Global economic growth slowed in June but remained the second-strongest seen for just over a year, according to PMI data, pointing to a further robust expansion in the second quarter of 2024 after the slowdown seen in late 2023. June saw a further slight acceleration of growth in the US, bucking a broader developed world slowdown, while India continued to lead the emerging markets by a wide margin.

Global growth meanwhile became more broad-based, with all 25 sub-sectors covered by the PMI reporting stable or rising output in June for the first time in three years.

Business expectations for the year ahead fell to the lowest for seven months, in part linked to political uncertainty surrounding elections in India, the UK and France, as well as upcoming presidential election in the US.

Global growth cools from 12-month high

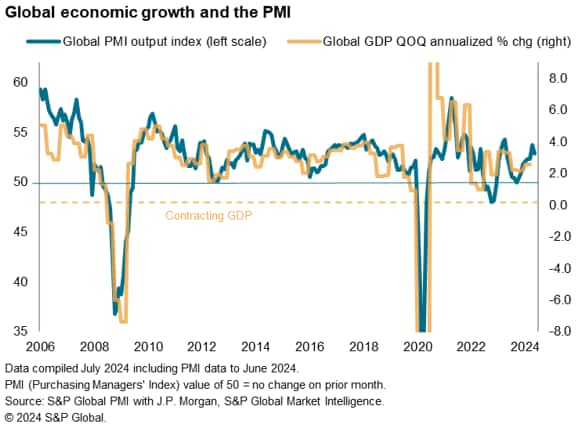

S&P Global Market Intelligence’s PMI surveys indicated that the global economy expanded for an eighth consecutive month in June. The rate of growth slowed slightly compared to May but remained the second-highest seen over the past 13 months. The headline JPMorgan PMI, covering manufacturing and services in over 40 economies, fell from 53.7 in May to 52.9.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 3.0% in June, with a 3.0% rate also signalled on average for the second quarter of 2024 as a whole.

United States bucks developed world slowdown

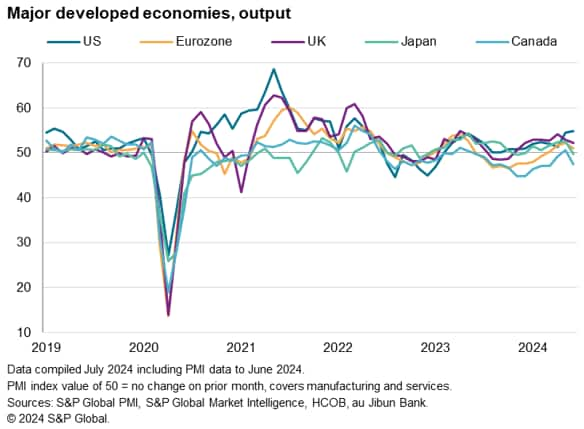

The US bucked a broader developed world slowdown, with output growing at the steepest pace since April 2022. US services activity growth hit a 26-month high, offsetting cooler manufacturing growth.

In marked contrast, output fell in Canada, having risen briefly in May for the first time in a year, led by a weakened service sector.

Japan also slipped back into decline. Although only marginal, the downturn was the first recorded for seven months. A first fall in services sector output for 22 months was partly countered by a rise in manufacturing output for the first time in 13 months.

Growth meanwhile slowed in Europe. While output rose in the eurozone for a fourth month, thanks to a sustained service sector upturn, the rate of increase slowed sharply amid declining output in France (amid an election-related hiatus of spending) and near-stalled output in Germany.

The UK meanwhile reported an eighth successive monthly expansion, though growth slowed in both manufacturing and services to result in the weakest upturn so far this year, albeit partly blamed on a pause in spending ahead of the upcoming election.

India sustains strong lead across emerging markets

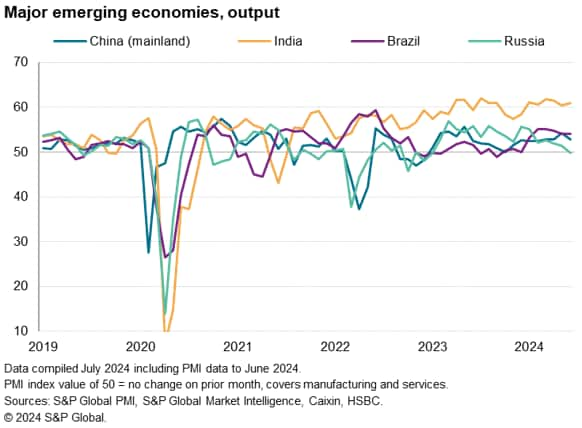

Mixed growth trends were evident across the emerging markets in June. India again led the four BRIC economies by a wide margin, with growth re-accelerating from an election-related dip in May to one of the strongest seen over the past 14 years. Faster growth was recorded for both goods and services.

