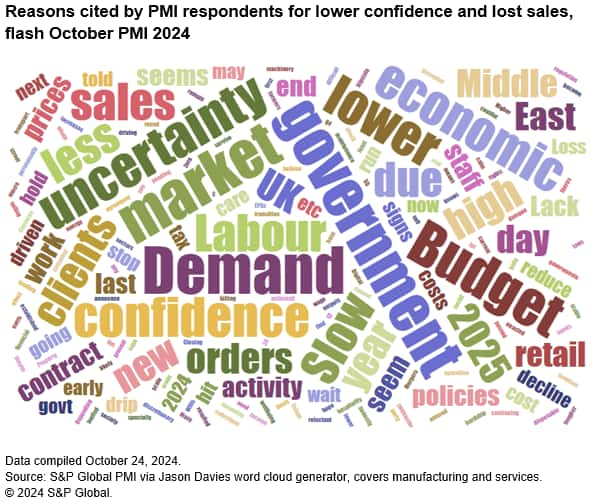

Business activity growth has slumped to its lowest for nearly a year in October as gloomy government rhetoric and uncertainty ahead of the Budget has dampened business confidence and spending. Companies await clarity on government policy, with conflicts in the Middle East and Ukraine, as well as the US elections, adding to the nervousness about the economic outlook.

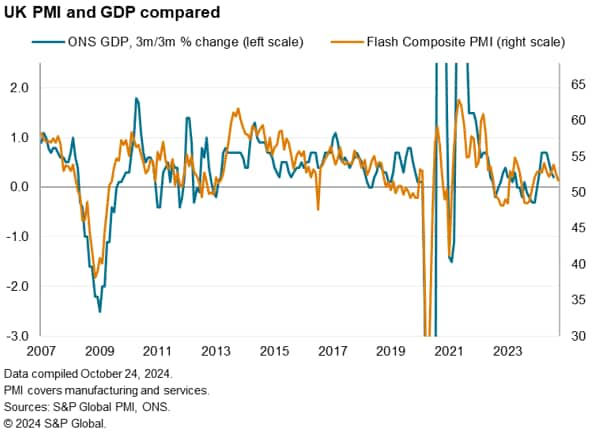

The early PMI data are indicative of the economy growing at a meagre 0.1% quarterly rate in October, reflecting a broad-based slowing of business activity, spending and demand across both manufacturing and services.

Worryingly, the deterioration in business confidence in the outlook has also prompted companies to reduce headcounts for the first time this year.

Cleary, the policies announced in the Budget have the potential to play a major role in steering the direction of the economy in the months ahead.

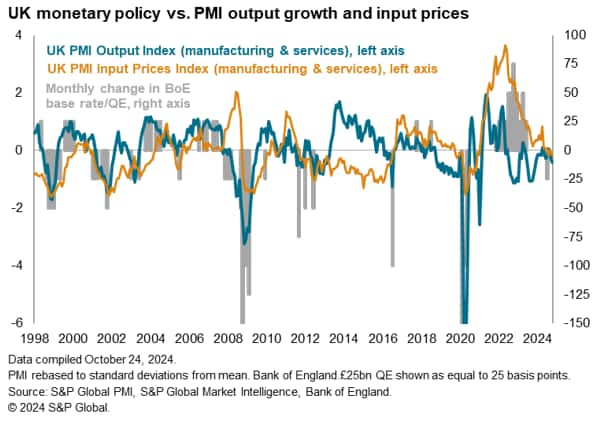

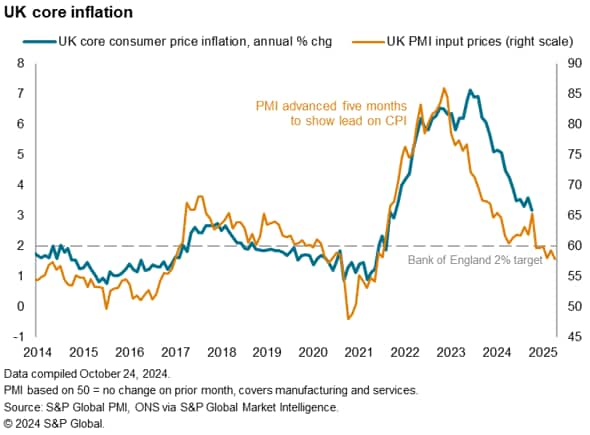

Encouragingly, however, a further cooling of input cost inflation to the lowest for nearly four years opens the door for the Bank of England to take a more aggressive stance towards lowering interest rates, should the current slowdown become more entrenched.

