Emerging market economic growth rebounded at the start of the final quarter of the year, according to S&P Global’s PMI surveys. Faster services activity growth was notably accompanied by an accelerated expansion of manufacturing production from near-stalled growth in September. Moreover, confidence among emerging market businesses improved following news of fresh stimulus in mainland China, though that has yet to translate into job creation, as emerging market employment fell for the first time in six months.

Meanwhile price pressures remained historically muted despite firms across both manufacturing and service sectors having raised selling prices at faster rates in October. The latest price data continue to hint at room for emerging market central banks to further lower interest rates post the November FOMC meeting, which may prove supportive of the rising new orders trend in October.

Emerging markets expand at fastest pace in four months

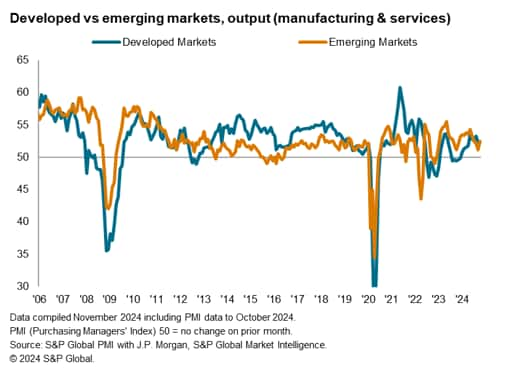

The PMI surveys compiled globally by S&P Global revealed that the rate at which output expanded across the emerging markets collectively accelerated for the first time in five months in October, reaching the fastest since June. The GDP-weighted Emerging Market PMI Output Index rose to 52.5 in October, up from 51.1 in September, supported by improvements in both the manufacturing and service sectors.

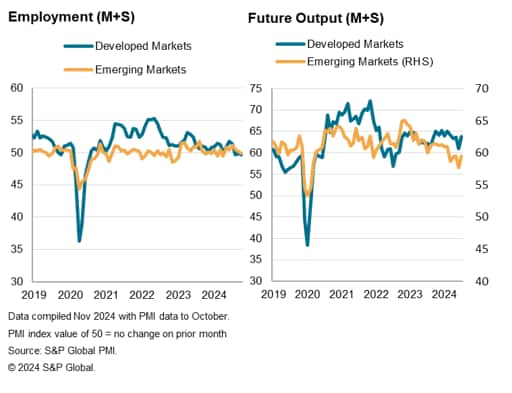

Compared with developed markets, the latest acceleration in growth pace enabled emerging markets to reclaim the lead following three successive months of relatively quicker developed markets expansions. The latest data also signalled that emerging markets have extended their growth streak to more than twice as long as developed markets at 22 months thus far.

Emerging market manufacturing expansion rebounds

While October’s PMI data revealed that emerging market services activity rose at a quicker rate, it was the re-acceleration in manufacturing output expansion that offered visibly better news amid the wider global manufacturing sector downturn. After near-stalling in September, emerging market manufacturing production rose at the quickest pace in four months. Although modest, this marked the first acceleration in production growth since June with the rate of growth now being only slightly below the long-run average.

Of course, the service sector, which is the bigger contributor to the GDP pie, had also seen an acceleration in growth to the fastest in three months, once again outperforming manufacturing at the start of the fourth quarter.

Broad-based improvements across major emerging economies

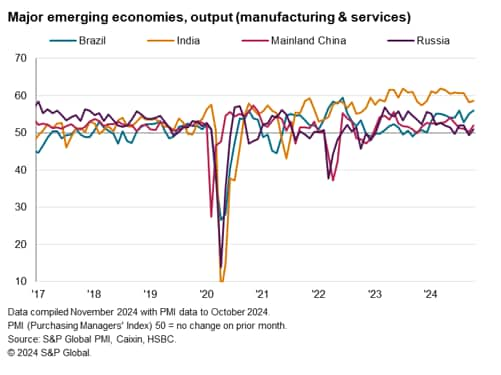

With Russia returning to growth, all four of the major emerging market economies expanded in October. Moreover, growth rates across the top three – India, Brazil and mainland China – also accelerated to reflect broad-based improvements in business conditions across key emerging market economies at the start of the fourth quarter.

India retained the lead among the major emerging economies for the twenty-eighth month running, though Brazil reported faster growth to close the gap in India. While India’s growth was the second-slowest so far in 2024, business activity in Brazil rose at the second-fastest pace in 28 months. The acceleration in Mainland China’s growth was meanwhile notable, reflecting early signs of improvements amid recent supportive government policies announcements.

Emerging market employment falls despite improvements in confidence

While emerging markets new orders and output expanded at quicker rates at the start of the final quarter of the year, employment underperformed. Staffing levels were lowered for the first time in six months, albeit only marginally. This nevertheless marked only the third time that headcounts fell among emerging markets this year. Job shedding mainly unfolded in the manufacturing sector, taking place at the most pronounced rate since May 2023, while services employment remained in marginal growth.

Despite an improvement in confidence among both emerging market manufacturers and service providers, albeit limited to mainland China, the latest data signalled that the upturn in optimism had not translated to better hiring activity which will be important for higher consumption.

Muted inflation

Finally, price pressures remained muted in October even as new business inflows and output growth improved. Selling price inflation ticked up from a 17-month low in September but remained below the long-run average. This was as input prices rose at among the softest pace so far into the second half of 2024, despite quickening slightly from September.

The subdued inflation situation bodes well for emerging market central banks to further lower interests rates following another rate cut by the US Federal Reserve in November. Amid rising uncertainty over global trade conditions, seeing emerging market export orders maintaining near-stalling conditions in October, the loosening of monetary policy conditions will hopefully provide further relief into 2025. That said, with the change in the head of state in the US, concerns for tighter-for-longer US monetary policy and a stronger US dollar have also risen, and we will continue monitoring the likelihood via the PMI price indices in the coming months.

Source: S&P GLOBAL – by Jingyi Pan

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.