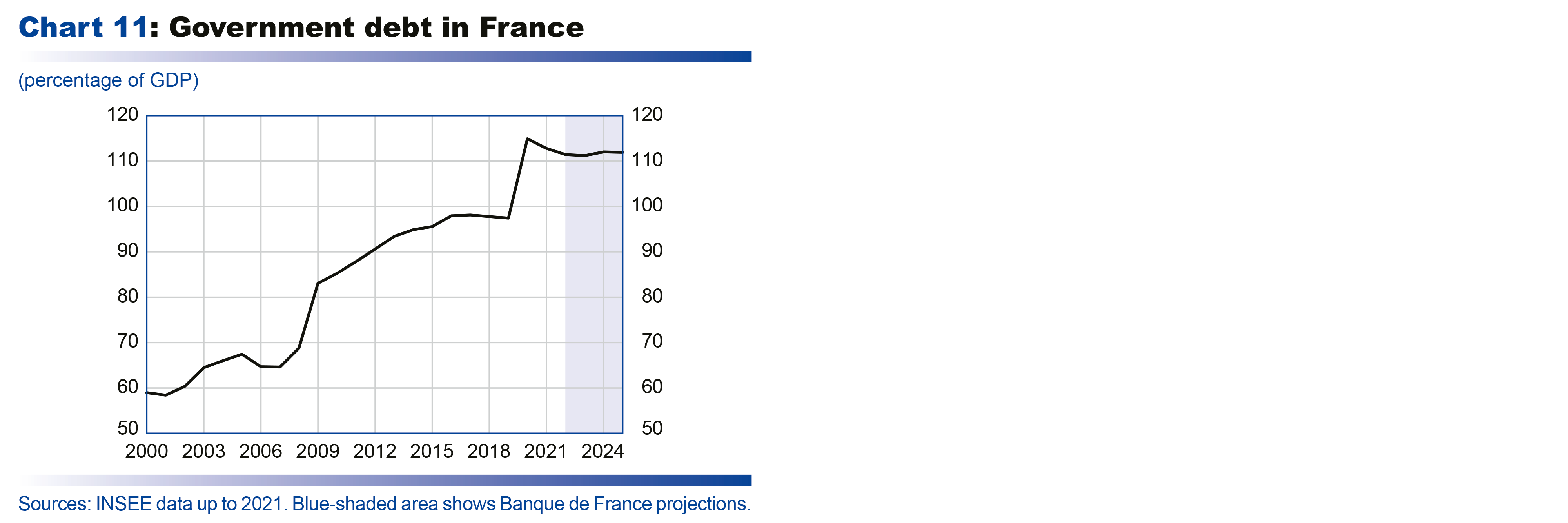

- Notwithstanding the successive shocks since 2020, the French economy should show resilience in terms of employment, household purchasing power and, by 2025, corporate margins – albeit with disparities across household categories and across business sectors. There is a downside to this resilience, however, linked to the cushioning role played by government finances: the government debt-to-GDP ratio, which had already deteriorated sharply due to the Covid shock, is at best projected to stabilise by 2025. Despite the end of the widespread support measures such as the price shield, the ratio of government expenditure to GDP should be more than 2 percentage points higher than its pre-Covid level by 2025, at 56% (with just over half of this stemming from the rise in government expenditure excluding interest payments).

Economic activity should be resilient in 2022, slow markedly in 2023 and recover in 2024 and 2025

These projections incorporate the first estimate of the third quarter 2022 national accounts published by INSEE on 28 October 2022, and short-term economic data from the Banque de France’s fourth quarter business surveys. They do not factor in the detailed quarterly national accounts published by INSEE on 30 November 2022, but their inclusion would not alter the growth projections for 2022 and 2023 (see Appendix B).

Overall, 2022 is expected to be characterised by a resilient pace of activity in the first half and a clear slowdown in the second half. In the third quarter of the year, GDP continued to expand, rising by 0.2% after 0.5% growth in the previous three months. According to the Banque de France’s business surveys, activity is continuing to hold up in the fourth quarter, with growth anticipated to come out at 0.1%. Annual average GDP growth should therefore remain strong in 2022 at 2.6%, although this is in part thanks to significant carry-over effects from the sharp post‑Covid rebound in the second half of 2021.

