June 20, 2024

Emerging market economic growth accelerated midway through the second quarter of 2024, according to PMI survey data. The expansion in activity was the fastest in a year, supported by solid improvements in both the manufacturing and service sectors. Forward-looking indicators further pointed to the expansion sustaining in the near-term, as new business rose at the fastest pace since last May.

Intensifying cost pressures was a continuing theme for emerging markets, however, even though the rate of cost inflation paled in comparison with developed markets. Average selling prices across emerging markets climbed at a quicker rate as a result. This an area worth monitoring, with rising price pressures, especially in the manufacturing space, having the potential to contribute to higher worldwide inflation should it sustain.

Emerging markets see broad-based improvement in growth

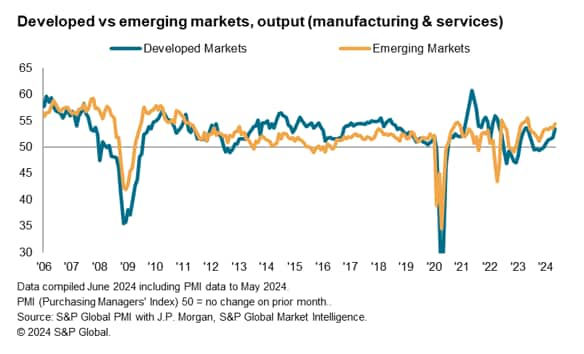

The PMI surveys compiled globally by S&P Global found the emerging markets to have collectively expanded at the fastest pace in 12 months. The GDP-weighted Emerging Market PMI Output Index rose to 54.4 in May, from 53.6 in April. This also extended the sequence of expansion to 17 months. Alongside the improvement in developed markets, worldwide economic growth thereby accelerated to a level matching an annualized growth rate of 3.4% according to PMI indications.

Detailed emerging market sector data revealed that the rates of expansion across the manufacturing and service sectors rose to the fastest in 23 and 11 months respectively. The growth rates were both solid, albeit with services activity expansion marginally outpacing the rise in global manufacturing output.

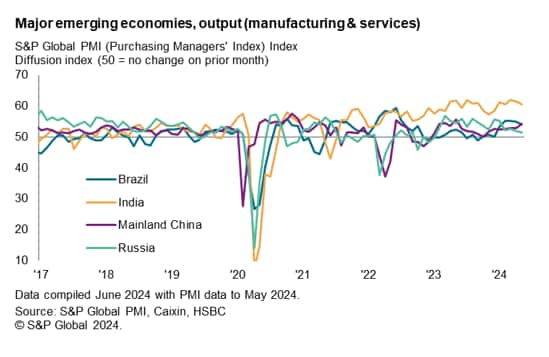

By economies, India continued to register the fastest rate of expansion among the four major emerging market economies, even though the rate of growth eased to the slowest in five months. Brazil and Russia also recorded softer rates of expansion in May among the BRIC nations. In contrast, Mainland China’s activity growth accelerated to the fastest since May 2023, supported by the most pronounced rise in manufacturing output in nearly two years. According to panellists, improvements in both domestic and external demand conditions helped spur the acceleration in business activity growth in Mainland China.

Emerging markets new business rises at quickest pace since May 2023

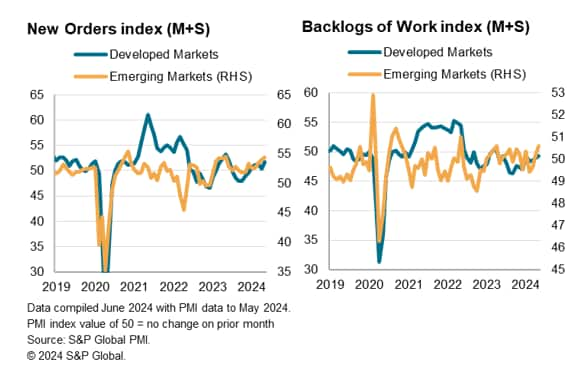

Forward-looking indicators, including the new orders, future output and backlogs of work indices, further hinted at the sustaining of emerging market business activity expansion in the near-term.

Incoming new business across emerging markets rose at the fastest pace in a year, far outpacing the pace of growth in developed markets. This was supported by improvements in trade conditions, which helped to power the global trade expansion in May as developed markets export orders continued to decline, albeit only marginally. The quicker expansion in new business across emerging markets led to further accumulation of backlogs, which remained exclusively an emerging market phenomenon in the latest survey period.

Overall sentiment also slightly improved among emerging market firms, according to the Future Output Index. Altogether, this indicated that growth is likely to sustain in the coming months across emerging economies.

Cost pressures intensify for emerging market businesses

May global PMI data indicated that selling price inflation remained elevated, reflecting persistently elevated service price increases and accelerating price growth in manufacturing. The rise in price pressures was especially prevalent for emerging markets.

Average input prices rose at a faster rate in the emerging market space in May, the quickest in nine months. Moreover, the rate of inflation edged back above the rolling 12-month average, attributed to faster cost increases in both the manufacturing and service sectors. The rise in emerging market cost inflation was also the main contributor to an uptick in global input price inflation as developed markets saw average input prices increase at a pace that was unchanged from April.

The solid hike in emerging market input prices led to firms raising selling prices at a faster rate in May, and this was again observed in both manufacturing and services. In contrast, developed market output price inflation fell over May.

All in all, this suggested that emerging markets had been the key source of rising global price inflation midway through Q2 2024 and further increases here will be worth monitoring. This is especially with the potential for manufacturing cost increases to pass through to developed markets, which would cloud the outlook for interest rates at a time when the inflation trajectory remains uncertain.

Source: S&P – Jingyi Pan

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.