May 7, 2024

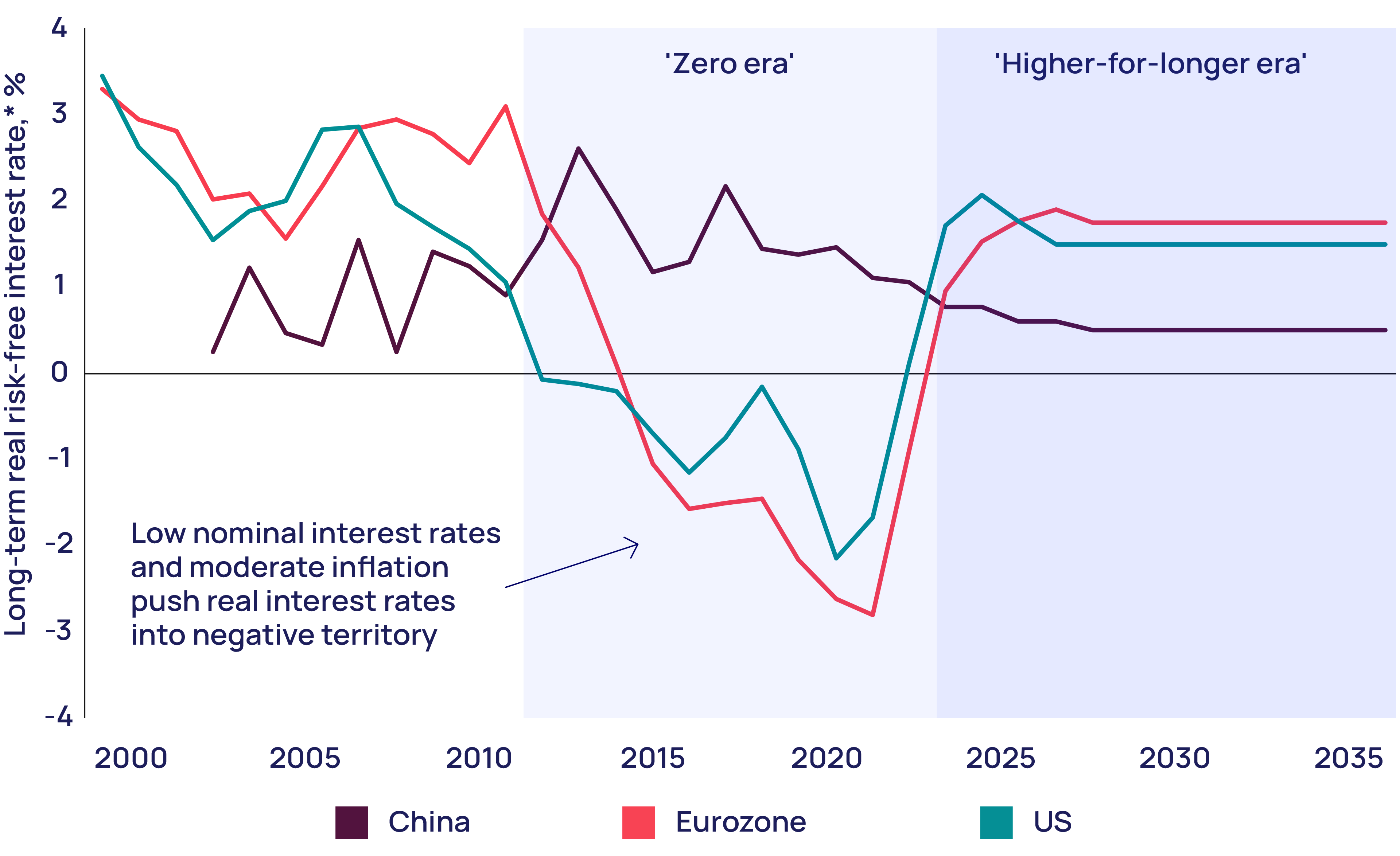

The ‘zero era’ for interest rates has come to an end. In the past two years, rates have risen sharply as central banks have scrambled to fight inflationary pressures. Governments, companies and households face markedly higher market rates and bond yields, which could yet rise further. The increase in the cost of capital has profound implications for the energy and natural resources industries, particularly the cost and pace of the transition to low-carbon technologies.

The monetary environment over the next couple of decades is likely to remain much tighter than it was in the period from 2009 to 2022. In major economies, nominal and real interest rates could be as much as two percentage points higher, on average, than in the ‘zero era’. Companies, investors and policymakers should brace themselves: tougher financial conditions could persist for some time to come.

