November 20, 2023

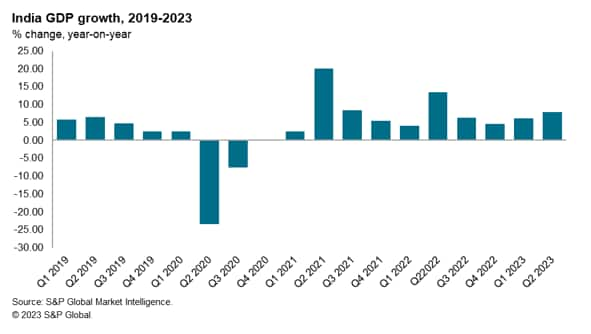

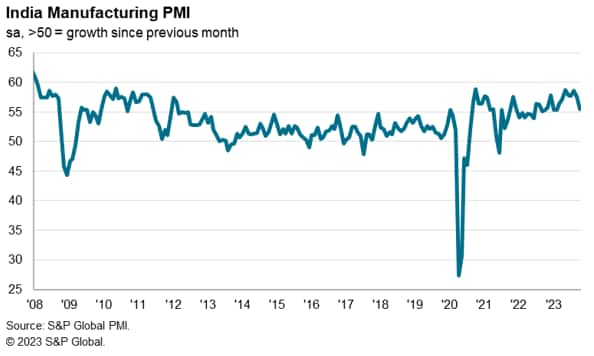

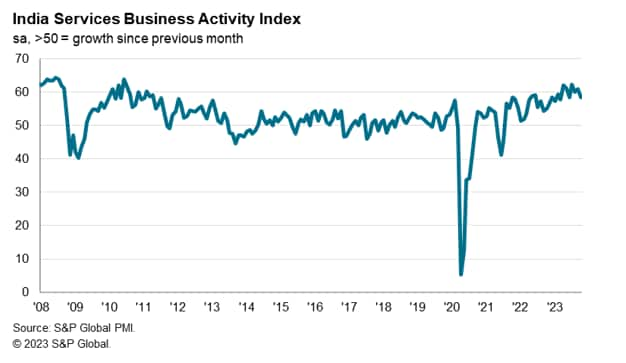

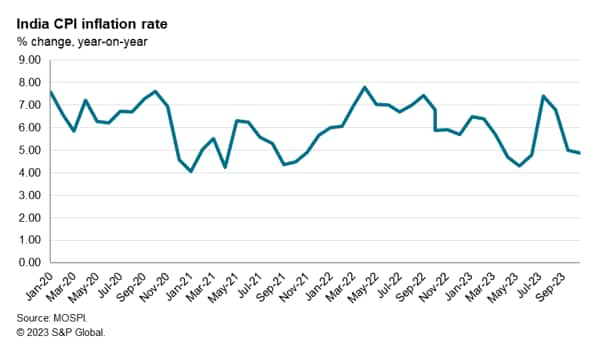

After rapid economic growth of 7.2% in the 2022-23 fiscal year, economic momentum has remained strong, with industrial production rising by 6.0% year-over-year (y/y) in the first six months of fiscal 2022-2023 and GDP growth of 7.8% y/y in the April-June quarter of 2023. The S&P Global India Services PMI Business Activity Index for October continued to signal expansionary conditions for output and new orders, while the October Manufacturing PMI survey also reflected expansionary operating conditions for the manufacturing sector. Meanwhile CPI inflation pressures eased further, with the headline CPI inflation rate moderating to 4.9% y/y in October from 5.0% in September.

