March 9, 2023

Global jobs growth accelerated to a six-month high in February as improving demand conditions and rising business confidence encouraged greater hiring, with job gains reported in all major economies bar Brazil.

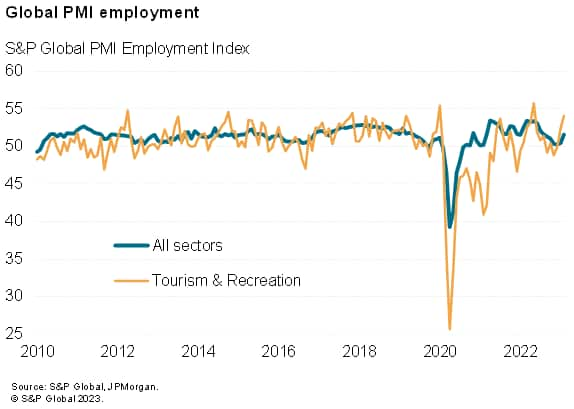

The upturn was led by rising employment in consumer-facing services, notably healthcare services and tourism and recreation, buoyed in turn by the re-opening of the mainland Chinese economy.

However, the number of companies reporting that operating capacity continued to be constrained by a lock of workers remained well above the long-run average, causing wage pressures to also remain well above their long run trend. Such tightness of the labour markets and the resulting inflationary pressures remain key concerns for the economic outlook.

Global jobs growth at six-month high

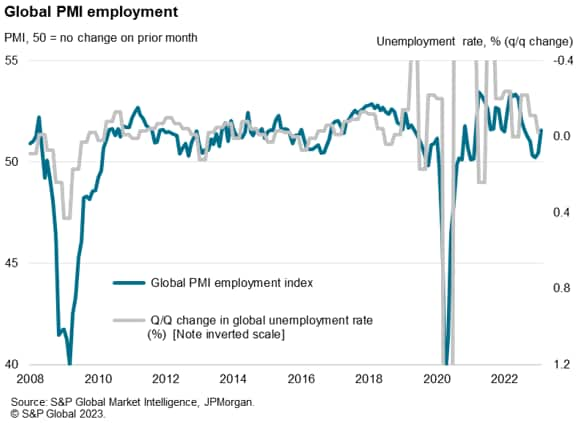

Employment growth picked up worldwide, according to the Global PMI – compiled by S&P Global across over 40 economies and sponsored by JPMorgan. Having slowed to near-stagnation since November, the rate of job creation accelerated in February to its highest since last August to signal a strengthening of the labour market alongside a pick up in the overall pace of economic growth recorded during the month.

Improved hiring was encouraged by an upturn in business confidence about prospects in the year ahead, which rose in February to its highest for a year. It also reflected a markedly slower reduction in backlogs of uncompleted work, meaning companies often took on extra staff to meet an anticipated additional pressure on workloads in the coming months.

Backlogs of work had risen sharply during the pandemic, but have fallen since July last year as companies were better able to deal with these orders, thanks to a combination of improved supply chains and reduced inflows of new orders. That said, February saw the pace of backlog depletion ease to the slowest in the past eight months, partly due to the first rise in new orders for seven months.