The higher cost of borrowing affects the energy and natural resources sectors unevenly. Highly capital intensive and often reliant on subsidies, low-carbon energy and nascent green technologies are most exposed. Debt accounts for a higher share of the capital structure for low-carbon energy sectors, too. The impact of higher interest rates grows as the capital expenditure (capex) share of total expenditure increases.

In contrast, the oil and gas industry, while also highly capital intensive, has far less exposure to the cost of debt, so is less affected by higher rates. The large metals and mining companies, with strong balance sheets, are also well positioned.

Transitioning to a net zero global economy is a monumental investment challenge. Meeting the challenge, already an outside bet, will have to happen against a less favourable monetary backdrop than the world has been used to since 2009.

Interest rates: higher for longer

Interest rates have normalised after the ‘zero era’, the period of loose monetary policy that followed the Great Recession. In 2023, policy rates in major developed economies hit their highest levels in decades after the most aggressive hiking cycle in 40 years. While inflation has fallen towards central banks’ targets of around 2%, rates may not come down as far or as quickly as markets anticipate.

Structural inflationary trends ‒ global trade reshuffling, deglobalisation and production onshoring ‒ are intensifying. Safeguarding the security of supply and protecting domestic industry and employment are being prioritised over economics. On the demand side, the energy transition will stimulate demand and, in some cases, even put upward pressure on inflation by shifting to higher-cost, low-carbon technologies.

To keep inflation averaging around 2%, therefore, higher nominal interest rates could persist. China is an exception, as its maturing economic development and lower growth are likely to translate into lower interest rates.

Figure 1. US and Eurozone real interest rates normalise

The energy transition to net zero could require US$75 trillion of investment by 2050. In a higher interest-rate scenario, achieving net zero will be even harder and more costly.

How do higher interest rates affect companies?