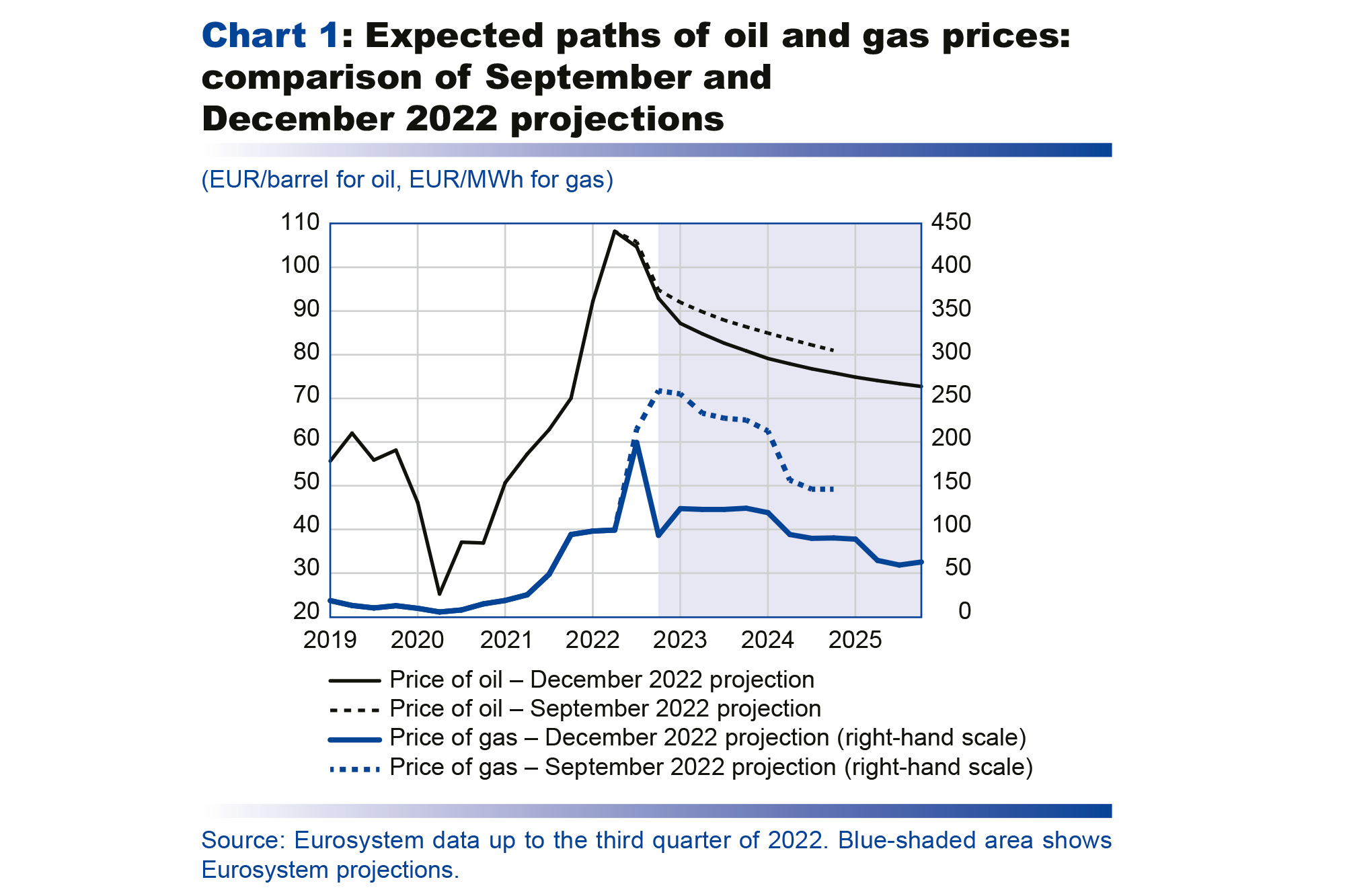

With the exception of most commodity prices, which have eased since September and are largely being cushioned for French households by the price shield on energy prices, the international and financial environment is slightly more unfavourable to growth than in our September projections. The Eurosystem assumptions, based on futures prices and with a cut-off date of 23 November 2022, are for a slightly faster decline in oil prices and significantly lower natural gas prices over the entire period than in the previous quarter’s projections (see Chart 1). Demand from France’s trading partners is expected to deteriorate markedly, and its growth rate has been revised down by 0.4 percentage point and 0.2 percentage point respectively for 2023 and 2024 compared with our September baseline scenario. The euro nominal effective exchange rate is projected to be around 3½% higher in 2023 and 2024 than in our September assumptions. Last, the rise in short and long-term interest rates is predicted to be more pronounced: based on market expectations, the three-month rate is expected to be nearly 100 basis points higher in 2023 than previously assumed in September.

Lower foreign demand for French goods and services, the stronger appreciation of the euro and the bigger rise in interest rates, combined with the upward revisions to our inflation forecasts, lead us to predict a slightly stronger slowdown in 2023 with annual growth of 0.3%. This projection is surrounded by significant uncertainty: as a result we are providing a confidence interval for this 2023 growth forecast of -0.3% to 0.8%. The interval has been quantified by applying a probabilistic approach to simulations made using our projection model. This means that a recession cannot be ruled out, but that it should be temporary and limited. Despite substantial government support for household purchasing power, all components of domestic demand should be hit by the “external tax” shock to income: the dissemination of this shock to general prices is expected to lead to high inflation and hence purchasing power losses which should drag on consumption; the shock should also squeeze corporate margins, causing businesses to scale back investments and jobs. Given the deterioration in the international environment, businesses are not expected to be able to offset this decline through external trade.

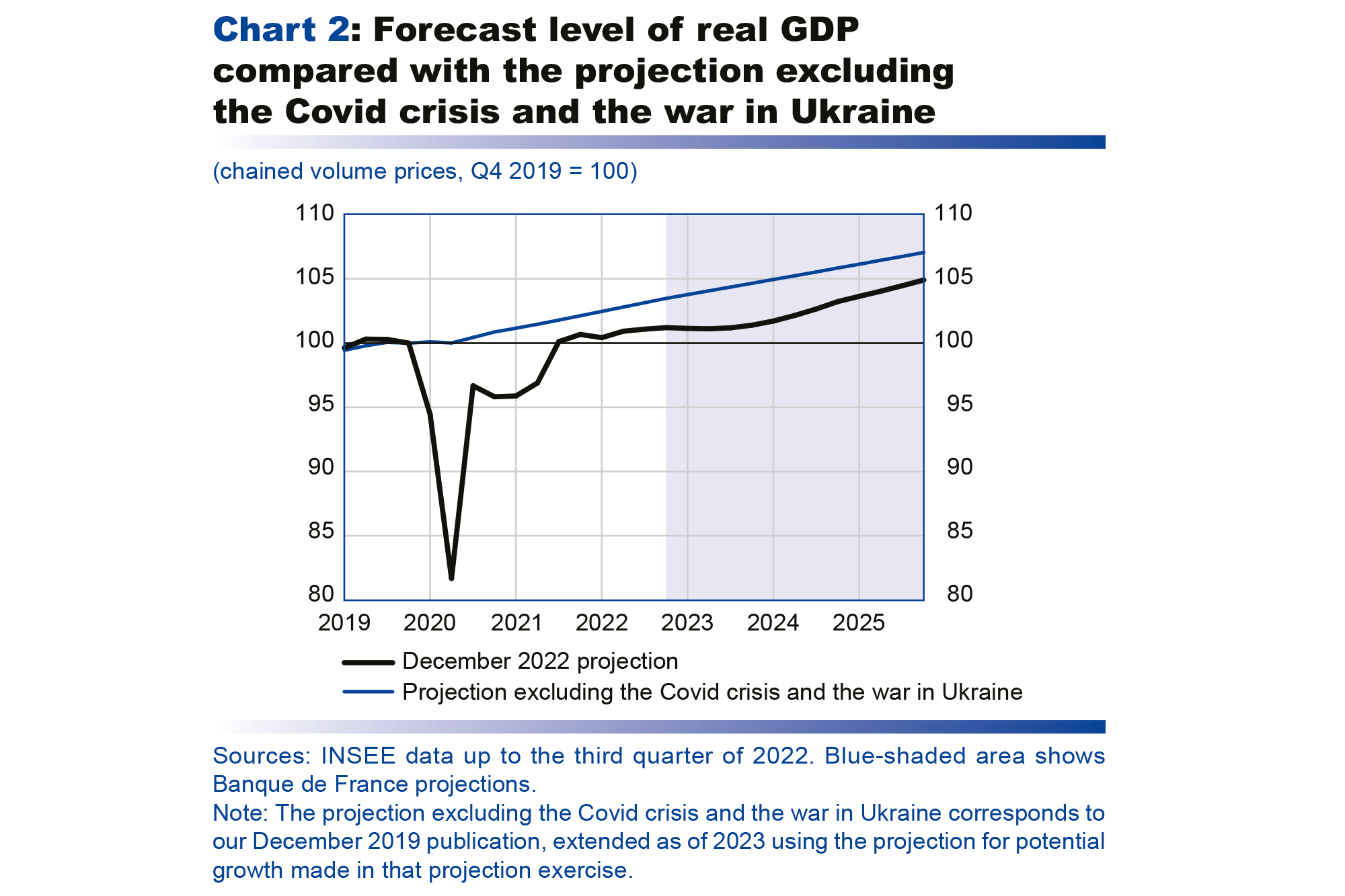

Once the pressures on commodity prices and energy supplies have passed their peak, the economy should start to recover again in 2024, albeit at a lower rate than that anticipated in September, with annual GDP growth of 1.2%. This expansion should then gain traction in 2025, with growth of 1.8%, and the level of GDP should gradually return towards its pre-Covid trend, while still remaining substantially below it by the end of the projection horizon (see Chart 2 above).

The external shock to terms of trade equates to an ex ante “external tax” of at least 1.5% GDP on the French economy in 2022

As a result of the war in Ukraine, the French economy is experiencing an external tax shock, linked to upward pressures on the prices of energy and other imported commodities, followed by a gradual normalisation.

These fluctuations in global prices have triggered a major transfer of wealth from countries that are net importers of commodities to those that are net exporters. For European economies, this represents a shock to real incomes that is eroding household purchasing power and corporate margins. It is also damaging the competitiveness of those exporting firms that have seen the biggest energy price jumps. In total, this shock and the associated inflation spike are expected to have a non-negligible negative impact on growth for at least several quarters.