Growth also ticked higher in Brazil, sustaining the strong expansion seen over the year to date. The upturn continued to be led by the service sector, though manufacturing also recovered from the near-stalled picture seen in May.

In contrast, Russia reported a marginal contraction of output, suffering its first decline in 17 months, as a steepening fall in services activity offset a sustained robust gain in manufacturing.

Growth meanwhile also slowed in mainland China, albeit merely paying back some of the strong gains seen in May to still register one of the strongest expansions seen over the past year. Manufacturing output rose at the sharpest rate for two years, helping counter a marked slowing in services activity.

All global sub-sectors stable or expanding for first time in three years

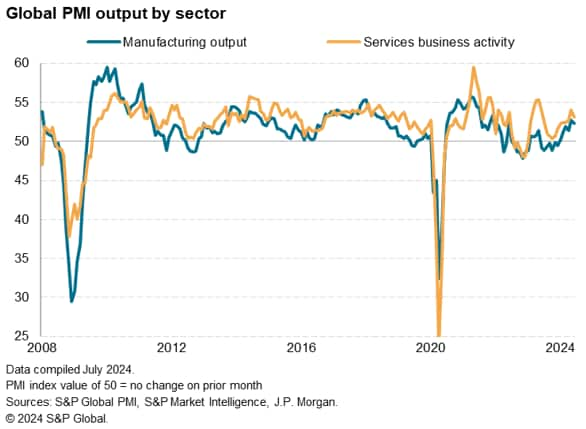

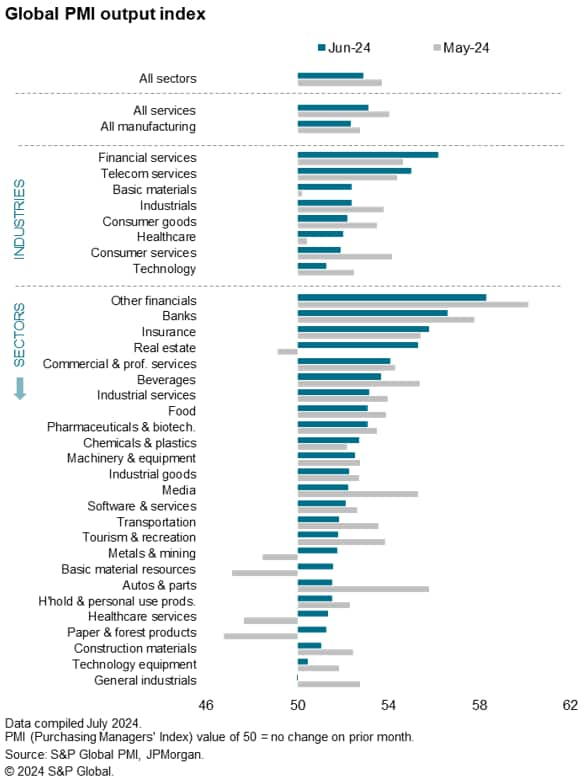

By sector, global growth was again led by the service sector despite its momentum slowing to the second-fastest seen for 12 months. Manufacturing growth also dipped from May but was still the second-strongest in two years.

Although the pace of expansion slowed, growth became more broad-based. All of the 25 sub-sectors covered by the PMI avoided contraction globally in June for the first time since July 2021. Expansions were reported across the board bar General Industrials, which reported stable output.

Growth was led by ‘Other Financials’, Banking, Insurance and Real Estate, underscoring the current dominance of financial services. Real Estate notched up its second-highest growth in three years.

However, other noteworthy developments include a two-year high for Chemicals & Plastics output, and a 28-month high for Forestry and Paper Products, while the Autos & Parts sector rounded off its best quarter since early 2021.

Capex-oriented construction materials and machinery & equipment sectors have also enjoyed improved performance in 2024 so far, albeit with growth slowing in June, but point to the strongest upward capex trend for three years.

Outlook marred by politics

Looking ahead, near-term global prospects darkened in June. Business expectations about the year ahead fell to a seven-month low, waning in both manufacturing and services. Sentiment deteriorated especially sharply in India following the elections, but also slumped in Europe, partly due to uncertainty surrounding elections in the UK and France. A small dip in confidence was also seen in the US, likewise in part reflecting upcoming election worries.

However, sentiment was also pulled lower by concern over the demand environment going forward, as reflected in a pull-back in new orders growth from May’s one-year high, which left backlogs of work largely unchanged again during the month. The latter is typically a sign of current capacity being sufficient to meet existing demand.

Source: S&P Global – by Chris Williamson

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.