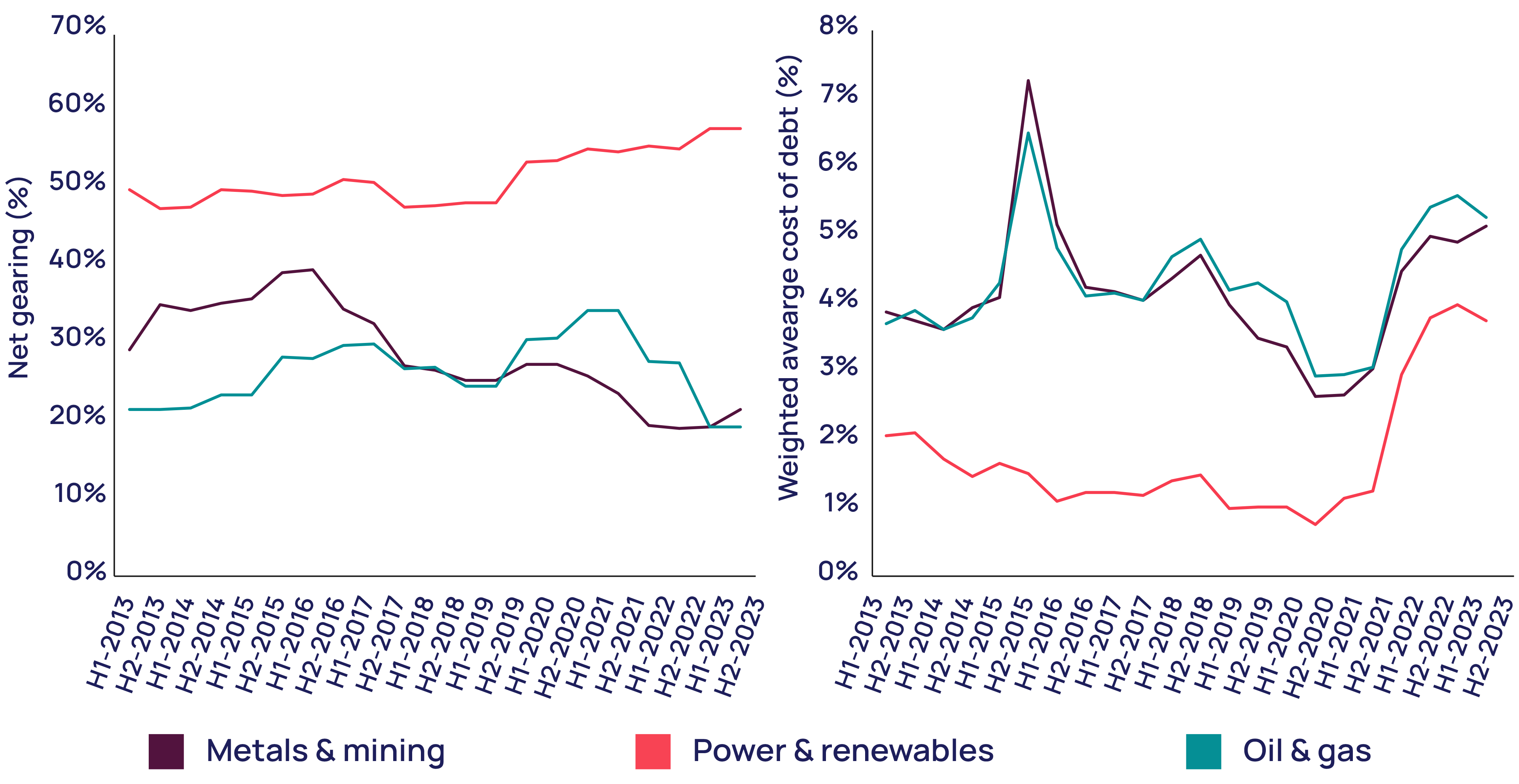

The higher cost of borrowing affects energy and natural resources sectors differently. Capital structure and balance-sheet resilience determine sensitivity to interest rates.

Thanks to their low gearing, many companies in the metals and mining and oil and gas sectors will be relatively unaffected by higher interest rates.

Gearing is higher for power and renewables firms. Debt from bonds and project finance, secured against long-term power purchasing agreements, has been used to fund rapid growth in renewables. Renewables and nuclear power, with their high capital intensity, are more exposed to interest rates . Project finance is less common in the metals and mining and oil and gas sectors, with the notable exceptions of liquefied natural gas (LNG) and midstream projects, where more stable revenues suit the financing model.

While power and renewables companies have higher gearing, they do compare favourably with other peer groups on a cost-of-debt basis. Mechanisms to reduce price and offtake risk enable power and renewables companies to obtain debt more cheaply than the relatively risky oil and gas and metals and mining sectors. The recent rise in interest rates, however, has a larger proportional impact on their cost of debt.

Figure 2. Cost of debt rising fastest for the highly geared power and renewables sector