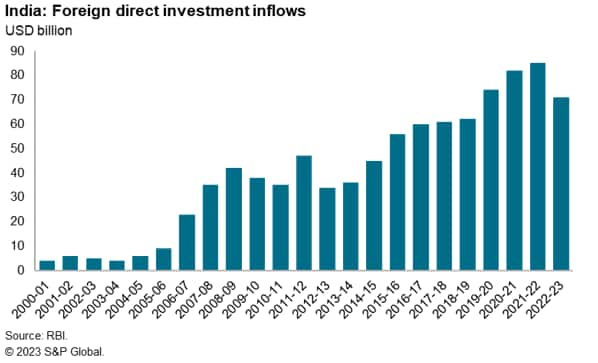

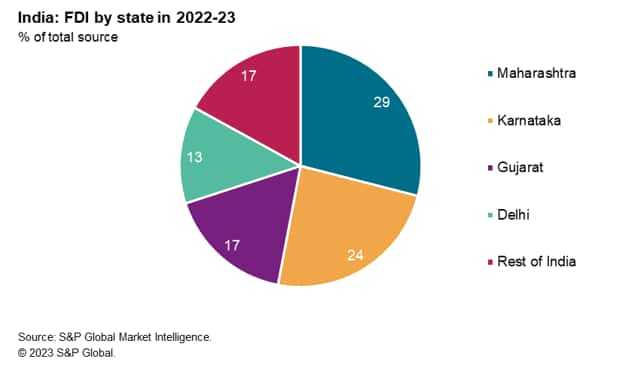

India has also become an increasingly attractive location for multinationals across a wide range of industries, with foreign direct investment inflows (FDI) having reached a new record high of USD 85 billion in the 2021-22 fiscal year. In FY 2022-23, the state of Maharashtra accounted for the largest share of total FDI inflows, at 29% of the total. Karnataka accounted for a further 24% of FDI inflows, while Gujarat and Delhi were also major recipients of FDI inflows.

India’s rapid economic growth continues in 2023

India’s GDP growth rate rose to a pace of 7.8% y/y in the April-June quarter of 2023, compared with growth of 6.1% y/y in the January-March quarter of 2023, according to data released by India’s National Statistical Office. The strong growth rate was despite high base year effects after GDP growth of 13.1% y/y in the April-June quarter of 2022.

Private consumption grew by 6.0% y/y in real terms in the April-June quarter of 2023, improving on the 2.8% year-over-year pace of growth recorded in the January-March quarter.

Gross domestic fixed capital formation remained strong, growing at a pace of 8.0% y/y in the April-June quarter of 2023 compared with 8.9% year-over-year growth in the January-March quarter of 2023 and buoyant growth of 20.4% y/y r in the April-June quarter of 2022.

Construction output rose by 7.9% y/y in the April-June quarter of 2023 compared with the 10.4% y/y growth rate in the January-March quarter of 2023, still showing firm expansion despite high base year effects after growth of 16.0% y/y in the April-June quarter of 2022.

Rapid growth was also evident in key segments of the service sector, with output in the financial, real estate and professional services sector growing by 12.2% y/y in the April-June quarter, while output in trade, hotels, transport and communications services up by 9.2% y/y.

India’s industrial production grew by 5.8% year-over-year in September 2023, according to data released by the Government of India’s National Statistical Office, compared with a year-over-year rise of 10.3% in August. For the first six months of the 2023-24 fiscal year, industrial production rose by 6.0% y/y.

Manufacturing output rose by 4.5% y/y in September. For the first six months of the 2023-24 fiscal year, manufacturing output rose by 5.8% y/y. Crude steel production rose by 12.8% y/y in August, while consumption of finished steel rose by 16.9% y/y.

Electricity output showed very rapid growth of 9.9% y/y in September. This reflected strong growth in electricity demand from households due to hot summer weather conditions.

Output of capital goods showed rapid growth of 7.4% y/y in September, albeit easing from 12.6% y/y in August. Output of infrastructure and construction goods rose by 7.5% y/y in September. For the first six months of the 2023-24 fiscal year, output of infrastructure and construction goods rose by 12.1% y/y, signalling strengthening investment expenditure due to sustained rapid growth in the Indian economy.

Output of consumer non-durables moderated to a pace of 2.7% y/y in September, while output of primary goods rose by 8.0% y/y in September.

Posting 55.5 in October, the seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) signalled an improvement in the health of the sector for the twenty-eighth month in a row. The latest reading was above its long-run average of 53.9 but slipped from 57.5 in September.