There are several ways of measuring this external tax on wealth. In the context of these projections, we can use the most macroeconomic approach and measure the “shock to terms of trade”, calculated as the difference between the relative rates of growth of the import and export deflators, weighted by the share of these flows in nominal GDP. For the full year 2022, the terms-of-trade shock is projected to amount to around 1.5% of GDP in France. This is slightly smaller than in the other large euro area economies: France is less dependent on fossil fuels, and industry accounts for a smaller share of its economy (compared with Germany or Italy), which mitigates the import price shocks. France is also benefiting from robust export prices in the sea transport and agricultural sectors. Historically speaking, the terms-of-trade shock in 2022 is the second largest that France has experienced since the first oil shock in 1974.

There are numerous uncertainties looming over 2023. If world commodity prices fall more than expected with the global economic slowdown, the terms-of-trade shock could be smaller than predicted in 2023. On the other hand, it could remain significant if the rebuilding of European gas stocks keeps gas prices very high over winter 2023-24.

Ultimately, the ex post impact of the external tax shock depends on both the fiscal policy response and a series of macroeconomic adjustments, including the extent to which businesses pass on higher costs to selling prices, and the response of wages to inflation. Our macroeconomic projections present the macroeconomic second-round effects of the distribution of the external tax across employees and businesses on the one hand (see Appendix A on the pass-through of the terms-of-trade shock to prices and wages), and across private sector agents and the general government sector on the other (see infra, section on government finances).

Inflation is expected to peak in the first half of 2023 and should then subside, coming back towards 2% at the end of 2024 and in 2025

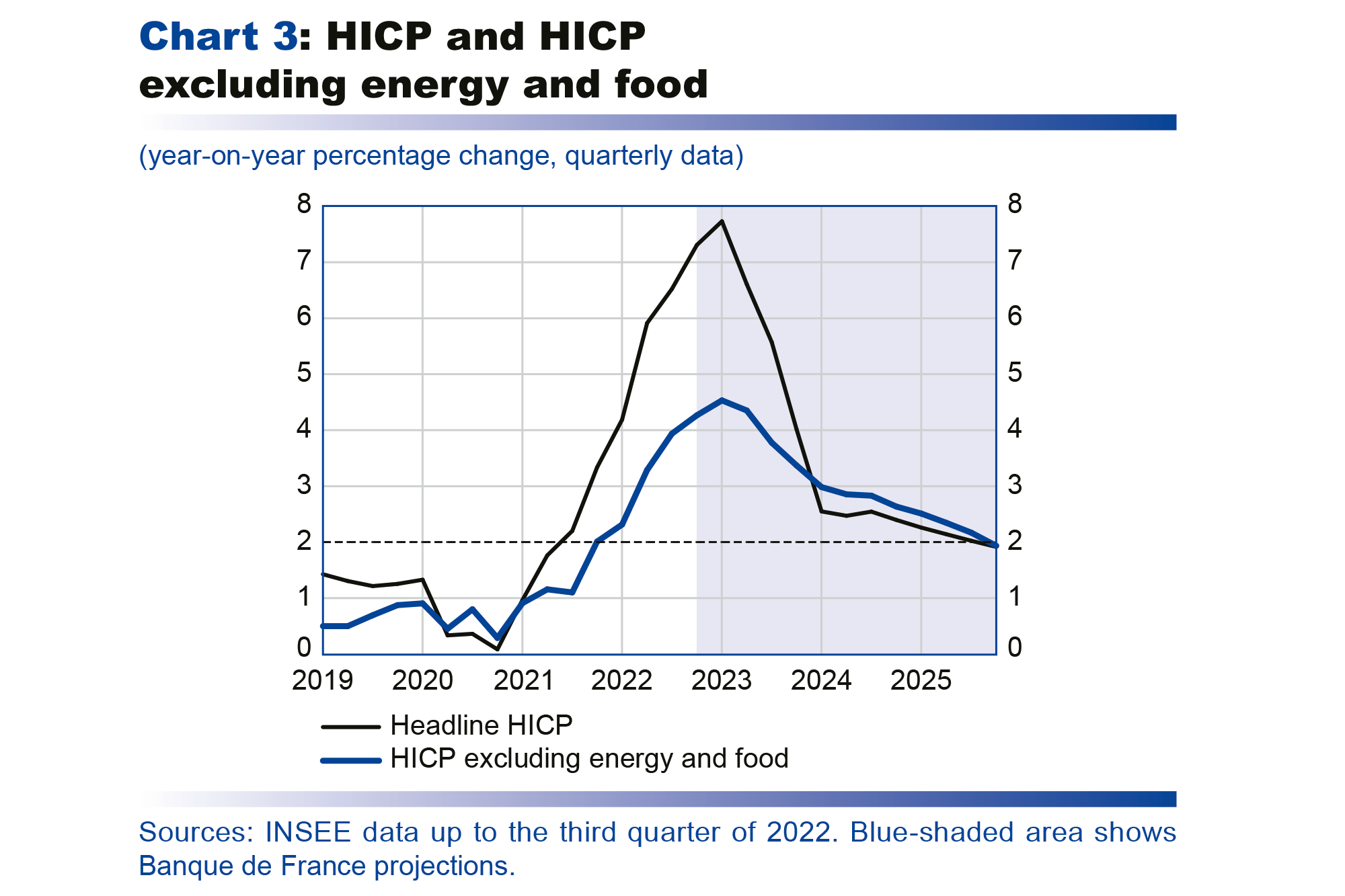

Inflation as measured by the Harmonised Index of Consumer Prices (HICP) has continued to rise in recent months, reaching 7.1% in November (see Chart 3 below). The upward pressures on commodity prices that emerged during the post-Covid recovery in 2021 have been amplified in 2022 by the war in Ukraine, fuelling a historic surge in energy prices. Moreover, these shocks have gradually fed through to the other components of inflation which are all currently rising at well above long-term average rates. Food prices have soared on the back of higher production costs and supply shortages for certain foodstuffs, with the result that food inflation has been above 10% since October. Manufactured goods inflation has also exceeded 5% since November, buoyed by robust growth in production costs at the start of the year which is being passed through with a lag to consumer prices. That said, industrial production prices have started to lose momentum in the second half, raising hopes that consumer prices of manufactured goods will moderate going forward. Services inflation has accelerated but has been more muted up till now (below 4% these last months); it is primarily being fuelled by wages, as a result of the inflation-indexation of the salaire minimum interprofessionnel de croissance (SMIC – the French minimum wage) and industry-level negotiated pay rises (see infra, section on nominal wages).