Renewables and green tech: feeling the squeeze

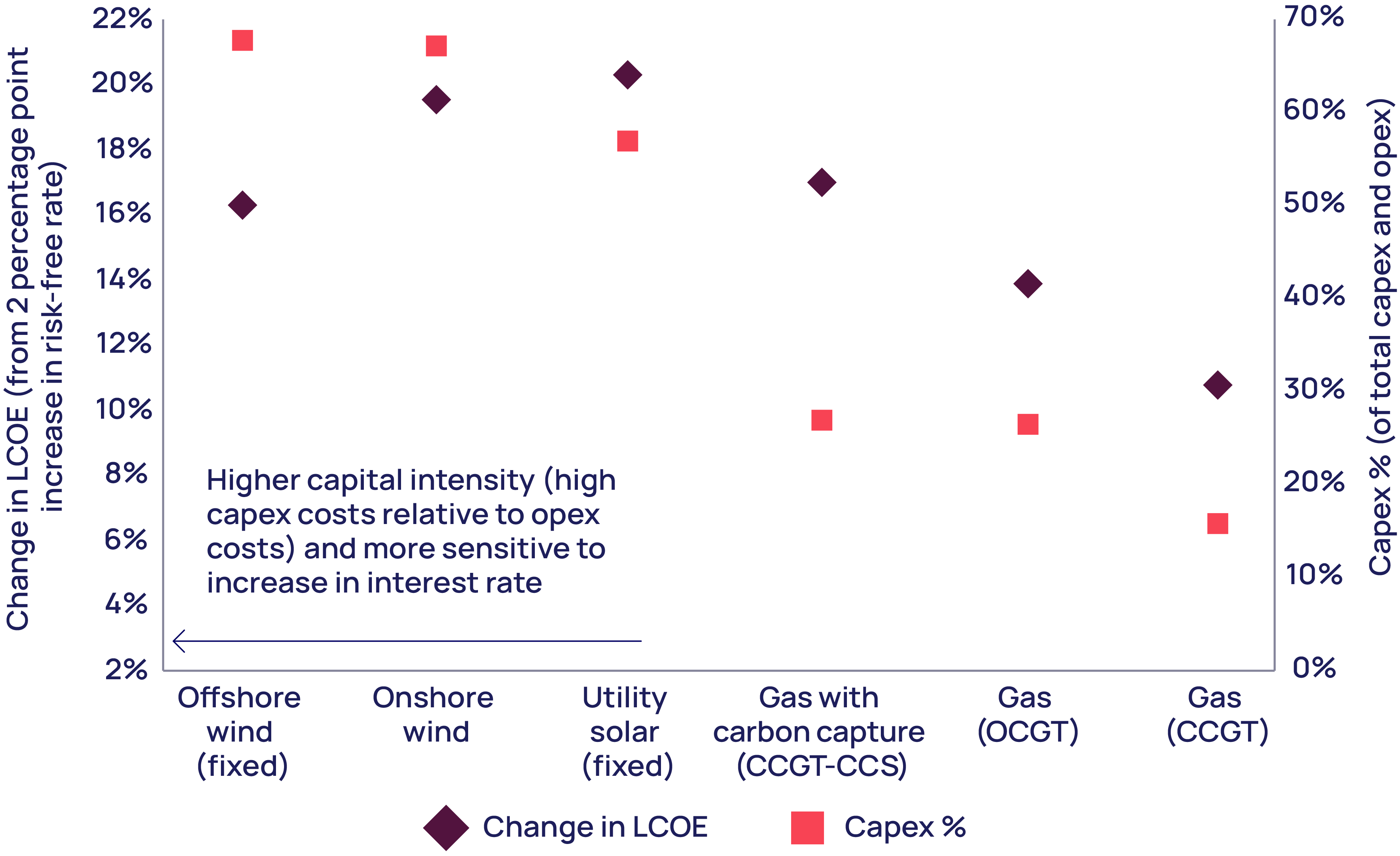

Higher interest rates disproportionately affect renewables and nuclear power. Their high capital intensity and low returns mean future projects will be at risk.

Renewable investments with subsidies and certainty on price and offtake can access cheaper finance, but the low cost of debt and low required returns are precisely what makes projects sensitive to interest rates. Higher interest rates affect required returns and the cost of capital more than other power generation projects that need higher returns in the first place.

In an illustrative example for the US, our analysis shows that a 2-percentage point increase in the risk-free interest rate pushes up the levelised cost of electricity (LCOE) by as much as 20% for renewables. The comparative increase in LCOE for a combined-cycle gas turbine plant is only 11%.

Figure 3: Renewables have highest capital intensity of US generation (New York, 2024)

Assumptions: debt 55%, debt term 15 years

Definitions: Levelised cost of electricity (LCOE), Combined cycle gas turbine (CCGT), Open cycle gas turbine (OCGT), Carbon capture and storage (CCS)

Source: Wood Mackenzie

The market structure matters, too. In the US and Australia, where renewables, including subsidies, must compete against the market price, higher interest rates will curb investment. In Europe, in contrast – where the mandate is to achieve decarbonisation targets and contracts for difference reduce price risk – investments are still likely to go ahead but result in higher prices.

We are seeing this play out. Offshore wind projects typically fix power purchasing agreements for 15 to 20 years ahead. Those projects that secured agreements three to four years ago are under pressure. Completed projects are booking impairments after razor-thin margins were squeezed by cost inflation, supply-chain constraints and the rising cost of capital. Some projects in development are being scrapped and some power contracts are being renegotiated.

