January 17, 2023

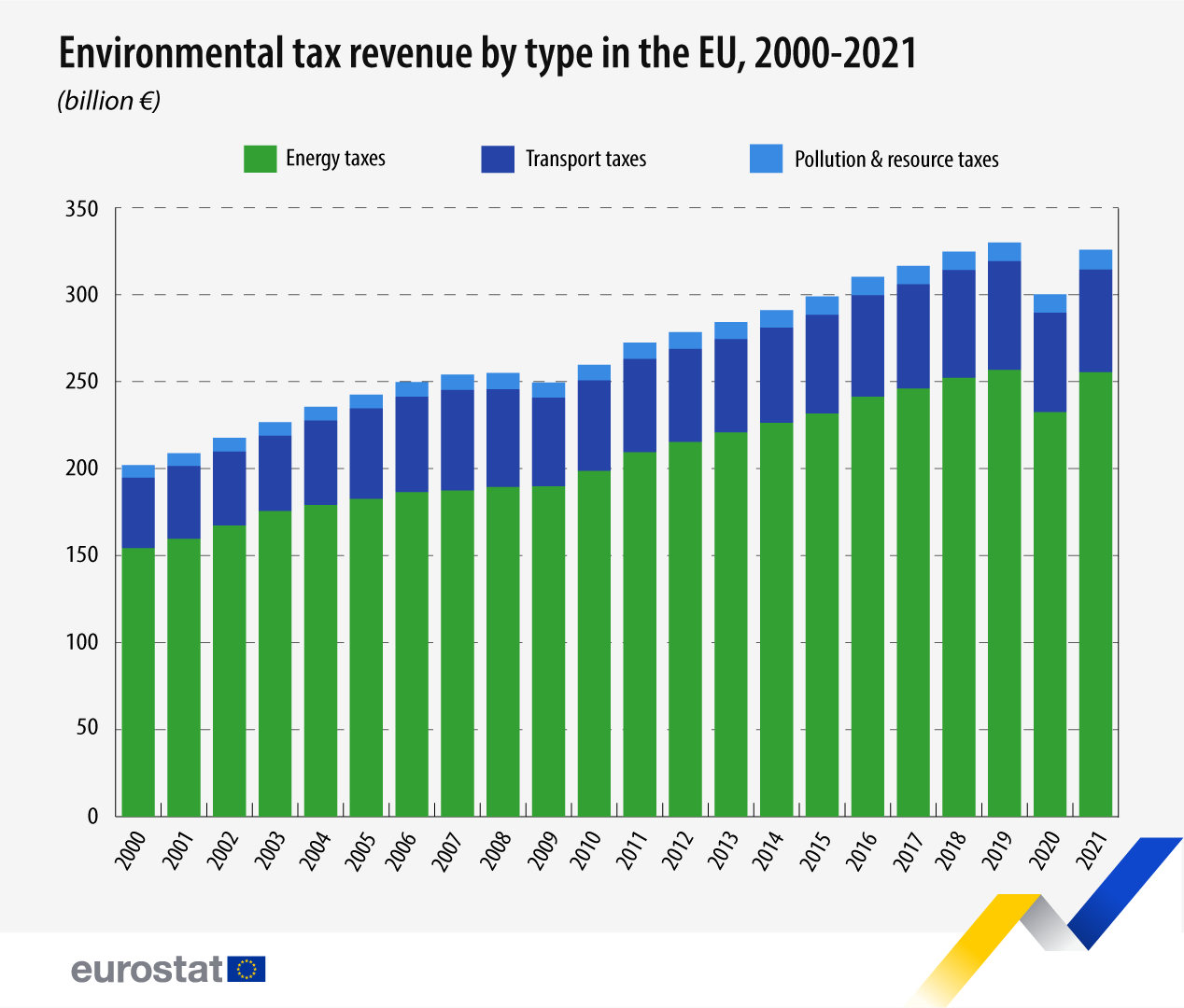

In 2021, environmental tax revenue in the EU returned to the level recorded before the COVID-19 pandemic. EU environmental tax revenue amounted to €325.8 billion (2.2% of the EU’s gross domestic product; GDP) compared with the €300.2 billion recorded in 2020.

The decrease recorded in 2020 was mainly due to a significant drop in energy tax revenues. However, energy tax revenues in 2021 returned to the levels recorded before the COVID-19 pandemic.

This information comes from data on environmental taxes by economic activity, published by Eurostat today. The article presents a handful of findings from the more detailed Statistics Explained article, which includes a section on taxes from emission trading schemes.

