October 11, 2023

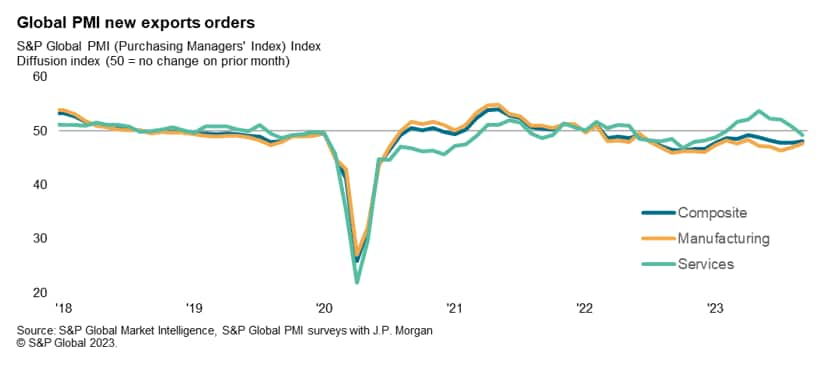

Trade conditions continue to deteriorate at end of third quarter

Renewed decline in services exchange

The improvement in the seasonally adjusted global PMI New Export Orders Index reading was primarily driven by a shallower decline in goods trade in September. In contrast, the exchange of services declined for the first time since January. Although only marginal, the decline in services trade represents a marked contrast to the resurgent expansion seen earlier in the year. This helped to narrow the gap in performance between the two sectors, shrinking the difference to the smallest in eight months.

Manufacturing new export orders fell at the softest rate since April and was modest overall. The rate of decline was also slower than the 12-month rolling average to signal an alleviation in the downward trend. Compared historically, however, the latest decline signalled continued to be among the steepest since the global financial crisis. To a large extent, ongoing inventory reduction policies remain key drags on factory output, though signs of the trend peaking may offer some reprieve in the months to come. While consumer and intermediate goods new export orders fell at rates comparable to their respective August readings, the decline in investment goods trade eased markedly to hint at a turnaround in conditions.

More detailed sub-sector data revealed that the steepest downturn in goods exports was recorded for paper & timber products, followed by household & personal use products. In contrast, renewed expansions of exports growth in chemicals and foods sectors supported improvements for basic material and consumer goods broad sectors respectively.

Turning to services, September data pointed to an end of the growth streak for the exchange of services, which commenced in March. Although marginal, the latest reading also marked the fourth consecutive month in which the service sector seasonally adjusted New Export Orders Index declined. This outlined the impact from past interest rate rises, sending goods exchange into contraction territory.

By region, both developed and emerging markets recorded lower trade activities in September. Developed economies again overtook emerging markets in the rate at which trade deteriorated, the pace of decline further accelerating on August to reach the sharpest since December 2022. A renewed downturn in the exchange of services in developed markets contributed to the latest fall in overall export orders. On the other hand, emerging markets export volumes fell only marginally, mainly due to weakness in the manufacturing sector while services trade stabilised in September.

EU export conditions worsen among developed economies

Measured across both goods and services, the majority of the top 10 economies monitored continued to report lower trade activity at the end of the third quarter. The downturn was again led by the EU, where export orders fell at one of the fastest rates on record, barring the pandemic period. According to detailed European sector data, goods trade continued to deteriorate at a sharp pace that was largely comparable to that in August while the downturn in services exchange worsened.

Once again, this UK followed close behind the EU, though its pace of export order contraction eased to the least pronounced since June. After falling at the sharpest rate since the GFC in August (barring COVID-19 lockdown months), UK manufacturing export orders declined at a slower, but still marked pace. UK services exports meanwhile returned to contraction for the first time since November 2022, albeit only modestly, feeling the impact of elevated interest rates.

Downturns in trade remained modest in the US and Japan, the former seeing no change in the pace of contraction from August. In line with the global theme, a slower manufacturing export contraction contrasted with a renewed fall in the exchange of services for the US. Japan saw a sharper decline in goods trade, which ran against the easing trend for the rest of Asia. This was as services export business growth stalled.

India export growth slows, but remain solid

In emerging markets, India remained the best performer with exports in strong expansion. Although slowing from the series record in August, the latest new export orders reading remained well above the rolling 12-month average to indicate solid growth. Favourable demand trends, positive market dynamics and fruitful advertising were all reported among the reasons supporting continued exchange of goods and services between India and major export partners in Asia, Europe, North America and the Middle East.

Russia which also saw growth in new export orders across both manufacturing and services. The expansion of services export accelerated markedly in September, attributed to marketing efforts and better demand conditions in some key export markets according to panellists.

Finally, mainland China and Brazil continued to see new export business contract at the end of the third quarter. The key manufacturing sector in mainland China experienced a shallower fall in new orders from abroad while foreign demand for services returned to growth, supporting an alleviation of overall export contraction. Brazil on the other hand saw conditions worsen across both manufacturing and services, the latter again experiencing lower export demand after four months of growth.

Source: S&P GLOBAL – by Jingyi Pan

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.