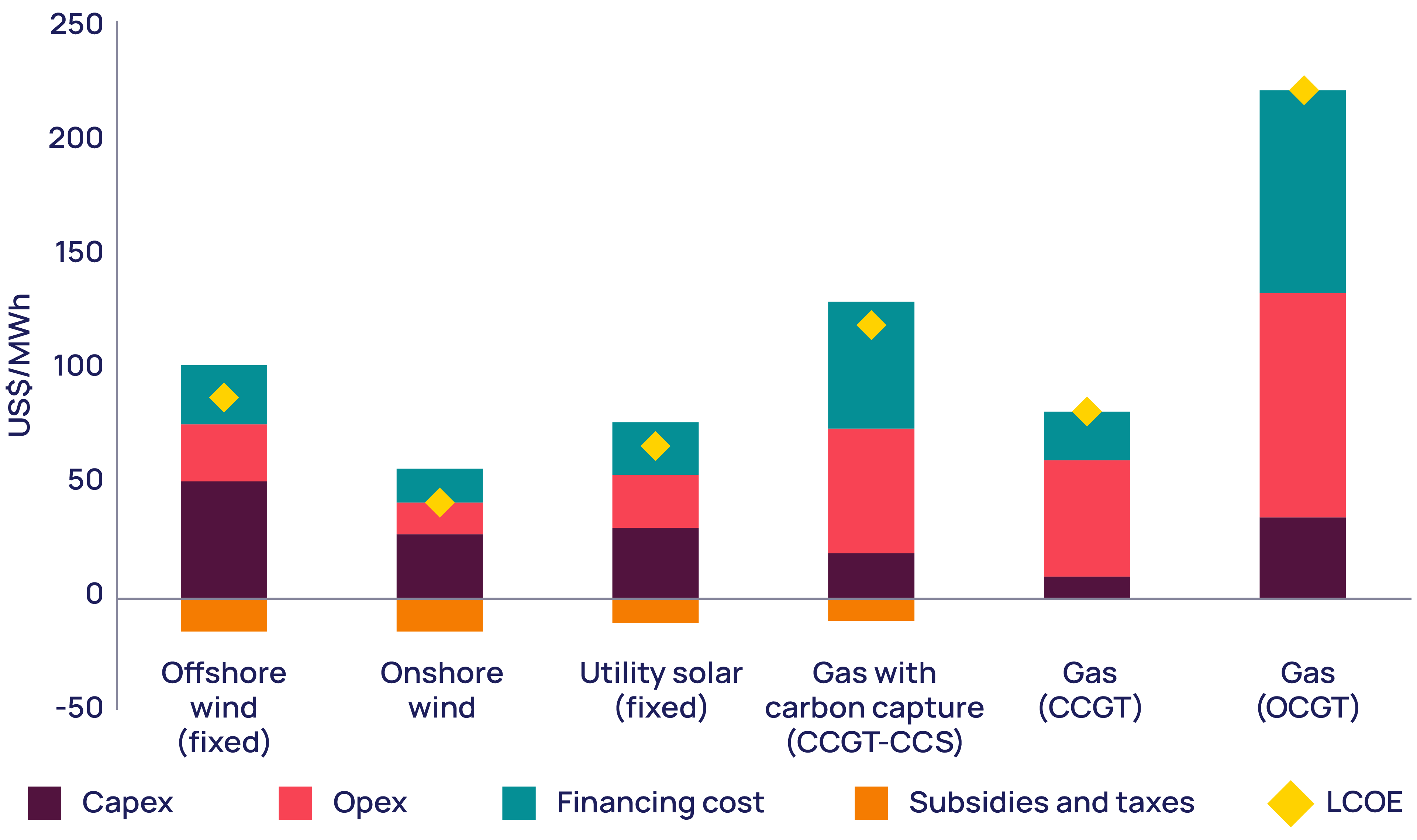

How competitive are renewables? In many markets, onshore wind and solar have an economic advantage over hydrocarbon generation sources, even without subsidies in some cases. In the US, onshore wind can generate electricity at an LCOE of US$40/MWh, 50% of the cost of gas-fired generation. Higher interest rates, though, are eroding that advantage.

Figure 4. LCOE of power generation in the US (New York, 2024)

Definitions: Investment tax credit (ITC), levelised cost of electricity (LCOE), combined cycle gas turbine (CCGT), open cycle gas turbine (OCGT), carbon capture and storage (CCS)

Source: Wood Mackenzie

Green tech under pressure

Nascent technologies – low-carbon hydrogen, carbon capture, utilisation and storage (CCUS) and direct air capture (DAC) – will play an important role in the energy transition. However, they require major development and incentives to transform them into commercially viable, large-scale options for energy supply or decarbonising the economy.

With their remarkable levels of capital investment and high capital intensity, these projects are under threat amid higher interest rates. The capital intensity of hydrogen varies greatly by project, with capex ranging from 20% to 75% of total cost. At higher capital intensities, a 2-percentage point increase in interest rates lifts the levelised cost of hydrogen by around 10%.

The lack of economic incentives to capture carbon and the lack of a market for hydrogen are the most significant obstacles to investment in these sectors, but for projects that do progress, higher interest rates hurt the economics. This affects both smaller development companies that struggle to access debt and larger, credit-worthy emitters that rely on low-interest leverage to render projects attractive for shareholders.

