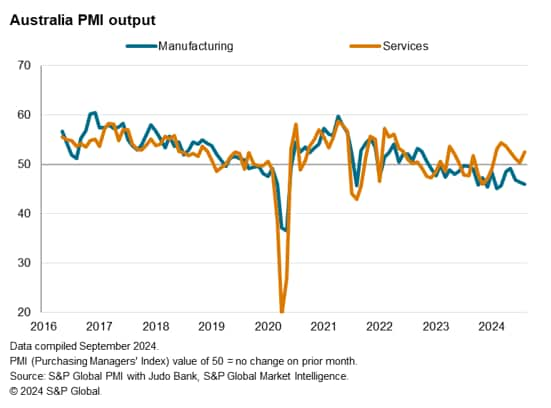

Australia’s private sector returned to expansion in August but detailed sector data revealed that growth was worryingly uneven, driven by the expansion in services activity while manufacturing output continued to decline.

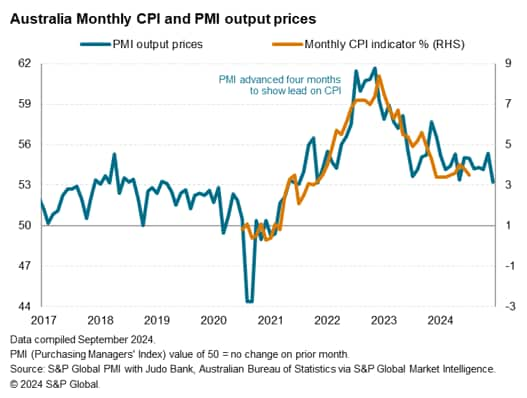

While hopes are for the easing of interest rates around the globe to support demand, including goods demand, early indications of stubbornly elevated price trends via the PMIs suggest that the Reserve Bank of Australia will be in no rush to start cutting rates.

Overall, forward-looking PMI indicators also hint that the two-speed economy may remain the case in the near-term, with better service sector conditions contrasting with a deteriorating goods producing sector.

Australia’s overall expansion likely to be sustained in the third quarter

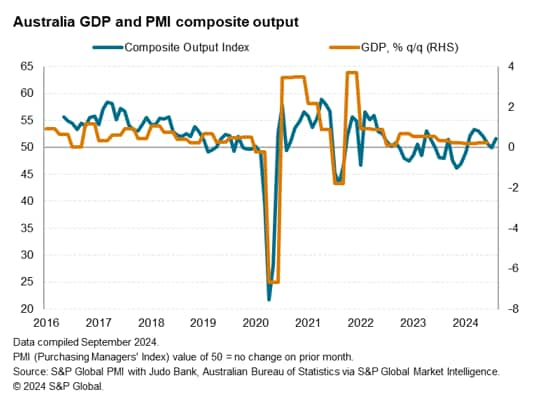

The Judo Bank Australia Composite PMI, compiled by S&P Global, rose to 51.7 in August, up from 49.9 in July. The latest reading signalled that Australia’s private sector returned to growth after a brief period of decline in July. The average PMI reading for the third quarter so far currently sits at 50.8. While the reading is lower compared to 51.9 in the prior quarter, it exceeded the 49.2 posted for the third quarter of last year. This suggests that we will see Australia remain in expansion, albeit at a slightly slower pace compared to the 0.2% quarter-on-quarter growth rate recorded for Q2 2024.

Australia’s output growth supported by services activity expansion

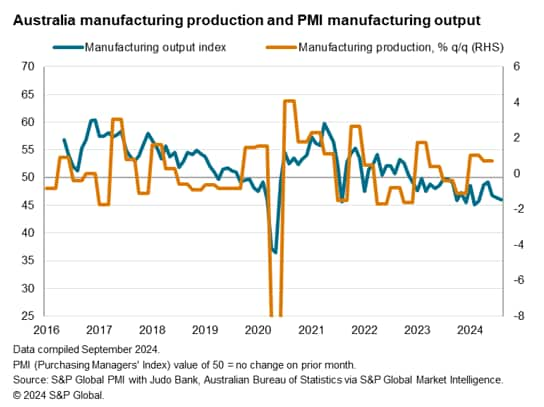

Detailed sector PMI data revealed that growth in August was driven by the services sector while the manufacturing sector remained in contraction. While services activity expanded at the fastest pace in three months, manufacturing output fell for the twenty-first successive month and at the most pronounced rate since March.