Output growth close to one-year low

Business activity growth lost momentum for a second consecutive month in October, dropping to the slowest for 11 months to herald a sluggish start to the fourth quarter

The headline indicator from the flash PMI surveys, the seasonally adjusted S&P Global UK PMI Composite Output Index, fell from 52.6 in September to 51.7 in October. While remaining above the 50.0 no change level to signal an expansion of activity for a twelfth successive month, the latest reading was the lowest since last November to indicate a slowing in the rate of expansion for a second month running.

The October flash PMI reading is broadly indicative of the UK economy growing at a quarterly rate of just 0.1%, down from a 0.2% rate signalled in September and a 0.25% expansion for the third quarter as a whole, based on the historical relationship of the PMI with GDP.

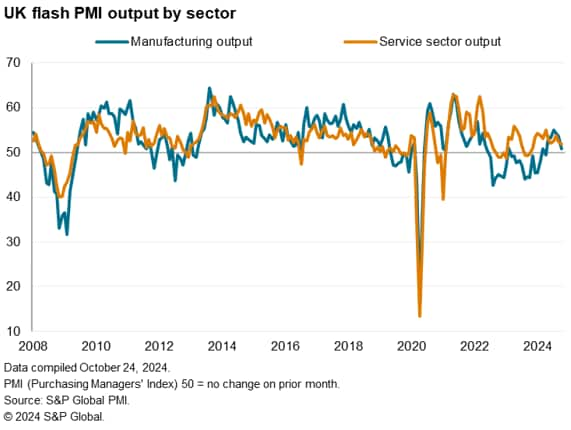

Manufacturing and services report slower growth

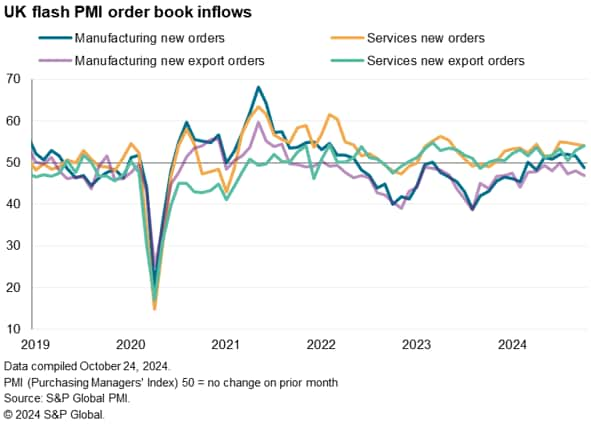

Growth slowed across both manufacturing and services in October. Manufacturing output grew especially modestly, rising at the slowest rate for six months amid the first fall in new orders seen over this period. Exports fell particularly sharply, registering the largest decline for eight months.

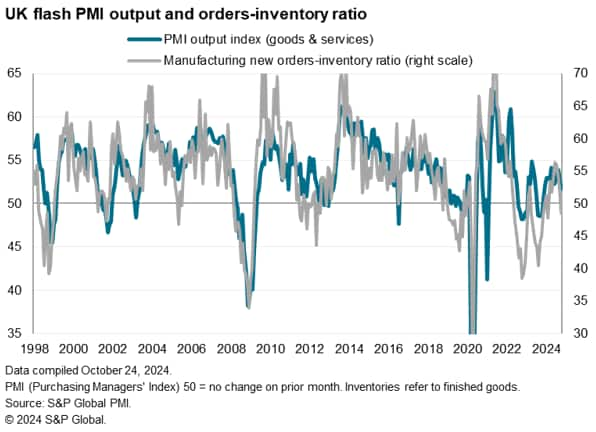

The drop in factory demand resulted in an increased rate of decline for backlogs of work alongside a rise in unsold stock levels for the first time in 16 months.

The manufacturing new orders to inventory ratio (the latter referring to the volume of unsold finished goods accumulating in warehouses) consequently fell in October to a seven-month low and to a level indicative of the economy slowing further in the coming months.

Weak demand also contributed to the factory sector becoming less optimistic about future output, with year-ahead expectations dropping to a 22-month low.

Services sector business activity growth also lost momentum to record the smallest gain for 11 months, with the survey sub-indices hinting at worse to come. Despite new business inflows continuing to be reported amid improved overseas sales, albeit at a slightly reduced rate, backlogs of uncompleted work fell sharply in the service sector, hinting at the possibility of business activity growth slowing further in the coming months. Hence future business expectations also moderated in the service sector in October, down to an 11-month low.