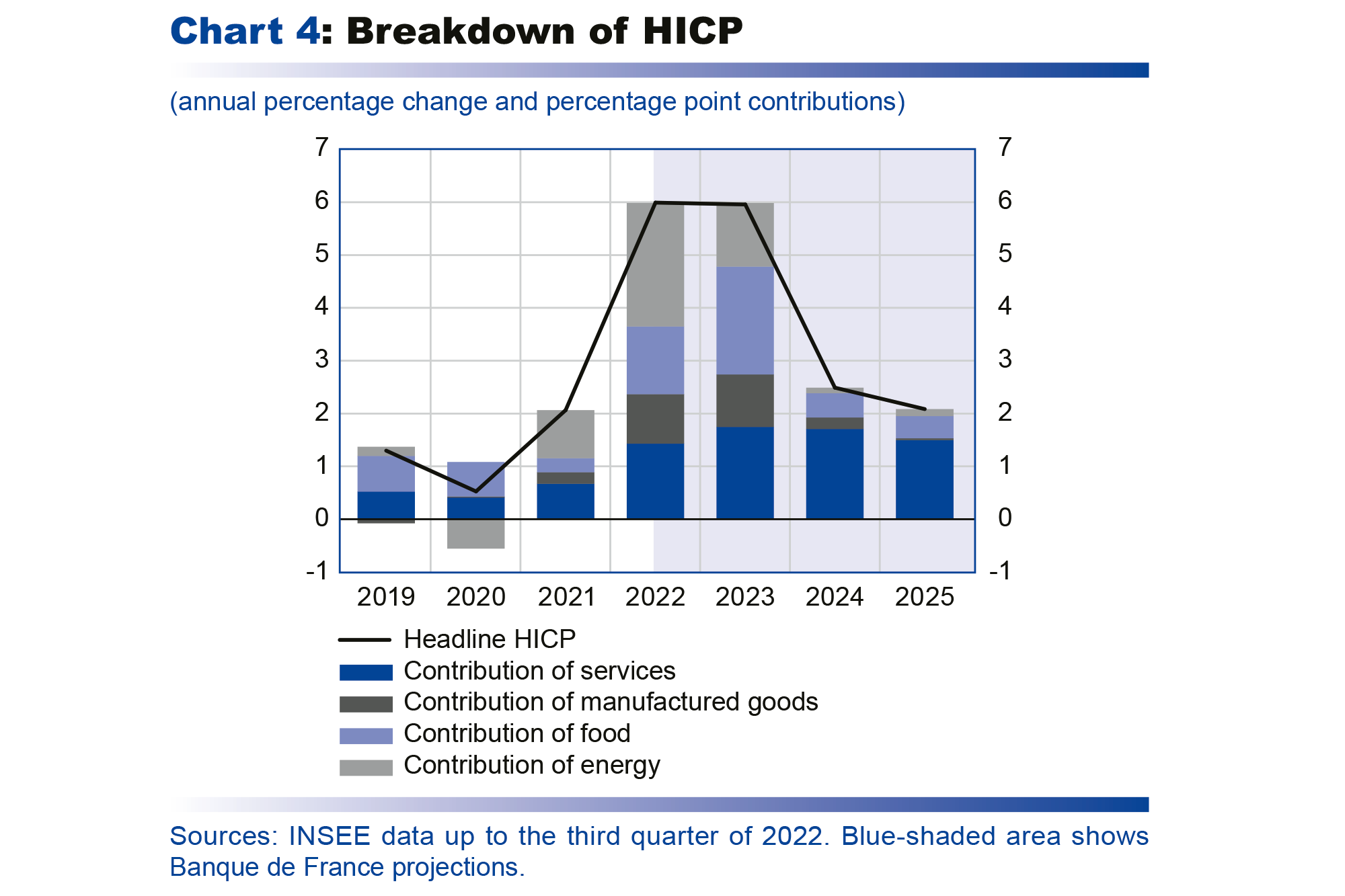

In 2022, therefore, headline inflation is expected to be 6.0% in annual average terms (underlying inflation, defined as inflation excluding energy and food, is seen at 3.5%). The main inflationary shock to the French economy this year is the surge in global energy prices. Admittedly, the pass-through of this shock to retail energy prices has been limited in 2022 thanks notably to the price shield, but it is being passed through indirectly, with a lag of a few months, to the other inflation components (food and manufactured goods) via the knock-on effects of higher production costs.

In 2023, headline inflation should remain at 6.0% in annual average terms, but is projected to follow a very different trajectory over the year, i.e. a peak in the first half and then a gradual but clear decline over the remainder of the year. In year-on-year terms, inflation is expected to subside to 4.0% in the fourth quarter of 2023, from 7.3% at the end of 2022. Its various components should also follow different paths. The end of the fuel rebate and the rise, albeit limited, in household electricity and gas prices at the start of 2023 should push up the energy component again, although to a more moderate extent than in 2022. Food and manufactured goods inflation is predicted to ease only gradually, as the ongoing pass-through of production costs fuels some persistent price growth. Services inflation, for its part, should be buoyed by the increase in nominal wages, but it should be kept in check by the 3.5% cap placed on the rent reference index between July 2022 and June 2023.

In 2024, with the easing of energy and food commodity prices currently factored in by futures markets, all components of inflation should fall, except for services prices which should be supported by the lagged adjustment of wages and rents (see Chart 4). Headline inflation is thus projected to be 2.5% in annual average terms and 2.4% year-on-year at the end of the year.

In 2025, headline inflation is seen abating further to an annual average of 2.1%, and underlying inflation should also slow to 2.2%. Year-on-year, headline inflation and underlying inflation are projected to fall to 1.9% in the fourth quarter of 2025. However, these figures mask contrasting trends caused by adjustments in relative prices. Whereas manufactured goods inflation is seen coming back to a feeble rate of scarcely above zero in annual average terms, services inflation should remain at an annual average of 3.4% (close to the rates seen in the 2000s), supported by robust wage growth. Overall, the gradual decline in inflation over the projection horizon reflects a combination of factors: the stabilisation of commodity prices in 2023 (implying the dissipation of base effects linked to the previous sharp rises) and their subsequent downward path in the technical assumptions underlying these projections, the impact of monetary policy and, as a corollary, medium-term inflation expectations remaining anchored at close to the ECB’s inflation target.

Nominal wages are seen growing sharply over the entire projection horizon

The growth in consumer prices is already being partly passed through to nominal wages, which are in turn fuelling further price rises according to the usual wage-price feedback effects that we have factored into our forecasts (see Appendix A: “Some wage rises but no inflationary spiral over the entire projection horizon”).

The SMIC, which is automatically indexed to inflation, was revised upwards four times between October 2021 and August 2022. As a result, in August 2022, it was up 8% year-on-year, although this growth rate then subsided to 5.6% in November 2022. These increases are in part being passed through to the rest of the pay scale, notably via industry-level wage bargaining agreements. In the fourth quarter of 2022, industry-level wage floors were up by around 5% year-on-year compared with rises of close to 1% in previous years. After the jump in the minimum wage in August 2022 and the further rise of just under 2% expected in January, some industries could find that their wage floor is below the SMIC, forcing them to factor in an upward adjustment of their pay scales when they start their compulsory annual wage talks in 2023. Many industry-level wage agreements also contain inflation clauses stipulating that discussions have to be reopened over the course of the year if inflation proves to be higher than anticipated.

