August 21, 2023

In July, prices of products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), increased 0.4% month over month and fell 2.7% year over year. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), increased 3.5% on a monthly basis in July and were 11.1% lower compared with July 2022.

Industrial Product Price Index

The IPPI increased 0.4% month over month in July 2023, following three months of consecutive declines, and fell 2.7% year over year.

Prices for energy and petroleum products rose 4.1% month over month, a second consecutive monthly increase. Year over year, prices were 22.2% lower compared with July 2022. The prices of diesel fuel (+7.0%) and finished motor gasoline (+1.5%) rose month over month in July 2023. The rise in prices for these energy products coincided with an increase in the price of crude oil, due in part to restricted supply from the Organization of the Petroleum Exporting Countries and its partners (OPEC+).

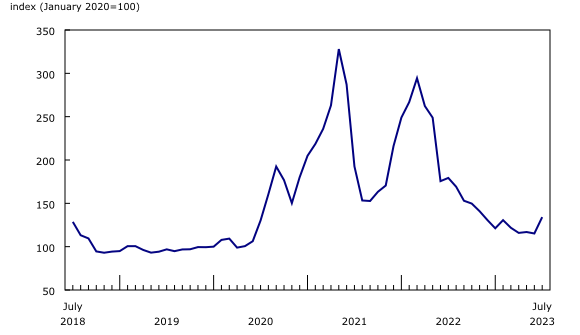

Prices for softwood lumber rose 16.4% in July, the largest monthly increase since December 2021 (+26.8%). Prices were down 25.2% in July compared with the same month in 2022; however, they remained 34.1% higher compared with the January 2020 level, pre-COVID-19 pandemic. Prices rose due to a confluence of factors in July 2023. Ongoing wildfires in the Pacific Northwest and the strike by port workers in British Columbia caused concern about future supply and added uncertainty to the market.

Prices for chemicals and chemical products fell 2.6% month over month in July. The decrease was mainly driven by lower prices for fertilizers, pesticides and other chemical products (-12.0%), a record monthly decline for the category. Year over year, prices for fertilizers dropped 27.0%; high levels of inventory and lower prices for inputs such as natural gas both played a part in the price decline.

Prices for meat, fish and dairy products fell 2.2% in July, mainly on lower prices for fresh and frozen beef and veal (-10.0%). This was the first monthly decrease for beef since October 2022 (-0.6%). Year over year, beef prices were up 12.6% in July 2023 and were 40.1% higher than in January 2020. Despite the price drop, supply remained tight for live cattle.

Prices for intermediate food products rose 4.3% in July 2023, mainly on higher prices for canola oil (+9.0%). Oilseed cake and meal (+9.2%) also rose in July. These price increases were partially attributed to hot and dry weather in Canada and the United States in late June and early July. Higher global prices in July for related products, including soybean oil and palm oil, was also a factor.

Raw Materials Price Index

In July 2023, the RMPI rose 3.5% month over month, following two months of consecutive declines, and was 11.1% lower compared with July 2022.

Prices for crude energy products in July 2023 increased 7.7% on a monthly basis after posting two months of consecutive declines. Higher prices for conventional crude oil (+8.6%) led the increase in this group. The price of synthetic crude oil (+8.3%) also rose in July. July crude oil prices were pushed up by restricted output from the OPEC+. According to the International Energy Agency, oil output from the OPEC+ fell by 1.2 million barrels per day in July. The agency also noted that the Organisation for Economic Co-operation and Development’s oil inventories fell in June.

Prices for live animals rose 2.4% month over month in July, mainly due to higher prices for hogs (+15.1%), the largest monthly increase since October 2020 (+16.9%). Year over year, prices for hogs were down 3.1% in July 2023. Seasonal and export demand both played a part in the monthly price increase. Canadian exports for both hogs and pork meat were trending up from April to June. Canadian pork exports to the United States, the primary export destination for the meat, increased 16.4% in June. US pork cold storage fell for the second month in a row in June.

Prices for crop products rose 4.0% in July, mainly on higher prices for canola (+10.6%) and wheat (+8.0%). Crop prices rose mainly as a result of the drought that hit the United States and Canada in late June and early July. The uncertainty surrounding Ukraine’s grain exports following Russia’s cancellation of the Black Sea grain initiative, as well as attacks on the Ukrainian port cities Odesa and Mykolaiv, also contributed to the price increase.

Source: Statistics Canada

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.