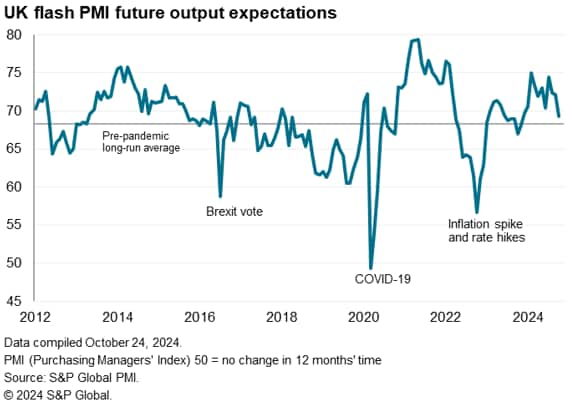

Lacking in confidence

Measured across both goods and services, business confidence measured by output expectations for the year ahead fell in October to the lowest since last November, and is now running only marginally above the survey’s long run average.

Companies across both manufacturing and services cite recent gloomy talk from the government and uncertainty surrounding the upcoming Budget as the major dampener on business optimism, with many firms – especially smaller companies – and their customers awaiting clarity on the new government’s policies. The US elections and conflicts in both the Middle East and Ukraine were also seen as further subduing confidence, fueling an environment in which both investment decisions and current spending were often reported to have been put ‘on hold’.

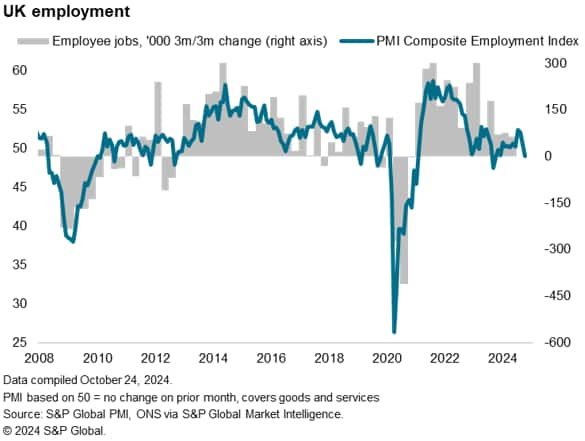

Hiring halt

The deteriorating outlook and slowdowns in business growth and demand caused companies to reduce headcounts for the first time since last December. A small rise in factory employment was more than offset by the first decline in service sector employment recorded so far this year, the latter falling at the fastest rate since last September.

Costs rise at slowest rate for nearly four years

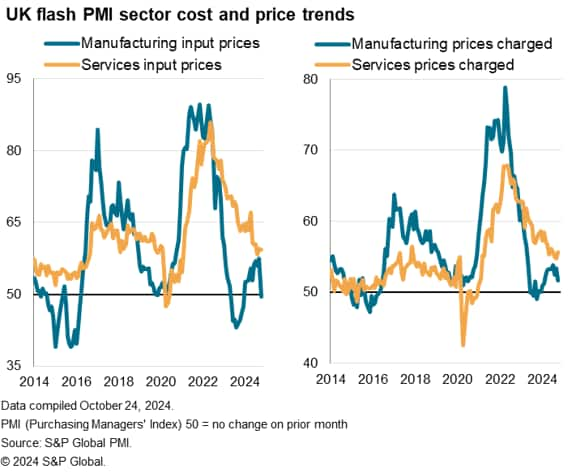

Despite the drop in employment, companies – notably in the service sector – continued to report upward pressure on selling prices due to pay growth. Services selling price inflation consequently ticked up to a four-month high, though is still running at one of the lowest rates seen since the pandemic. Encouragingly, service sector input cost inflation edged down to the second-lowest for 44 months, and is running only slightly above the pre-pandemic average.

However, the biggest change in the inflation picture in October came from the manufacturing sector, where selling prices rose at the slowest rate since February amid the first fall in input costs since last December. Producers reported costs to have fallen due to a variety of factors including the reduced import costs arising from the stronger pound, lower oil prices and greater discounting by suppliers.

Measured overall, input costs across goods producers and services providers rose in October at the slowest rate since November 2020, boding well for core inflation to fall further in the coming months.

Source: S&P GLOBAL- by Chris Williamson

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.