At 58.4 in October, the seasonally adjusted S&P Global India Services PMI Business Activity Index continued to signal strong expansion in service sector business conditions, albeit easing from 61.0 in September.

India’s exports of goods and services in October 2023 rose by 9.4% y/y. However, India’s exports of goods and services for the April-October 2023 period showed a modest contraction of 1.6% y/y, due to a decline in merchandise exports of 7.0% y/y in the April-October period. The decline of merchandise exports was mitigated by strong growth in services exports, which rose by 6.2% y/y over the same period.

CPI inflation pressures have moderated

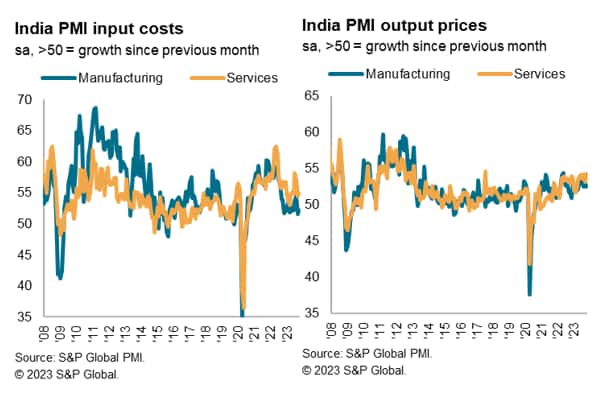

Input price inflation across India’s private sector picked-up pace in October but remained below its long-run average. The service economy registered a stronger rate of increase in cost burdens than the manufacturing sector. October PMI survey data showed increases for both manufacturing input costs and output charges. Input price inflation accelerated while output prices rose to a weaker extent. When listing materials that had increased in price, firms mentioned aluminium, chemicals, leather, paper, rubber and steel.

The latest statistics on India’s consumer price index (CPI) showed that the headline CPI inflation rate fell sharply to 4.9% y/y in October compared to 5.0% y/y in September and 6.8% y/y in August.

The September CPI data has brought India’s CPI inflation rate further within the Reserve Bank of India (RBI’s) inflation target for CPI inflation of 4% within a band of +/- 2%.

Factors contributing to the moderation in the headline CPI inflation rate were a further contraction in the fuel and light subindex and further easing of the food and beverages CPI subindex.

High energy prices were an important factor contributing to India’s CPI inflation pressures in 2022 but have eased during 2023. This has been helped by some moderation in world oil prices during late 2022 and the first half of 2023, as well as the impact of base-year effects owing to the spike in world oil prices in the second quarter of 2022. In October, the fuel and light subindex contracted by 0.4% y/y, after having declined by 0.1% y/y in September 2023. This compared with a rise of 4.3% y/y in August. The recent decline in the fuel and light subindex was helped by increased government subsidies for LPG cylinders for qualifying households, which helped to constrain fuel costs for households.

The food and beverages CPI subindex rose by 6.2% y/y in October, compared with 6.3% y/y in September, significantly lower compared with the increase of 9.2% y/y in August and 10.6% y/y in July.

An important factor that has contributed to the significant slowdown in the food and beverages CPI subindex in recent months has been a sharp easing of the inflation rate for the vegetables CPI subindex, which rose by 2.7% y/y in October, following a rise of 3.4% y/y in September after having surged by 26.1% y/y in August and 37.3% y/y in July. However, prices for pulses continued to show a strong increase, rising by 18.8% y/y in October after rising by 16.4% y/y in September. A key concern for the Indian government has also been rapid rises in rice prices, with the overall cereals subindex up by 10.7% y/y, similar to the increase of 11.0% y/y in September.