Oil and gas: capital discipline puts the industry in a strong position

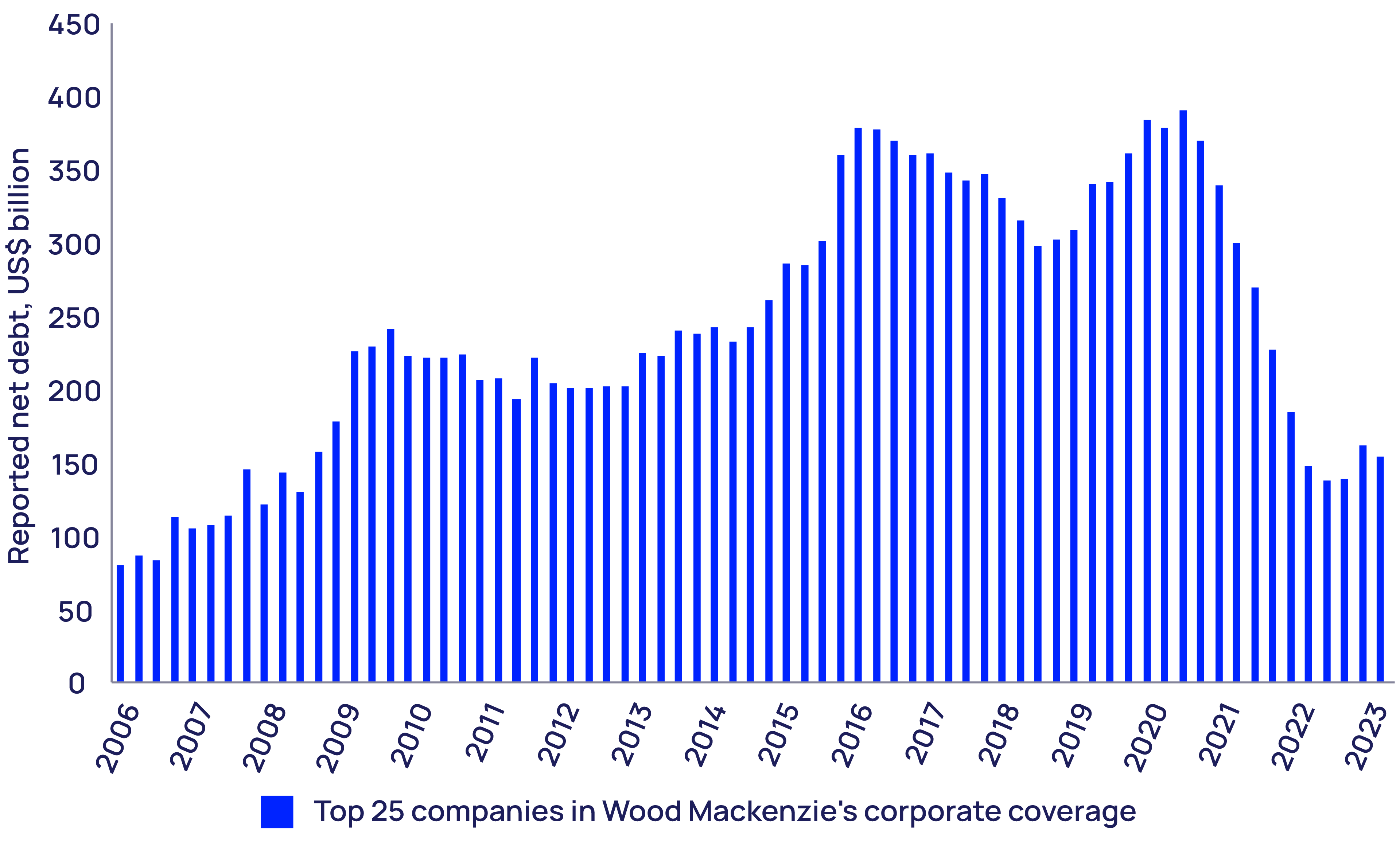

The oil and gas sector has less to fear in a tighter interest-rate environment. After record debt repayment in the last few years, the average balance sheet is healthy and gearing is low. Net debt for 25 of the largest international and national oil companies in Wood Mackenzie’s corporate coverage fell to US$150 billion in 2023 from US$390 billion in 2020. Gearing of 10% to 20% is already the ‘new normal’ for many and will be reinforced in a higher interest-rate era.

Figure 5: Oil and gas companies have cut debt sharply since 2020

Our analysis shows that a 2-percentage point interest-rate increase has a similar effect on total corporate cash flow as a modest US$1/bbl change in the oil price. While the cost of capital is an ever-present consideration, interest rates are far from a primary concern. Rather, the availability of finance is a problem for small or financially stretched operators, with environmental, social and governance concerns contributing to an ever-shrinking list of lenders.

