November 3, 2023

Global manufacturing prices rose for a third successive month in October, according to the latest JPMorgan Global Manufacturing Purchasing Managers’ Index™ (PMI® ) compiled by S&P Global, hint at some renewed upward pressure on consumer price inflation from the industrial sector. However, drilling down into the details provided by survey contributors providers some encouraging news on a moderation in underlying drivers of price hikes, and in particular a cooling of wage-related price pressures.

Global factory prices rise modestly for third month in October

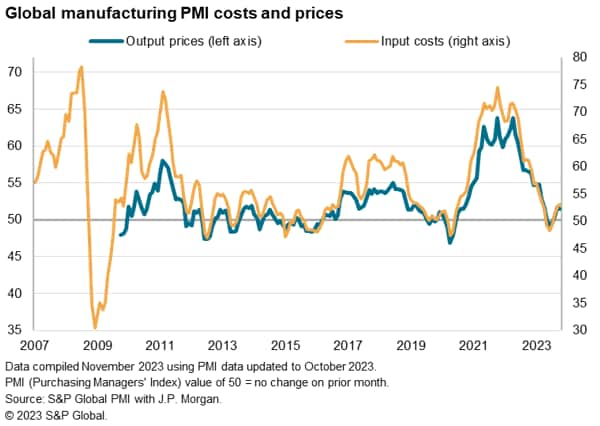

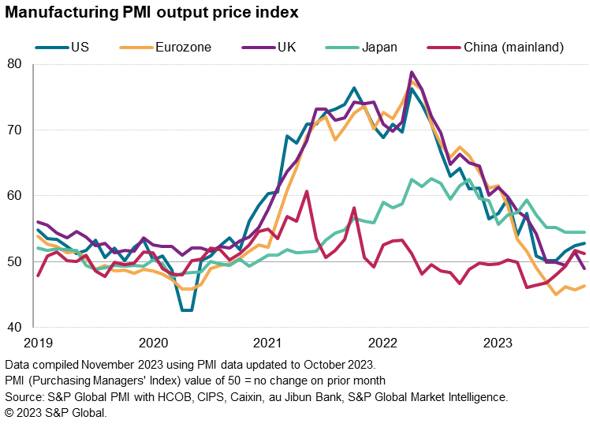

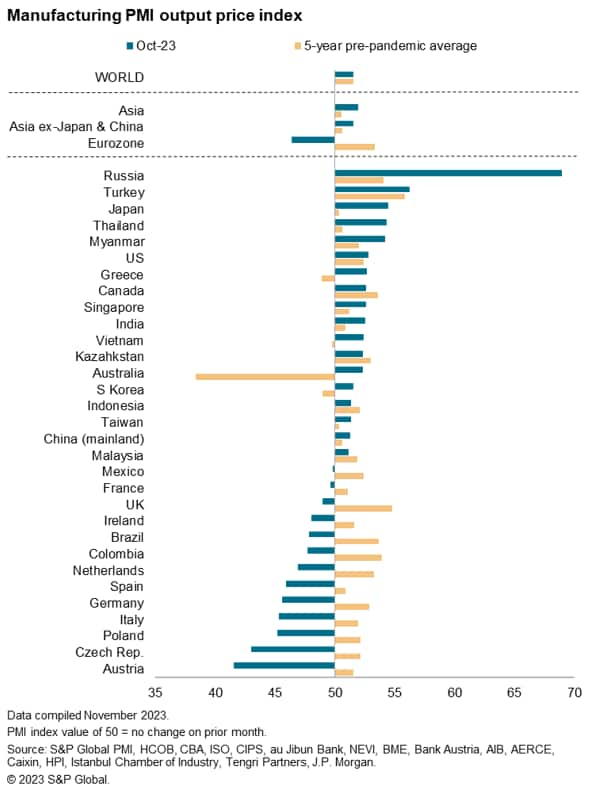

Manufacturers worldwide charged more for their goods on average for a third successive month in October, according to the latest PMI surveys compiled by S&P Global and sponsored by JP Morgan, contrasting with declines recorded over the prior three months. However, the rate of increase remained modest by historical standards. Although the uplift in prices was the second-largest for six months, the rate of increase slipped compared to September to a level in line with the average seen in the five years prior to the pandemic (and only very marginally higher than the pre-pandemic 10-year average).

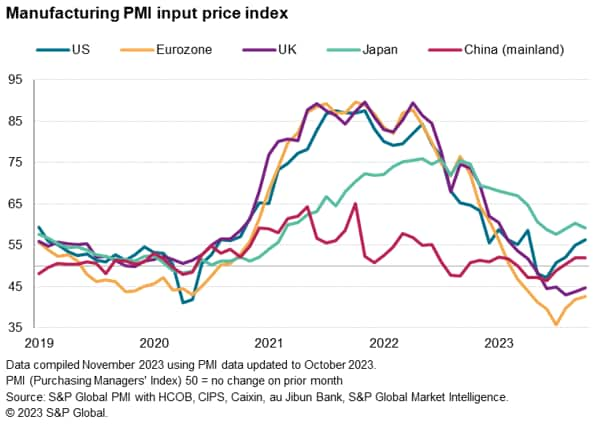

The modest rise in prices reflected higher input costs, which rose in October at the fastest rate for seven months. However, the rate of cost increase remained well below the five- and ten-year pre-pandemic averages, suggesting that cost pressures remain muted by historical standards, in marked contrast to the experience of 2021 and 2022.

