May 25, 2023

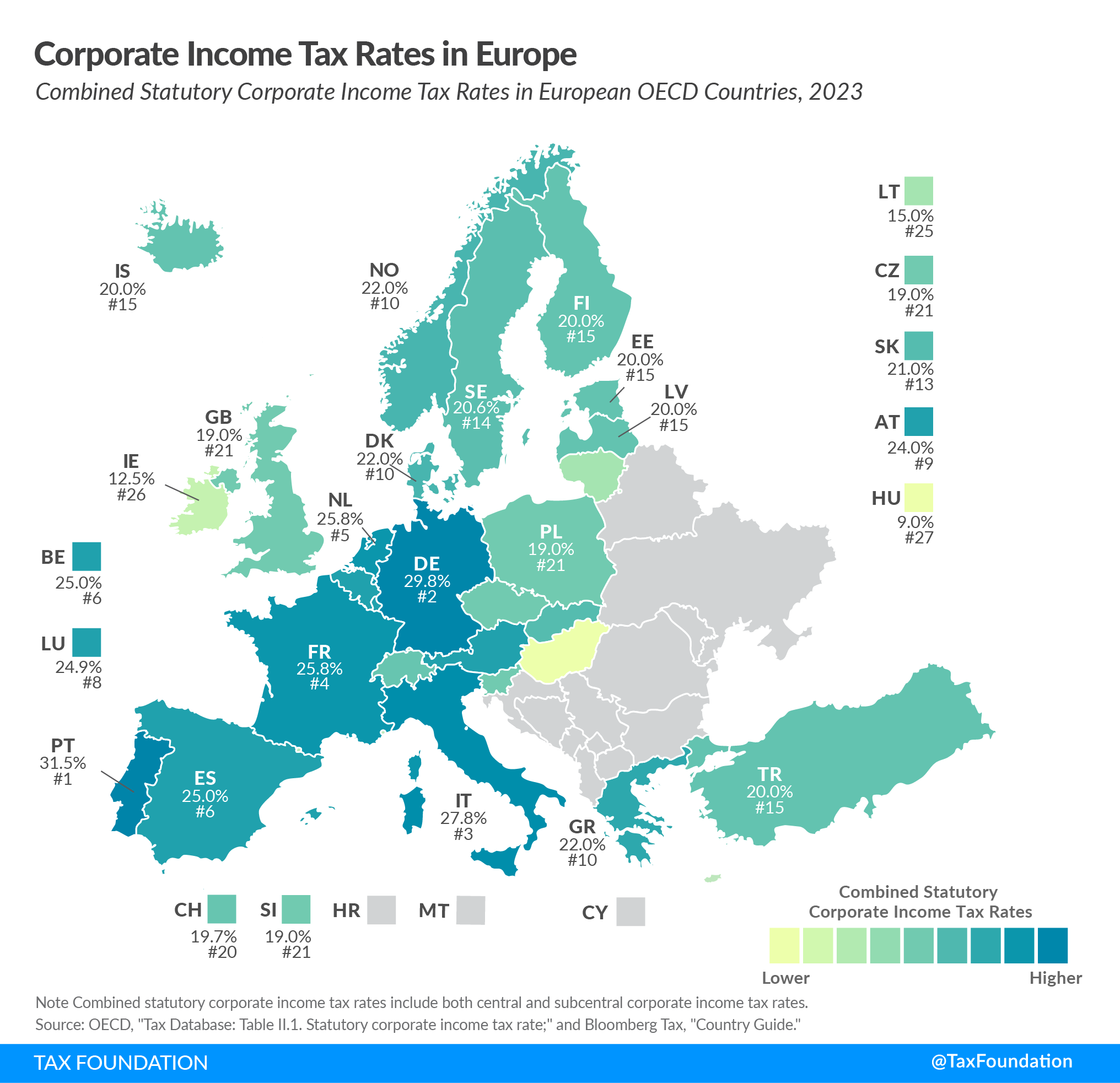

Nearly all nations in the world, including those in Europe, compel corporations to pay corporate income taxes on their profits. The corporate tax base and the corporate tax rate affect how much tax an organization ultimately pays on its profits. The map of today illustrates how the statutory corporate income tax rates vary among European OECD nations.

Portugal has the highest statutory corporate income tax rate among European OECD nations, at 31.5 percent, after accounting for central and subcentral taxes. At 29.8% and 27.8%, respectively, Germany and Italy are next. The lowest corporate income tax rates are in Lithuania (15%), Hungary (9%) and Ireland (12,5%).

Like most other parts of the world, European nations have seen a drop in corporate income tax rates during the past few decades, but in recent years, the average corporate income tax rate has leveled off. Only one of the 27 European nations, the Netherlands, raised its corporate income tax rate in the previous year. This trend is anticipated to continue as more effective tax structures become available.

| Combined Statutory Corporate Income Tax Rates in European OECD Countries, 2023 | |

|---|---|

| European OECD Country | Combined Statutory Corporate Income Tax Rate |

| Australia | 30.00 |

| Austria | 25.00 |

| Belgium | 25.00 |

| Canada | 26.21 |

| Chile | 10.00 |

| Colombia | 35.00 |

| Costa Rica | 30.00 |

| Czech Republic | 19.00 |

| Denmark | 22.00 |

| Estonia | 20.00 |

| Finland | 20.00 |

| France | 25.83 |

| Germany | 29.83 |

| Greece | 22.00 |

| Hungary | 9.00 |

| Iceland | 20.00 |

| Ireland | 12.50 |

| Israel | 23.00 |

| Italy | 27.81 |

| Japan | 29.74 |

| Korea | 27.50 |

| Latvia | 20.00 |

| Lithuania | 15.00 |

| Luxembourg | 24.94 |

| Mexico | 30.00 |

| Netherlands | 25.80 |

| New Zealand | 28.00 |

| Norway | 22.00 |

| Poland | 19.00 |

| Portugal | 31.50 |

| Slovak Republic | 21.00 |

| Slovenia | 19.00 |

| Spain | 25.00 |

| Sweden | 20.60 |

| Switzerland | 19.70 |

| Türkiye | 23.00 |

| United Kingdom | 19.00 |

| United States | 25.81 |

| Note: Combined statutory corporate income tax rates include both central and subcentral corporate income tax rates.

Source: OECD, “Tax Database: Table II.1. Statutory corporate income tax rate;” and Bloomberg Tax, “Country Guide.” |

|

Source: Tax Foundation

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.