Anecdotal evidence gathered from our panels of around 400 firms each for the manufacturing and service sectors revealed that the downturn in manufacturing sector conditions was underpinned by the adverse impact of higher interest rates and subdued demand conditions, thereby suggesting that improvements in the goods producing sector may hinge on the lowering of lending rates.

Given the correlation between manufacturing sector output and production data, the latest downtrend suggests that manufacturing production has declined into the third quarter of 2024.

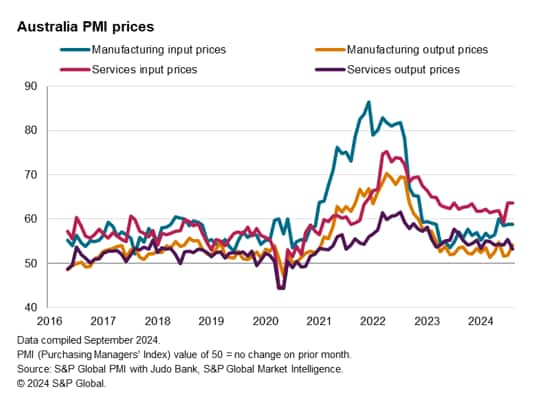

Australia inflation remains elevated

Ahead of the September US Federal Open Market Committee (FOMC) meeting, the global economy is viewed to be at an inflection point. Certainly, the two-track economy condition is not only prevalent for Australia, but is also seen on a global scale. However, the issue is that a deteriorating manufacturing sector often precedes a wider slowdown, including afflicting pressure on the services economy, which has fuelled jitters over the growth outlook.

That said, there are hopes that the lowering of interest rates, including in the US and other economies, may help to shore up business confidence and boost goods demand down the line.

While the Fed is well expected to lower rates in September and potentially thereafter as well, especially as US inflation is set to descend to a level consistent with the FOMC’s 2% CPI target in the coming months, the Reserve Bank of Australia (RBA) may have less impetus to start lowering rates with still-elevated inflation.

The latest PMI selling price data, which preludes the trend for official CPI data by around four months, indicate that we will likely see Australia CPI hovering above the 3% level despite having fallen to a seven-month low in August. Furthermore, average input prices, measured across both manufacturing and services, rose at the fastest rate in almost a year-and-a-half in August, which risks further increases in selling prices in the coming months should businesses opt to pass on their rising cost burdens to customers.

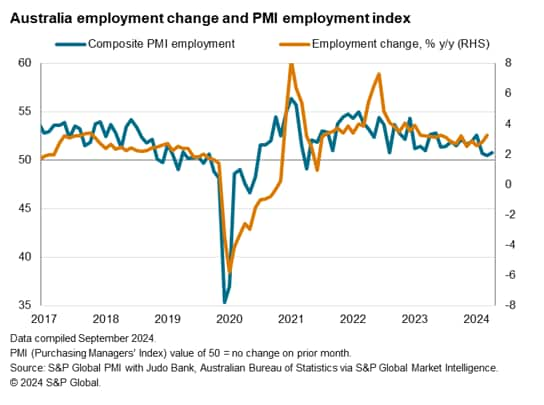

Employment growth slowed into the second half of 2024

Meanwhile employment remained in growth in August, though PMI data showed that the rate of hiring has slowed into the second half of 2024 thus far. While official data revealed some improvement in employment change over July, the deviation suggests that the rise in employment may be concentrated in certain sectors.

Forward-looking indicators hint at two-speed economy to continue in near-term

Another topic of interest is the impact of stimulus working through to households, with tax cuts and cost-of-living support being implemented. The official measure of retail sales has seen subdued growth in recent months, but the PMI services new business index, which is highly correlated with retail sales, hints at some improvement in August, which is a positive development that will be continued to be monitored.

The PMI new orders index also serves as a valuable forward-looking indicatorin providing signals on output in the immediate months to follow. While the new business gauge for services exhibited the fastest growth in three months, the equivalent for manufacturing showed new orders for goods fell at a more pronounced pace compared with July. This is indicative of the likelihood for the two-track economy in Australia to be sustained in the near term, especially amid any lack of policy intervention.

However, the path forward is by no means certain. According to future output indications, the only sentiment-based PMI index which likewise contains forward-looking elements, a recovery in confidence was observed in August. Future output expectations rose to the highest since January 2023. This included an improvement in the manufacturing sector, where optimism was at a one-year high in part due to hopes for lower interest rates around the world. As such, we will be looking for any clues of changes to economic and inflation conditions with the upcoming September flash PMI data, due to be released on Monday, September 23.

Source: S&P GLOBAL – Jingyi Pan

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.