The RBI in its October Monetary Policy Statement maintained its projected CPI inflation rate for the current fiscal year (2023-24) at 5.4%, the same rate as the year-over-year projection made in the August Monetary Policy Statement. This represents a significant moderation from the 6.5% rise in CPI inflation in fiscal year 2022-23. The near-term trajectory of CPI inflation was projected in the RBI October Monetary Policy Statement at 6.4% year over year for the July-September quarter, 5.6% y/y for the October to December quarter of fiscal 2023-24, moderating to 5.2% year over year in the January-March quarter of 2024.

The Reserve Bank of India (RBI) in its October Monetary Policy Statement maintained its projected CPI inflation rate for the current fiscal year (2023-24) at 5.4%, the same rate as the y/y projection made in the August Monetary Policy Statement. This represents a significant moderation from the 6.5% rise in CPI inflation in fiscal year 2022-23. The near-term trajectory of CPI inflation was projected in the RBI October Monetary Policy Statement at 6.4% y/y for the July-September quarter, 5.6% y/y for the October to December quarter of fiscal 2023-24, moderating to 5.2% y/y in the January-March quarter of 2024.

However, the RBI also noted some risks to food production from the impact of the skewed south-west monsoon so far, as well as upward pressures on food prices due to a possible El Niño event. The renewed upturn in world oil prices since July and risks of escalating conflict in the Middle East has also added some additional upside risk factors to the inflation outlook.

Helped by strong economic growth conditions, residential property prices rose by an estimated 7% in 2022 and were estimated to have risen by around 5% y/y in the June quarter of 2023, according to the All-India Home Price Index of the Reserve Bank of India. Despite moderate monetary policy tightening by the Reserve Bank of India in 2022 and early 2023, residential property price rises were boosted by post-pandemic pent-up demand as well as rising construction costs. Residential property markets in New Delhi, Bangalore, and Pune were among the leaders in terms of price gains in 2022, with Delhi housing prices rising by an estimated 15% year over year in the June quarter of 2023, while housing prices rose by an estimated 7.6% y/y in Mumbai in the June quarter of 2023

Foreign direct investment

Net new foreign direct investment into India has risen very rapidly in recent years, with FDI reaching a new record level of USD 85 billion in the 2021-22 fiscal year, after inflows of USD 82 billion in the previous 2020-21 fiscal year. Although FDI inflows moderated to USD 71 billion in the 2022-23 fiscal year, this compares with FDI inflows of just USD 4 billion in the 2003-04 fiscal year.

The sustained large FDI inflows over the past decade have helped to reduce India’s external account vulnerability and have contributed to boost India’s FX reserves.

A key contributor to strong FDI inflows over the past decade has been technology-related FDI, which has become an important source of investment. The Computer Software and Hardware sector was the largest recipient of foreign direct investment equity inflows in the 2021-22 fiscal year, at around 25% of the total inflows.

US technology firms have been a key source of recent FDI inflows into India. In 2020, Google established the “Google for India Digitization Fund”, through which it announced plans to invest USD 10 billion into India over seven years through a mix of equity investments, partnerships, and operational, infrastructure and ecosystem investments. Also in 2020, Facebook announced an investment of USD 5.7 billion in Jio Platforms, owned by Reliance Industries Limited.

Infrastructure investments have also been an important sector for FDI inflows. A large FDI deal in 2020 was the USD 3.7 billion investment by Singapore’s GIC and Canada’s Brookfield Asset Management in the acquisition of Tower Infrastructure Trust, which owns Indian telecom towers assets.

In the 2020-21 fiscal year, FDI from Saudi Arabia also rose sharply, reaching USD 2.8 billion. Saudi Arabia’s Public Investment Fund acquired a USD 1.5 billion stake in Jio Platforms and a USD 1.3 billion stake in Reliance Retail in 2020.

Reliance Retail also received investment from other foreign firms in 2020, with Singapore’s GIC and TPG Private Capital having invested a combined amount of USD 1 billion, while US private equity firm Silver Lake Partners also invested USD 1 billion.

By source of origin of FDI inflows, Singapore, Mauritius and United Arab Emirates were three of the four top sources of FDI inflows into India in FY 2022-23, alongside the USA. This highlights the growing importance of India’s bilateral economic and investment relationships with global financial hubs in emerging markets, in addition to strong ties with advanced economies like the USA, Japan, EU and UK.