Only Brazil reports lower employment

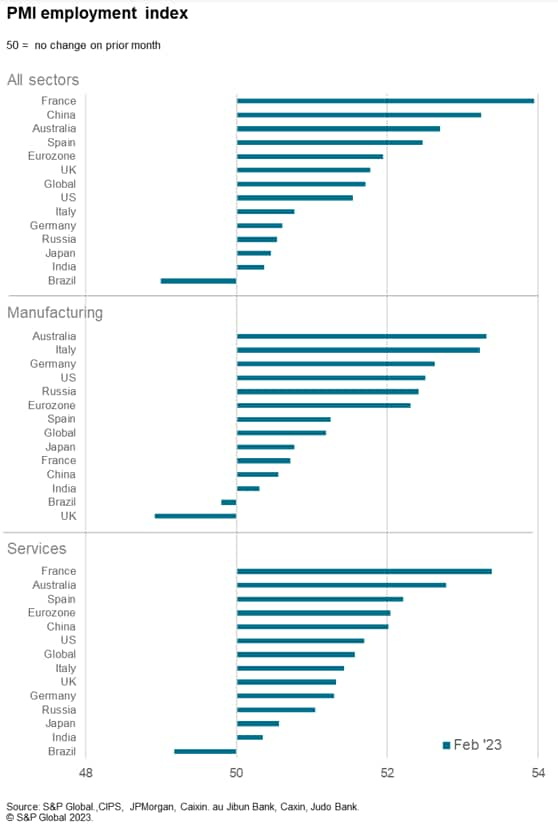

The fastest jobs growth, by a whisker, was recorded in France followed by mainland China, which saw renewed job gains after three months of decline. Employment also edged higher in Japan and Russia, leaving Brazil as the only major economy still reporting falling employment levels. However, the UK’s manufacturing sector was another outlier in recording falling staffing levels in February.

In the US, jobs growth hit a five-month high and net hiring in the eurozone remained up on the lows seen late last year, though the above-average gains seen in France and Spain were offset by weaker rises in Italy and Germany.

Job gains led by consumer service providers

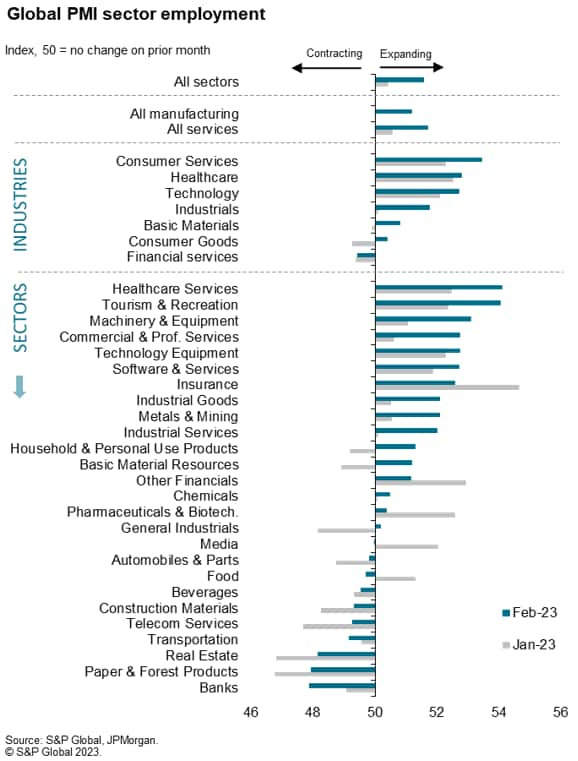

By sector, the strongest jobs growth globally was recorded for consumer services firms, which had also seen the largest rise in overall business activity and demand. Jobs growth in consumer services in fact hit the second highest recorded since the pandemic, beaten only by that recorded in May 2022.

Job gains were especially marked in tourism & recreation, in part linked to the re-opening of the Chinese economy form COVID-19 restrictions, as well as rising demand for travel in the rest of the world. However, the coinciding of the jump in employment with China’s reopening raises questions about the sustainability of the upturn, as prior re-openings around the world spurred similar bouts of job creation which soon petered out.

Jobs growth nonetheless also improved in all other major industries around the world, the exception being financial services and telecommunication services, the only two broad industries to report falling headcounts for a third and second successive month.

Staff shortages drive up wages

Despite the stronger jobs growth recorded worldwide in February, staff shortages clearly remain a constraint on businesses, and a source of rising costs.

The number of companies reporting that a lack of staff led to a rise in backlogs of work continued to run at two and a half times the long run average in February. Such a level of worker shortages had not been witnessed in the 15 years of data availability prior to the pandemic.

At the same time, the number of companies reporting that higher prices had been fueled by increased salary costs rose above four times the long-run average, likewise surpassing anything seen prior to the pandemic.

Although both of these gauges are running lower than prior peaks seen during the pandemic, the sustained lack of staff and resulting upward pressure on wages speaks of a tightness in the labour market that is a concern to business and a concern for the broader inflation outlook.