January 5, 2023

UniCredit Bank Austria Purchasing Managers’ Index in December:

Downturn in Austrian industry losing pace

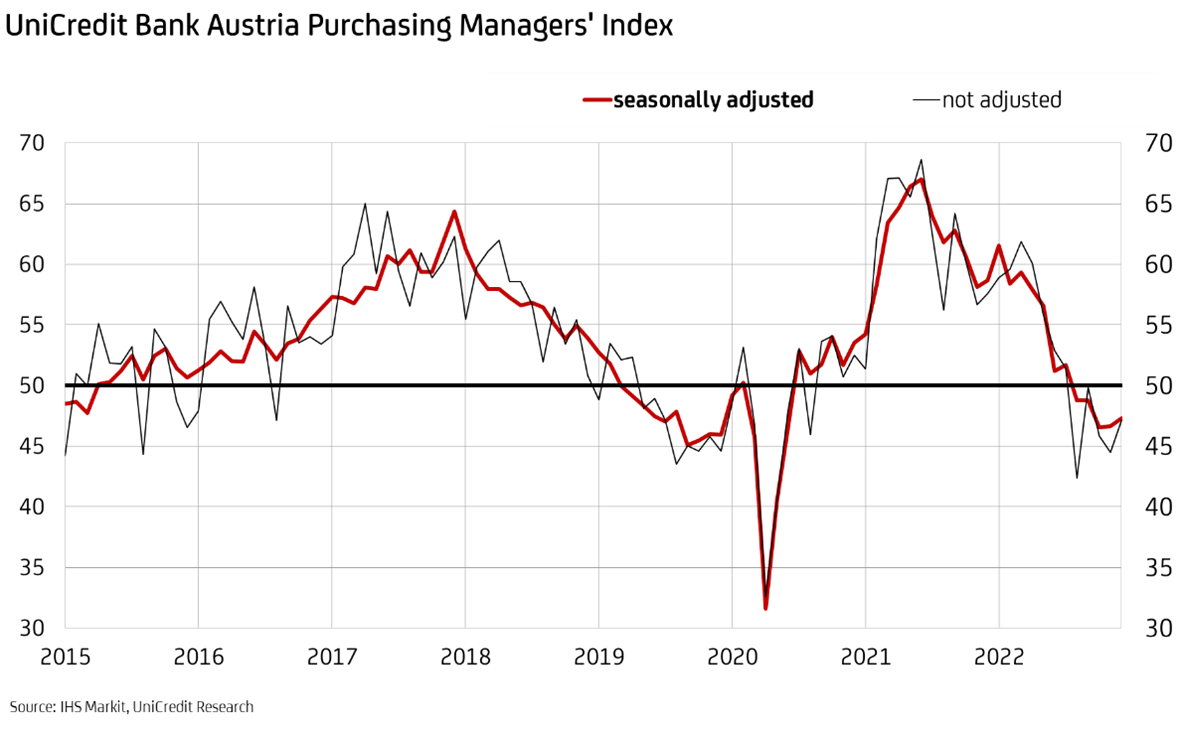

- Industrial economy stabilises: In December, UniCredit Bank Austria Purchasing Managers’ Index rises slightly to 47.3 points, but is below growth threshold for fifth consecutive month

- Easing of supply bottlenecks slows decline in production output in December despite continued sharp decline in new business

- Strong slump in demand puts the brakes on cost increases and rise in output prices also slows significantly compared to previous months

- Lowest increase in delivery times since pandemic began in spring 2020

- Pace of job creation rises slightly in December as vacancies are filled

- Stabilisation of short-term outlook and production expectations for the year signal a slight easing of the recession in industry moving into 2023

The decline in Austrian industry slowed towards the end of 2022. “In December, the UniCredit Bank Austria Purchasing Managers’ Index showed a slight upward trend for the first time in six months, rising by 0.7 points compared to the previous month to reach 47.3 points. The indicator is thus signalling a reduction in the downturn rate in domestic industry and sending the first signs that the industrial economy is stabilising after the significant slump in the second half of 2022”, says UniCredit Bank Austria Chief Economist Stefan Bruckbauer. However, the increase in the indicator was not sufficient to exceed the growth threshold of 50 points. This is the fifth month in a row that the UniCredit Bank Austria Purchasing Managers’ Index has been below the threshold that indicates growth in the industry.

The December survey provided the first signs that the recession in Austrian industry is beginning to ease. “In December, domestic industrial businesses were once again confronted with a strong slump in new business. However, as demand declined, supply problems were reduced, which supported production output and contributed to a significant slowdown in price dynamics. In addition, the filling of vacancies continued to ensure a positive employment trend”, says Bruckbauer, summarising the most important results of the survey.