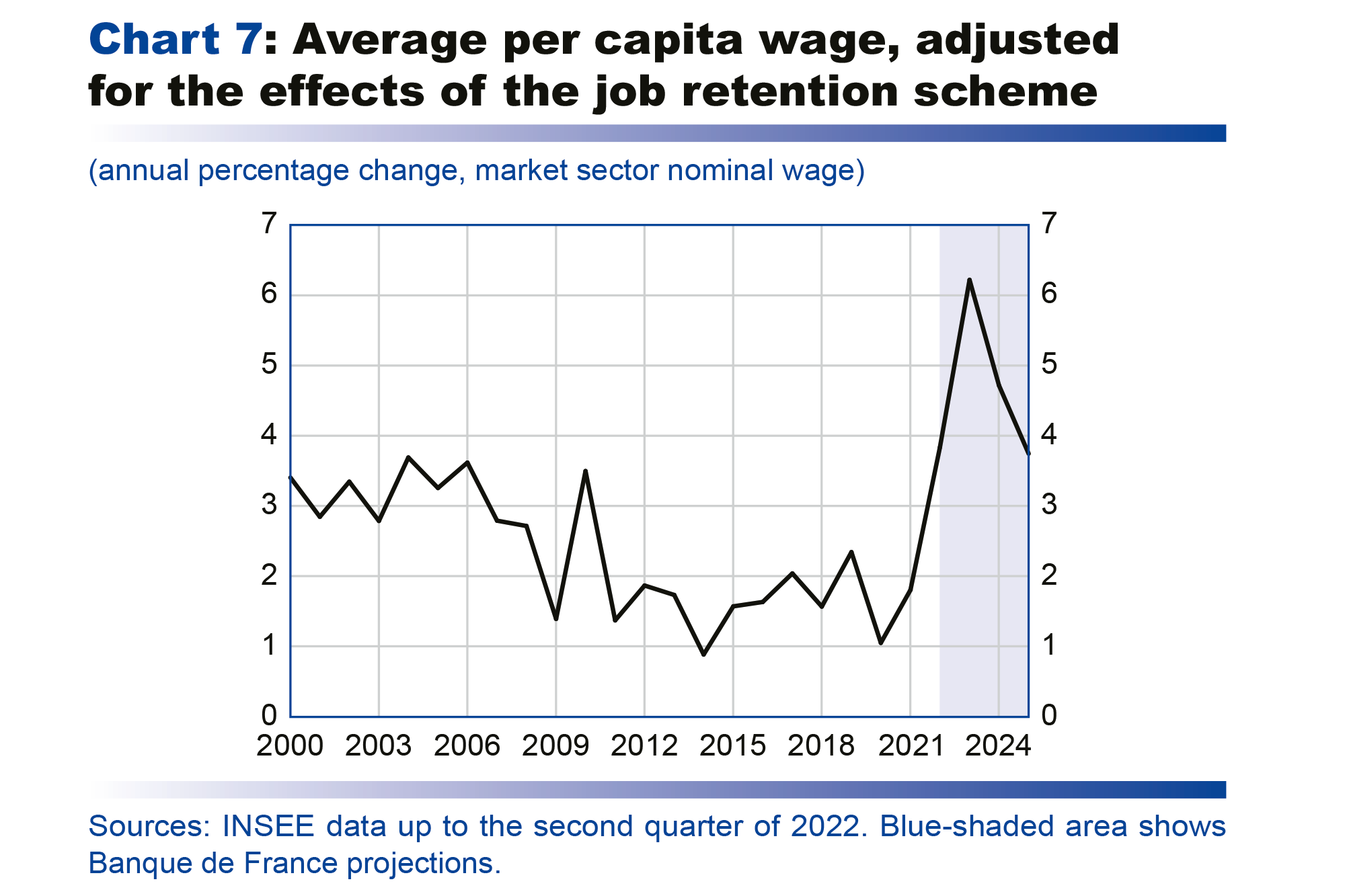

Against this backdrop, the average per capita nominal wage, which includes the prime de partage de la valeur (PPV – value sharing bonus) and is also being supported by individual pay rises (amid ongoing recruitment difficulties), should accelerate markedly. Its year-on-year growth rate should peak at 6.4% in the second quarter of 2023, and then gradually slow to just under 4% by the end of 2025, which is still slightly above the average seen over the first decade of the millennium (see Chart 7).

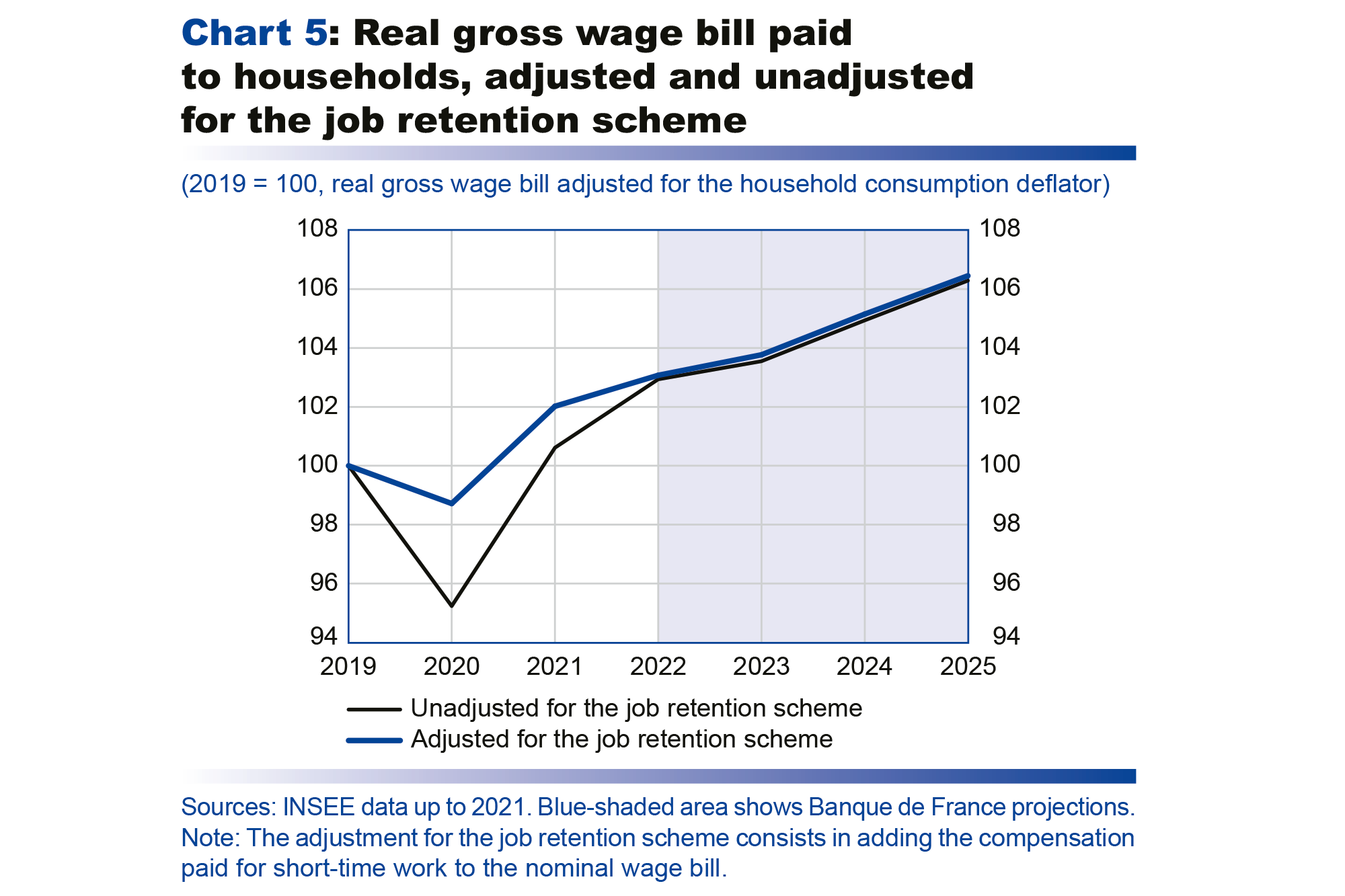

Historical regularities suggest that nominal wage increases have initially only partly offset rises in inflation since the end of wage indexation in the 1980s. However, the counterpart to this is that nominal wages also fall more slowly than consumer prices when inflation subsides. It is thus important to take these trends into account over the entire projection horizon. Furthermore, while the average real wage (adjusted for the job retention scheme and for consumer prices) is projected to decline in 2022, the total real wage bill is not expected to shrink, owing to strong employment growth (see Chart 5). Real wages should start to pick up again in 2023, and should converge towards their pre-Covid growth rate in 2024 and 2025 (see Appendix A: “Some wage rises but no inflationary spiral over the entire projection horizon”).