Waning wage pressures

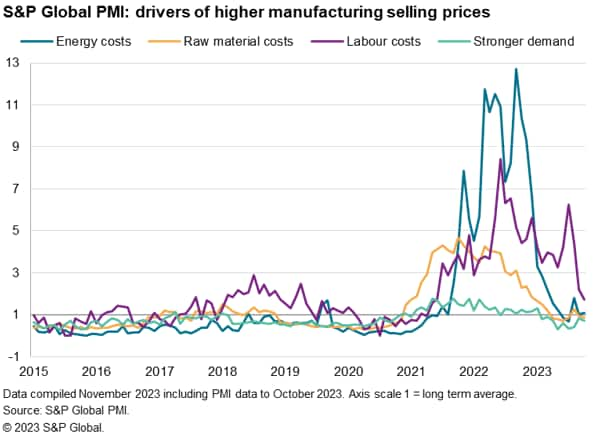

Looking at the reasons cited by manufacturers for higher selling prices in October, there is encouraging news from an inflation-fighting perspective. Despite higher oil prices, overall energy cost pressures remain close to their long-run average, as do other raw material price pressures.

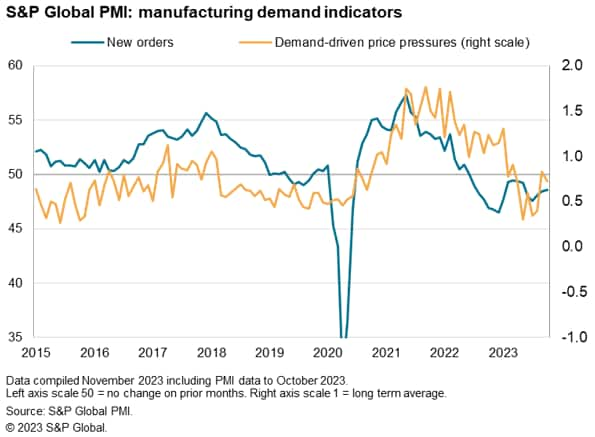

Demand meanwhile remains a drag compared to its long-run average, underscoring a lack of pricing power amid the ongoing manufacturing downturn signalled by the PMI. New orders received by factories have now fallen globally for 16 successive months.

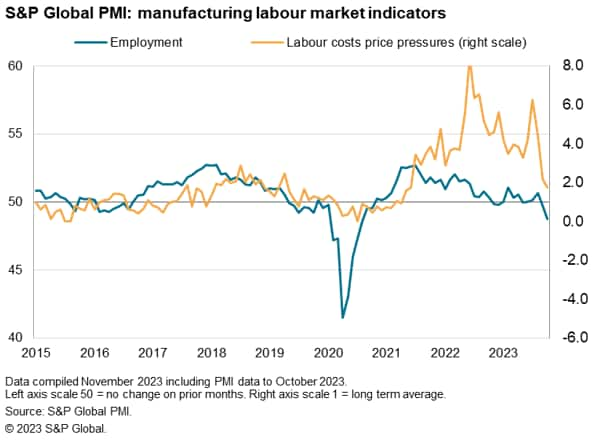

Even more encouraging is the reduced upward pressure from wages. Labour costs had spiked after the pandemic, sustaining higher selling prices into the first half of 2023. But this labour market effect has moderated considerably in recent months, with upward pressure from labour costs diminishing globally in October to its lowest since May 2021.

This cooling of wage pressures corresponds with a reduction in demand for labour by manufacturers. Global factory employment fell in October for a second successive month in October, according to the PMI, dropping at a pace not seen since the global financial crisis in 2009, if early pandemic lockdown months are excluded.

Rising prices in the US and Japan contrast with falling European charges

Looking geographically, there are some variations in price trends around the world, though in general, price trends remain muted by historical standards.

Higher costs were most notably recorded in Japan and the US, the latter seeing an accelerated rate of increase, albeit still below the ten-year pre-pandemic average. Costs also rose modestly in mainland China, as well as across Asia as a whole. In contrast, costs fell in both the Eurozone and the UK.

These cost variances were reflected in changing selling price trends. Average prices charged by factories for goods continued to fall sharply in the eurozone and also fell in the UK, the latter reporting the steepest fall since February 2016.

Prices meanwhile rose markedly in Japan and at a rate that was unchanged for the third successive month. The rate of charge inflation across the US was the quickest in six months, though was modest overall. Prices also rose slightly for a second successive month in mainland China, helping to assuage recent deflation concerns.

One stand-out during the month was Russia, where prices charged have surged higher in recent months, rising in September and October at rates not seen since early 2015, excluding the initial months following Russia’s invasion of Ukraine in February 2022.

Source: S&P GLOBAL – by Chris Williamson

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.