When it comes to decisions on capital allocation and project sanctioning, higher interest rates could impact investment sentiment. The cost of capital is baked into the 15%-plus return targets the industry’s biggest players expect from oil projects. The cost of equity is also a factor but, even in isolation, interest rates could impact investment models to a degree.

One area that embraces project financing and where rising interest rates have caused some concern is LNG. On a value basis, the sector accounts for 12% of the global oil and gas industry. Capital is raised with the project itself acting as collateral to access cheaper finance.

LNG projects already operating will have either partly or fully paid down or repackaged their project finance. New projects are more exposed. The burgeoning US LNG sector accounts for most of the new tolling capacity. Increasing development costs and higher interest rates have already caused a US$0.30-US$0.40/mmbtu increase in tolling fees ‒ around a 20% rise. A structural 2-percentage point increase in interest rates would permanently lock in more than half of that. These higher costs would mostly be passed through to the consumer.

Metals and mining: accelerating a shift to growth?

Mining companies are running very low levels of debt and look well-positioned for a high-rate environment. High capital requirements are limiting new project sanctioning and hampering extraction growth, however.

For the mining Majors, we don’t think a higher-for-longer interest-rate environment will alter their approach. A focus on low-cost assets to protect margins, minimise earnings volatility and boost credit ratings is entrenched.

Things might start to get tricky for mining projects that require dedicated project finance. The scale of copper and aluminium projects presents a significant hurdle for independent developers. Debt interest payments will be higher, lowering the coverage ratio of projects and limiting the amount of borrowed capital available. This may force independents to consider alternative financing options or partner with the Majors to derisk project execution.

The mining industry faces a challenge in meeting metals demand in the energy transition. Capital intensity has reached a point where growing output is difficult. This is the conundrum for the mining industry.

By further suppressing output growth in the short term, higher rates may help underpin a shift to growth as the energy transition accelerates. Eventually as demand grows, price rises will kick in and support a shift to growth for the mining and metals sector.

How can policymakers offset the headwinds?