Following a limited decline in 2022-23, average household purchasing power should start to grow again in 2024-25

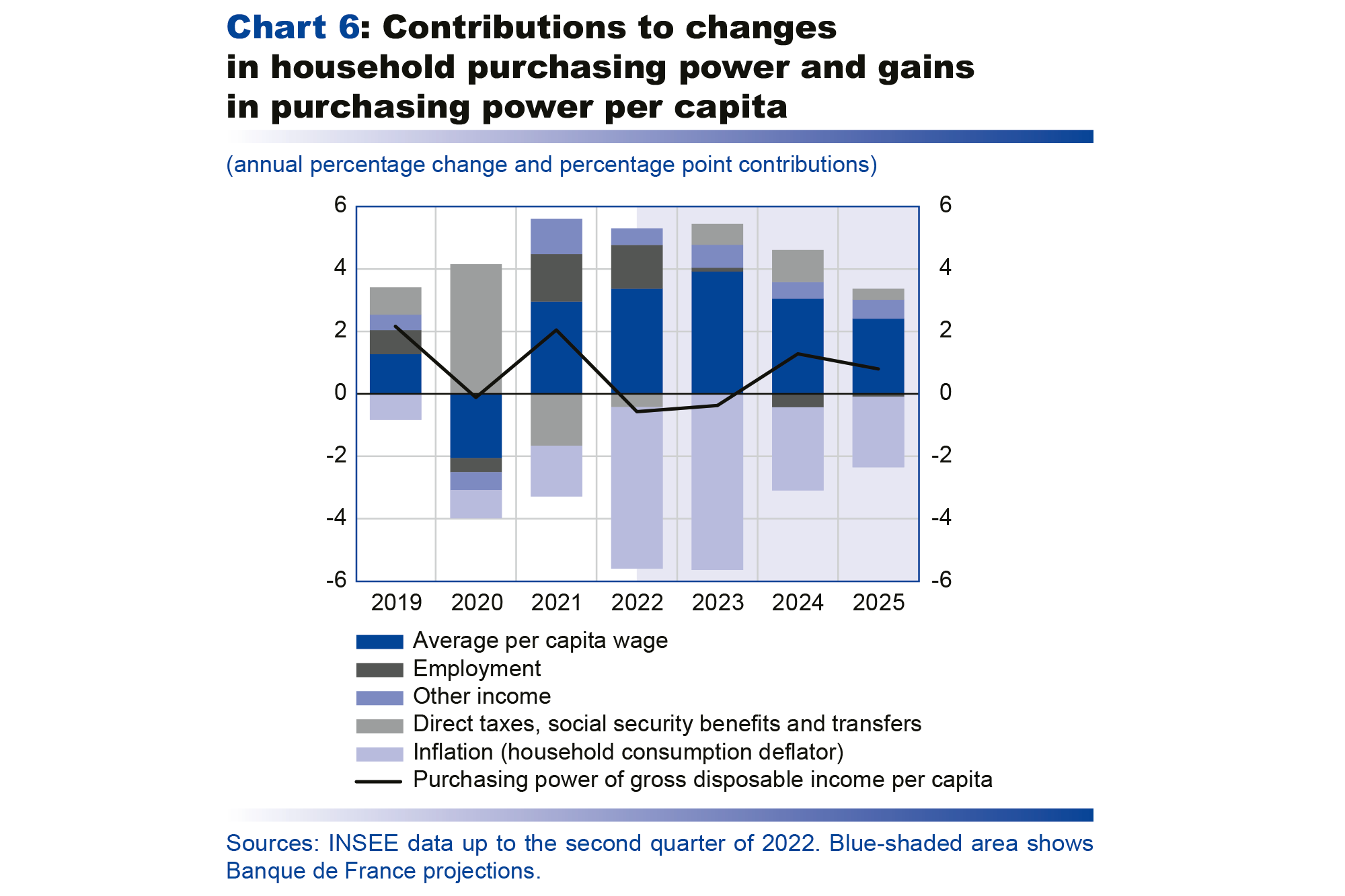

Despite strong growth in per capita nominal wages, given the high inflation, household purchasing power is expected to decline slightly in 2022 and 2023 (respective falls of 0.6% and 0.4%), but less than the marked 2.0% rise seen in 2021 (see Chart 6). The various fiscal measures put in place to support purchasing power should, however, cushion the external shock to real incomes. The total amount of support for households is expected to be around EUR 50 billion in 2023, which should contribute around 3.5 percentage points to household purchasing power, all else being equal. Purchasing power per capita should then recover gradually in 2024 and 2025 as the price shock abates and nominal wage growth remains robust. It is projected to exceed its pre-Covid crisis level by more than 3 percentage points in 2025. This aggregate picture nonetheless masks significant disparities across households, depending on the income share they spend on energy and food, and on the extent to which their income is protected from inflation (e.g. via the rise in the SMIC and in certain social transfers).

This limited loss of purchasing power over a two-year period should dampen consumption in 2022 and 2023. Household consumption should see weak growth in 2023 (0.3%), as households are only expected to make modest use of their savings to smooth their spending, reflecting precautionary behaviour in the face of rising unemployment and fears over the global geopolitical situation. Consumption is then predicted to accelerate gradually over 2024 (growth of 1.1%) and to return to more robust growth in 2025 (1.7%).

The excess financial savings accumulated during the Covid crisis fuelled a sharp rebound in household investment in 2021, essentially in real estate. It should now stagnate, however, due to the loss of purchasing power, to rising construction costs linked notably to building material shortages and structural hiring difficulties in the construction sector, and to the gradual normalisation of financing conditions. After peaking at the start of 2022, the household investment ratio is anticipated to decline gradually up to 2025, returning to near its pre-Covid level.

In the uncertain environment, households are projected to continue saving more than before 2020. The saving ratio should thus remain high over 2022-24, at an average of 16.4% of gross disposable income. It should then fall gradually to around 16% in 2025, although this is still close to the maximum ratio seen before 2019, as the uncertainty – and associated precautionary saving behaviour – is only seen easing gradually under our scenario.