In FY 2022-23, the state of Maharashtra accounted for the largest share of total FDI inflows, at 29% of the total. Karnataka accounted for a further 24% of FDI inflows, while Gujarat and Delhi were also major recipients of FDI inflows.

The rapid growth in numbers of Indian unicorns (start-ups that have achieved a valuation of over USD 1 billion) over the past five years has also become a major focus for foreign direct investment inflows into India. By mid-2023, there were an estimated 108 Indian unicorns, with 44 of these having reached unicorn status within the 2021 year and 21 in the 2022 year, according to Invest India, the National Investment Promotion & Facilitation Agency.

Indian economic outlook

After two years of rapid economic growth in 2021 and 2022, the Indian economy has continued to show sustained strong growth during the 2023 calendar year. The near-term economic outlook is for continued rapid expansion in 2024, underpinned by strong growth in domestic demand.

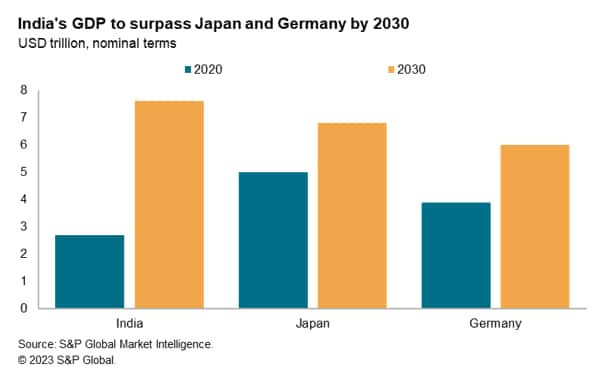

The acceleration of foreign direct investment inflows into India over the past decade reflects the favourable long-term growth outlook for the Indian economy, helped by a youthful demographic profile and rapidly rising urban household incomes. India’s nominal GDP measured in USD terms is forecast to rise from USD 3.5 trillion in 2022 to USD 7.3 trillion by 2030. This rapid pace of economic expansion would result in the size of the Indian GDP exceeding Japanese GDP by 2030, making India the second largest economy in the Asia-Pacific region. By 2022, the size of Indian GDP had already become larger than the GDP of the UK and also France. By 2030, India’s GDP is also forecast to surpass Germany.

The long-term outlook for the Indian economy is supported by a number of key growth drivers. An important positive factor for India is its large and fast-growing middle class, which is helping to drive consumer spending. The rapidly growing Indian domestic consumer market as well as its large industrial sector have made India an increasingly important investment destination for a wide range of multinationals in many sectors, including manufacturing, infrastructure and services.

The digital transformation of India that is currently underway is expected to accelerate the growth of e-commerce, changing the retail consumer market landscape over the next decade. This is attracting leading global multinationals in technology and e-commerce to the Indian market.

By 2030, 1.1 billion Indians will have internet access, more than doubling from the estimated 500 million internet users in 2020. The rapid growth of e-commerce and the shift to 4G and 5G smartphone technology will boost home-grown unicorns like online e-commerce platform Mensa Brands, logistics startup Delhivery and the fast-growing online grocer BigBasket, whose e-sales have surged during the pandemic.

The large increase in FDI inflows to India that has been evident over the past five years is also continuing with strong momentum evident even during the pandemic years of 2020-2022. India’s strong FDI inflows have been boosted by large inflows of investments from global technology MNCs such as Google and Facebook that are attracted to India’s large, fast-growing domestic consumer market, as well as a strong upturn in foreign direct investment inflows from manufacturing firms.

Overall, India is expected to continue to be one of the world’s fastest growing economies over the next decade. This will make India one of the most important long-term growth markets for multinationals in a wide range of industries, including manufacturing industries such as autos, electronics and chemicals to services industries such as banking, insurance, asset management, health care and information technology.

Source: S&P Global- by Rajiv Biswas

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.