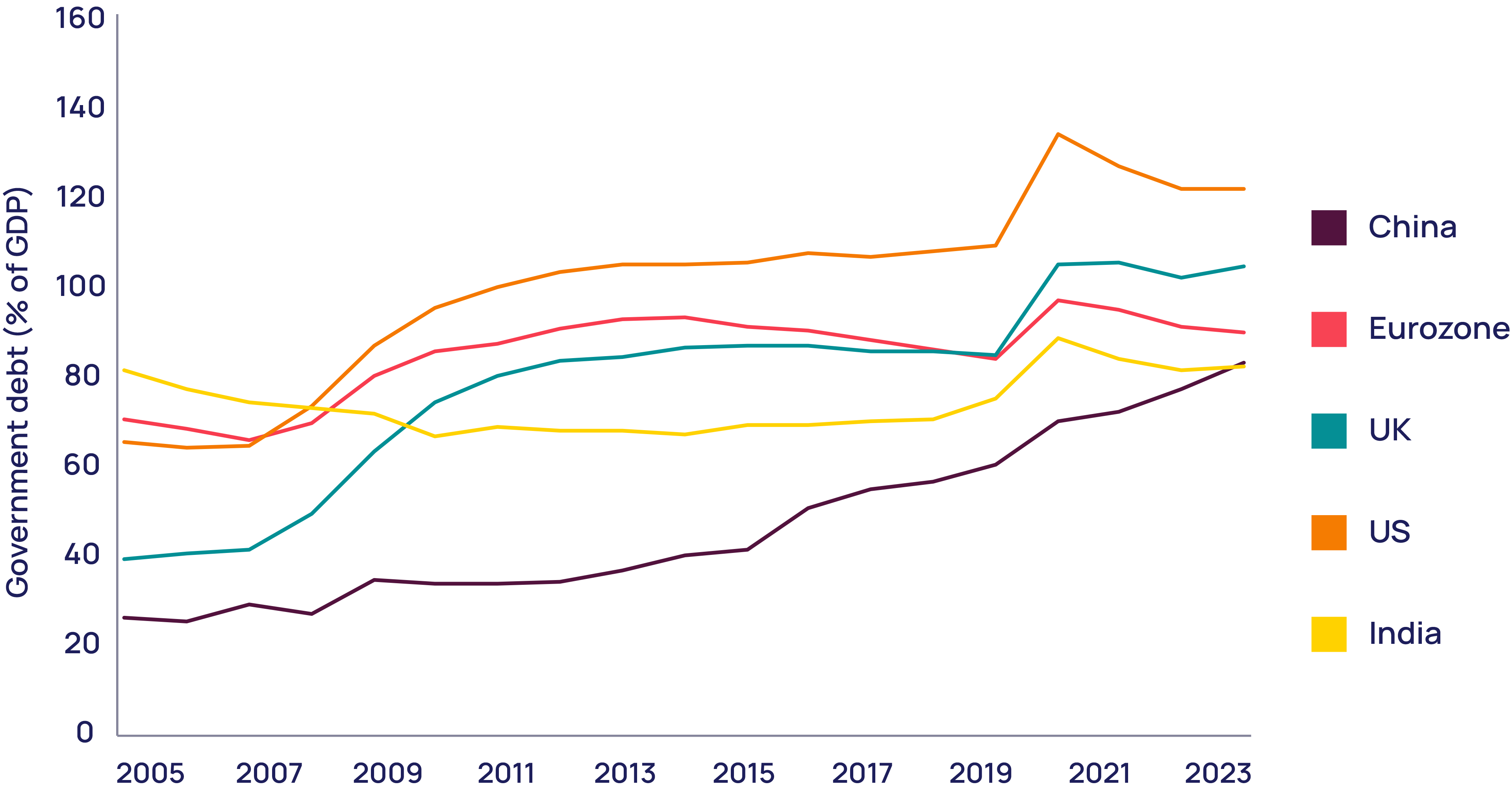

Governments need to subsidise the energy transition to encourage investment. But high interest rates put those subsidies at risk. With elevated debt and higher interest rates, governments’ debt servicing costs are increasing. This squeezes out other government spending and could restrict transition efforts by reducing supportive subsidies and tax incentives or cutting direct public capital investment in a low-carbon economy.

In the US, government expenditure on interest payments as a percentage of GDP has risen by 1.2 percentage points to 3.7% since the start of 2022; US$1 of every US$7 spent goes on interest. Budget trade-offs are a reality. The US Inflation Reduction Act could total US$1.8 trillion in subsidies to the power sector alone by 2050.

Figure 6. Elevated government debt in major economies

What’s playing out in China now may reflect the constraints other governments could soon experience. Public debt in China as a percentage of GDP has doubled over the past decade. The central government stopped subsidising new renewable power capacity in 2022, yet legacy subsidy payments to the renewables sector are climbing fast, rising from RMB40 billion in 2022 to RMB100 billion (US$14 billion) in 2023. As of 2021, subsidy arrears stood at RMB400 billion, as eligible projects outstripped available funding. China could struggle to support subsidies in future.

Three policy priorities

What can policymakers do? The higher-rate environment is a headwind to the energy transition globally, so it is imperative that they remove other barriers to transition. We see three priorities:

- Focus on subsidy efficiency. With government finances under pressure, subsidies need to have the maximum impact on decarbonising the global economy. Targeted and non-discriminatory subsidies are most efficient, minimising nationalistic subsidy battles that are counterproductive to global emissions targets.

- Bolster carbon markets. Article 6 of the Paris Agreement is the original ‘rulebook’ on carbon markets and non-market approaches to mitigating global emissions. For many countries, an operational Article 6 is likely to be necessary to meet their nationally determined contributions to reducing emissions. With governments having failed to conclude and sign off on the carbon crediting mechanism (Article 6.4) at the COP28 climate conference in Dubai in December 2023, the next opportunity will be at COP29 in Baku in November.

- Mobilise climate finance. Drumming up climate finance, be it from the private or the public sector, is critical to supporting green investment for climate change mitigation and adaptation in developed and developing economies. Developed economies committed to transferring US$100 billion per year to developing economies by 2020 and may have belatedly hit that target in 2022. However, it is a drop in the ocean compared with the trillions of dollars needed each year to steer the global economy onto a net zero path. Greater use of financial mechanisms and instruments to maximise private-sector investment is needed. Central banks could offer loans to commercial banks at preferential rates, specifically to be used to finance low-carbon investments. These models have been tried by central banks in Japan and China and advocated for Europe by President Emmanuel Macron of France.

Source: Wood Mackenzie – by Peter Martin, Head of Economics, Macroeconomics, James Whiteside, Head of Corporate, Metals & Mining, Fraser McKay, Head of Upstream Analysis, Srinivasan Santhakumar, Senior Research Analyst, Offshore Wind

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.