After an overall favourable environment in 2019-21, corporate margins should be squeezed by higher production costs and a near-absence of productivity gains in 2022-23, before normalising to an extent

The global supply chain bottlenecks and upward pressures on non-food commodity prices have begun to ease, although prices in general remain high. Higher energy costs, the acceleration of nominal wages and the near-absence of gains in apparent labour productivity (caused by the fact that employment growth is currently outstripping activity growth) are all weighing on corporate margins. Businesses are beginning to be hit by soaring electricity and gas bills, which are pushing up production costs and eroding margins. According to the Banque de France’s business surveys, a substantial share of businesses (nearly 20%), especially in industry (nearly 30%), expect the energy situation to have a strong impact on their margins over the next three months. However, due to the gradual expiry of fixed-tariff contracts, the pass-through of energy bills to production costs tends to be lagged, and should therefore continue over 2023.

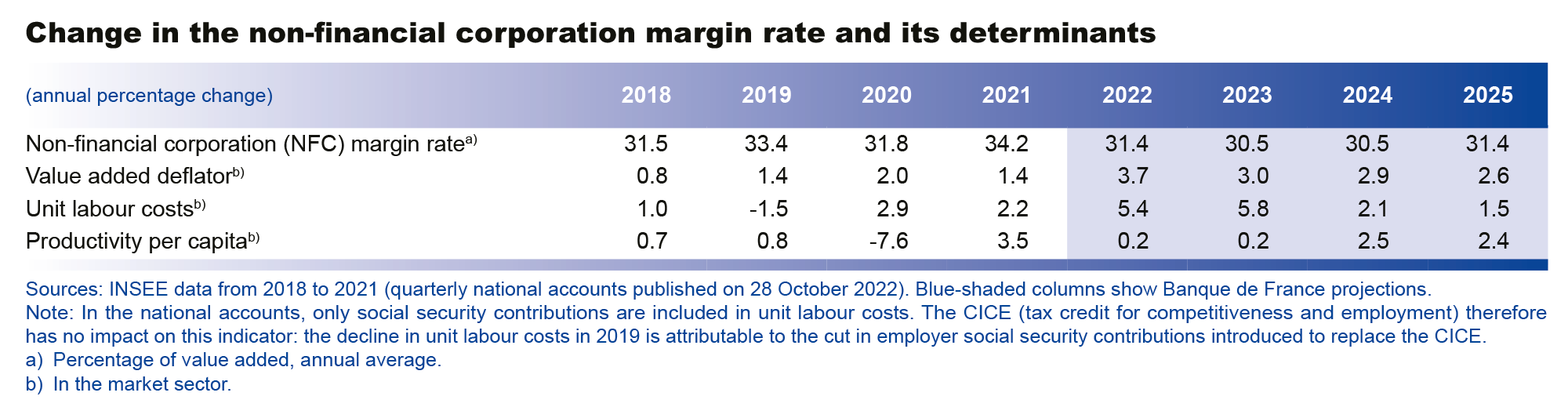

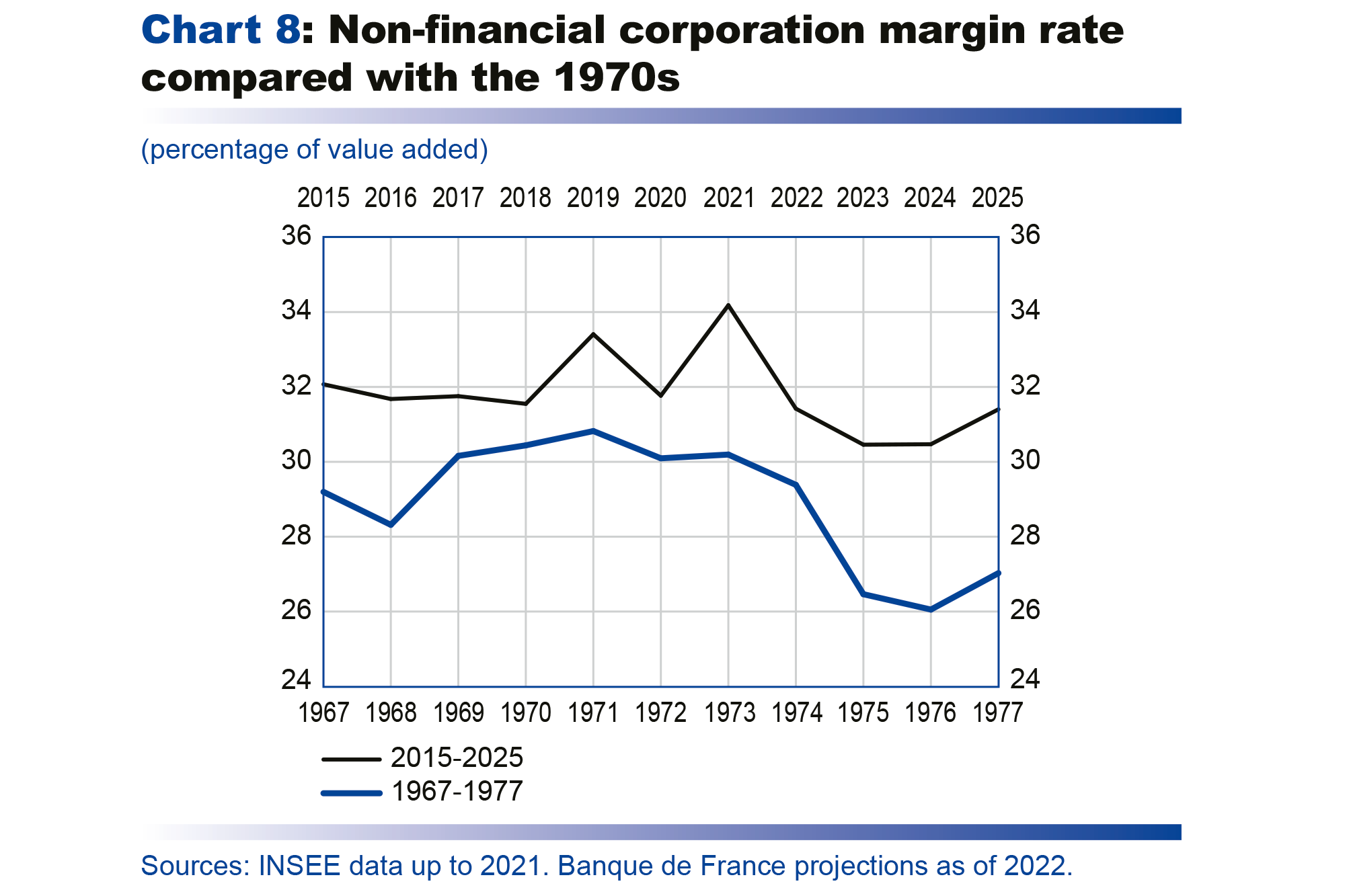

Against this backdrop, unit labour costs (ratio of compensation per employee to labour productivity) are projected to grow by 5.4% in 2022 and 5.8% in 2023, while per capita productivity should only rise by 0.2% in each of those years. The weakness in productivity gains stems notably from the rise in work-study contracts and a preference by some businesses to hold on to staff in anticipation of the future rebound in activity. Despite the significant increase in the value added deflator, reflecting firms’ ability to partially pass on cost rises to prices, the non-financial corporation (NFC) margin rate, which was supported in 2020 and 2021 by the measures to tackle the Covid crisis, should be around 1 percentage point lower in 2023-24 than it was in 2018, which is being taken as the pre-Covid reference period (2019 was impacted by the double-counting of the crédit d’impôt pour la compétitivité et l’emploi (CICE – tax credit for competitiveness and employment; see table). The decline should be smaller than the drop of around 4 percentage points during the 1970s oil shocks, when businesses bore the brunt of the external shock (see Chart 8 below).