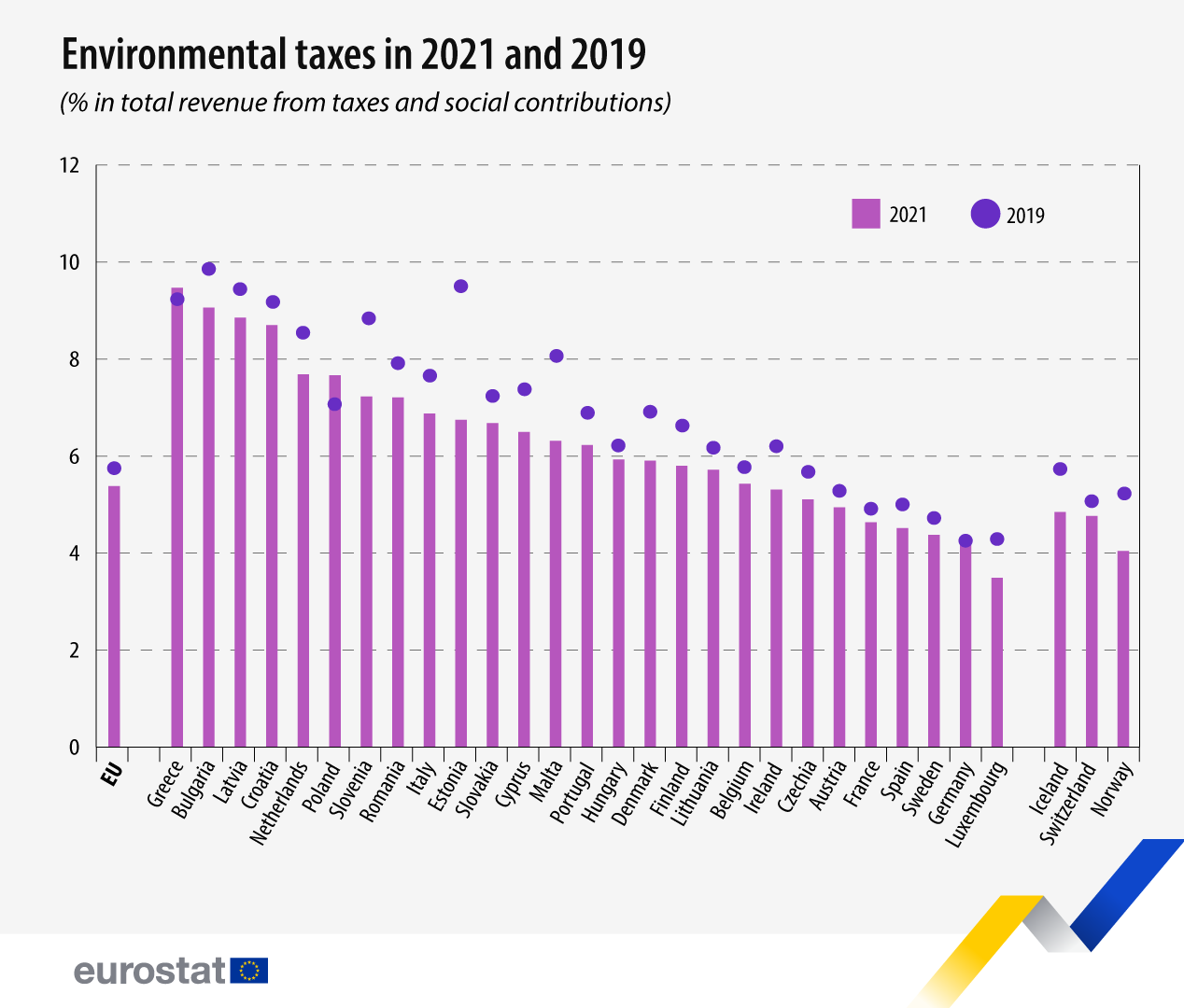

Large variations in the revenue from taxes and social contributions across the EU

EU environmental taxes accounted for 5.4% of the total revenue from taxes and social contributions in 2021, the same share recorded in 2020 but lower than the one recorded in the pre-COVID-19 year of 2019 (5.7%).

This share varied significantly across the EU Member States. Greece (9.5%), Bulgaria (9.1%), Latvia (8.9%) and Croatia (8.7%) recorded the largest shares in the EU, whereas Luxembourg (3.5%), Germany (4.2%), Sweden (4.4%), Spain (4.5%) and France (4.6%) recorded the smallest shares.

The share of environmental taxes in total revenue from taxes and social contributions was lower in 2021 than in 2019 in all the EU Member States except Poland (7.1% in 2019 compared with 7.7% in 2021) and Greece (9.2% compared with 9.5%).

Source: Eurostat

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.