Between July 2013 and July 2023, new and second-hand house sales in Türkiye amounted to 14,238,936 units.

In the same period, the number of house sales to foreigners was 368,493.

From January 2020 to the first 7 months of 2023, Russia, Iran and Iraq took the first three places in house sales to foreigners.

| Country | 2020 | 2021 | 2022 | 2023 Jan-Jul |

TOTAL |

| Iran | 7.189 | 10.056 | 8.223 | 2.929 | 28.397 |

| Iraq | 6.674 | 8.661 | 6.241 | 1.188 | 22.764 |

| Russia | 3.078 | 5.379 | 16.312 | 7.228 | 31.997 |

| TOTAL | 16.941 | 24.096 | 30.776 | 11.345 | 83.158 |

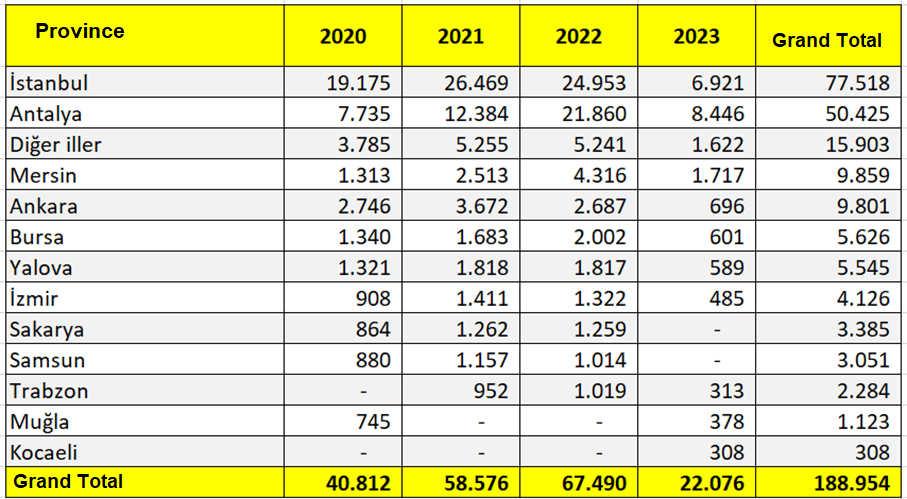

Between January 2020 and July 2023, the province with the highest number of houses sold to foreigners was Istanbul with 77,518 units, followed by Antalya with 50,425 units, Mersin in 4th place and Ankara in 5th place.

The number of house sales to foreigners by province in this period is given in the table below.

Foreigners who purchase residences or workplaces in Türkiye for different purposes and receive rental income are obliged to file an annual income tax return just like Turkish citizens. Failure to comply with this obligation will result in penalties.

The annual income tax return for rental income must be submitted in March of the year following the year in which the rental income was obtained.

The annual income tax return should be submitted to the tax office of the place where the foreign property owner resides in Türkiye, if he/she resides in Türkiye, to the tax office where his/her residence is located, if he/she resides abroad, to the tax office to which the real estate from which rental income is obtained is connected.

The calculated income tax is paid in 2 equal installments. The first installment must be paid by the end of March and the second installment must be paid by the end of July. If the tax is not paid, a monthly late fee must be paid. As of August 2023, the monthly default fee rate is 2.5%.

If, for whatever reason, the income tax return is not filed and the tax office notifies the property owner in writing, a penalty equal to the tax due will be imposed and a late payment fee will be calculated. If the property owner voluntarily submits the declaration after the deadline, only the late fee is applied but no tax penalty is applied.

If a foreign national resides abroad and does not have a permanent residence in Türkiye or if he/she has stayed in Türkiye for less than 185 days in 1 year, he/she will not declare the rental income of the workplace on which income tax (withholding) has been withheld. However, residential rental income will be declared in any case. If a foreign citizen obtains both residential and workplace rental income with withholding tax from Türkiye, only residential rental income will be declared, and workplace rental income will not be declared.

The declaration regarding the rental income can be submitted to the tax office personally by the person who obtains the rental income, or it can be submitted by mail or through the tax office interactive tax office or through Certified Public Accountant Financial Advisors.

In the calculation of the tax, some expenses of the real estate and the person from which the rental income is obtained can be deducted. It will be useful to get the support of a Financial Advisor for the elements to be deducted from the tax base and other specific situations related to taxation.

In order to avoid penalties, it is important to declare the rental income from Türkiye correctly and on time and to pay the accrued taxes on time.

Ali KARAKUŞ

CPA, Independent Auditor

Karen Audit & Consulting

Istanbul

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.