Then, as productivity growth is expected to bounce back and wage growth to slow (albeit remaining robust), the margin rate should expand again over 2025, helped by cuts to production taxes, and come back to near its pre-crisis 2018 level. Our forecast is for a gradual closure of the productivity cycle by the end of the projection horizon, in other words productivity levels are expected to come back towards their medium-term trend by the end of 2025.

This overall forecast for the NFC margin rate masks considerable disparities between sectors. Up until the first quarter of 2022, margins rose sharply in the energy sectors, contrasting with non-energy manufacturing activities. However, according to the latest available data from the third quarter national accounts, the trend appears to be evening out across sectors and this could be confirmed over the coming quarters thanks to the measures implemented at the domestic and European levels (charge de service public de l’énergie (CSPE – public service energy charge) at the domestic level, and European windfall tax on energy providers; see infra, section on government finances).

After recovering rapidly following the public health crisis, business investment remained strong in the first half of 2022, buoyed by spending on digital technology and a recovery in transport equipment investment in the third quarter. However, the upward trend in the investment ratio observed over recent years should come to a halt over the projection horizon, reflecting the slowdown in activity, a wait-and-see approach linked to the macroeconomic uncertainty, and the normalisation of financing conditions which should push up the cost of capital. Over the entire projection horizon, the NFC investment ratio is seen stabilising at around 25.5% of value added, in line with the historic high reached in 2021 (see Appendix E, Table E3).

A temporary rise in unemployment linked to the changes in activity and productivity

Employment gains remained very strong over the first three quarters of 2022, with the private sector adding 271,000 net salaried jobs between end-December 2021 and end-September 2022, after 841,000 in 2021. These gains were supported in the first half by the lifting of the Covid-related restrictions and reopening of services, as well as by a continuing rise in the number of apprenticeship contracts. There were 921,000 apprentices employed in the private sector at the end of September 2022 compared with 788,000 a year earlier. With activity slowing, however, the counterpart in 2022 to this robust growth in employment and in the volume of hours worked is a near‑stagnation of per capita productivity (growth of 0.2%) and a 3.5% decline in hourly productivity.

In the fourth quarter of 2022, based on the carry-over effect and the latest available data (reporting of new hires, business surveys), growth in market sector salaried employment is projected to remain robust. However, despite the strength of apprenticeships factored into our projections, market sector salaried employment should start to fall in 2023, reflecting the slowdown in activity for 2023 and an expected improvement in productivity in 2024 (see Chart 9 and section on businesses). Employment should then stabilise at the start of 2025, slightly lagging the recovery in activity which is predicted to start the previous year. It should then start to rise again over the course of 2025.

The unemployment rate should thus follow a bell-shaped trajectory: it should rise first from its current low level, due to the sharp slowdown in growth and recovery in productivity, then start to fall back over 2025 (see Chart 10). Indeed, over the entire projection horizon, it should remain close to the historic lows observed for France, particularly since the start of the 2000s.

The government deficit is expected to remain large in 2022-23 despite the end of the Covid-19 support measures, due to continuing recovery measures and the support to cushion the economy from inflation. Based on data available at this stage, the government debt ratio should remain at around 112% of GDP over the projection horizon

The government budget balance is projected to remain firmly negative in 2022, at close to -5.0% of GDP, albeit less so than in 2021 when it was -6.5% of GDP. Government receipts are expected to rise, fuelled by a tax revenue-to-GDP elasticity of above unity and the receipts from the charge de service public de l’énergie (CSPE – public service energy charge), and despite the tax cuts for households and businesses (continuing abolition of housing tax and the TV licence fee, lowering of the corporation tax rate). With regard to government expenditure, this is expected to slow to an extent as the Covid-19 emergency measures come to an end. However, the government is still deploying significant funds in 2022 to protect households and businesses from inflation (estimated gross expenditure of over EUR 50 billion in 2022), via the price shield (payment of compensation to gas and electricity suppliers, rebate on fuel) and other support measures (upward revision of welfare benefits, increase in the index points in the public sector pay grid, resilience plan for businesses). On top of this, it should also continue to spend under the France Relance and France 2030 recovery plans. The interest burden on government debt is expected to rise amid the increase in interest rates and in inflation (which directly affects interest payments on inflation-indexed bonds).

In 2023, as activity slows, the government deficit is projected to widen slightly to 5.4% of GDP, reflecting the continuation of inflation-cushioning measures and the impact of high inflation on operating costs and interest payments. Regarding receipts, the gradual normalisation of corporation tax receipts should lower the spontaneous elasticity of taxes and social security contributions to slightly below unity. However, the tax-to-GDP ratio should increase by around 1 percentage point owing to taxes on electricity producers (receipts linked to the CSPE mechanism and European windfall tax on energy providers). This should be partially offset by the first stage of the abolition of the cotisation sur la valeur ajoutée des entreprises (CVAE – corporate value added contribution). Regarding expenditure, the reduction of the recovery plan measures should be counter-balanced in part by new schemes (increase in France 2030 spending, green fund, support for apprenticeships, etc.), and the increase in gross spending on measures to cushion the energy price rise, which should reach just under EUR 60 billion based on the trajectory of electricity futures prices. As a result, the primary expenditure-to-GDP ratio should only remain stable. The interest burden is projected to continue rising, tracking interest rates and inflation.

In 2024-25, at constant legislation, the government deficit is forecast to narrow, reaching 4½% of GDP at the end of the projection horizon. The tax-to-GDP and government expenditure-to-GDP ratios are projected to decline as spending on the price shield is lifted. In 2025, the tax-to-GDP ratio should be close to that seen in 2018 (44.5%), before the Covid crisis. However, the ratio of government expenditure to GDP should be 56% in 2025, which is still about 2 percentage points higher than it was in 2018-19, with just over half of this attributable to the rise in primary spending and just under half to the rise in the debt burden. The government’s budget documents mention further savings for beyond 2023, but these have not been set out in sufficient detail at this stage (as pointed out by the Cour des Comptes and Haut Conseil des Finances Publiques).

Overall, the government debt ratio is not projected to fall and should remain at close to 112% of GDP over the entire projection horizon (see Chart 11 above).

Strong and persistent uncertainty, notably over energy prices and supplies

The geopolitical situation linked to Russia’s war in Ukraine remains highly uncertain. The risks relate notably to the supply and price of gas in the event that insufficient alternative sources are found. Moreover, any continuation of the maintenance problems at France’s nuclear reactors could lead to additional electricity supply disruptions. In the short run, these risks are to the downside for activity and to the upside for inflation. In the medium run, the risks around our projection become more balanced. Notably, the decrease in the energy price might be stronger than expected. Conversely, a sharper acceleration in nominal wages would cause a more persistent wage-price loop.

There are other risks to our forecasts, both on the upside and downside. In particular, in China, a severe resurgence of the pandemic following the easing of the “zero Covid” policy could force the authorities to reintroduce public health restrictions. This would once again disrupt global supply chains and global trade. At the same time, however, the deterioration in China’s macroeconomic situation could take some of the pressure off commodity prices.

Source: Banque de France

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.