Weak demand continues

The decline in domestic industry was again mainly due to the huge losses in new business. In particular, orders from abroad continued to be lacking in December. High prices, well-stocked customer warehouses and low willingness to spend, as well as the general slowdown in the global economy, were the main reasons for the lower demand for products “Made in Austria”. Nevertheless, the decline in new orders was not quite as serious as in the previous month, with the index rising to 38.3 points.

“In view of the decline in new orders, domestic businesses also reduced production output less sharply in December than in recent months. The production index rose to 48.1 points, significantly higher than that of incoming orders. The easing of delivery problems meant that existing backlogs of orders could be fulfilled”, says UniCredit Bank Austria economist Walter Pudschedl. With declining new business and the clearing of backlogs, orders on hand in industry have decreased significantly. December therefore saw the lowest increase in delivery times since just before the outbreak of the coronavirus pandemic in spring 2020.

Less demand, higher stock levels

Due to the sharp drop in demand and declining call-off orders from customers, there was an increase in stocks of finished goods in December, the eighth month in a row. At 51.2 points, however, the corresponding index indicates the lowest stock accumulation in this period.

“Due to lower production requirements, declining new business and increased efforts to reduce storage costs, twice as many of the companies surveyed (36 percent) reduced the volume of raw materials and other primary materials they purchased in December than increased it. Nevertheless, there was a further increase in stocks of purchases, but with the lowest rate of growth in 18 months”, said Pudschedl. With supply bottlenecks easing, building up safety stocks to maintain production became less important. In contrast, Austrian companies are once again becoming more cost aware in the way they manage inventories.

Price dynamics slowed significantly

The fact that demand has been falling for eight months now, with the resulting easing of supply chains, has led to a significant reduction in price pressure in purchasing. The increase in purchase prices slowed for the third month in a row and the corresponding index reached 61.1 points, its lowest level in two years. However, due to the only slightly reduced supply-side pressure from energy prices, the long-term average was still clearly exceeded in December.

“Domestic industry once again raised output prices at an above-average rate in December, but at a noticeably slower pace than in the previous month”, says Pudschedl, adding: “For the second month in a row, companies were able to pass the average cost increase on to their customers in full. Earnings are therefore likely to have improved on balance as a result of the price trends.”

Pent-up demand for labour continued

Despite falling demand, employment in domestic industry continued to rise and even rose at a higher rate than in the previous month. The employment index climbed to 55.4 points in December. During the recovery phase following the height of the pandemic in spring 2020, the increasing demand for labour could not be met quickly enough; consequently, despite production capacities being adapted to meet this falling demand, there was still some catching up to do.

“After an average of 4 percent in 2021, the unemployment rate in the domestic manufacturing sector fell to an average of 3.1 percent in 2022. As a result, the unemployment rate was significantly lower than it was the year before the outbreak of the pandemic (2019: 3.7 percent) and less than half that of the economy as a whole, estimated at 6.4 percent”, says Pudschedl. While the unemployment rate in the manufacturing sector was below average in Upper Austria, Tyrol, Salzburg and Styria, Vienna once again saw the highest level of all federal states, at 6.6 percent.

Over the course of 2022, the development of the labour market in Austrian industry was characterised by increasing labour shortages. At the end of 2022, companies report just under 14,000 vacancies. In contrast to this, there are just over 20,000 jobseekers, meaning that there were on average only 1.5 jobseekers in Austria for every vacancy at the turn of the year. The labour shortage was particularly problematic in the industrial powerhouse of Upper Austria, where the job of jobseekers per vacancy is below 1.

Mild recession, but no end in sight for now

The first signs that the industrial economy is stabilising after the sharp slump in the second half of 2022, as indicated by the current increase in the UniCredit Bank Austria Purchasing Managers’ Index to 47.3 points at the turn of the year, are not limited to Austria. A slowing of the industrial downturn can be seen throughout Europe. The preliminary Purchasing Managers’ Index for the eurozone rose to 47.8 points in December, mainly driven by tailwinds from Germany. The index for German industry has risen for the second month in a row, currently standing at 47.4 points. Compared to the trend in Austria, European industry experienced a less severe fall in demand in December. This, combined with the improvement in the index, particularly in Germany, the most important buyer of Austrian industrial products, could have a positive impact on the further development of Austrian industry at the beginning of 2023.

Although there will be a slight easing at the start of 2023, for now there is no end in sight to the recession in domestic industry. Although the order-to-stock ratio improved slightly in December, it continues to clearly indicate that with the present stock levels in sales warehouses, the smaller order volumes can be fulfilled even if production capacities are lower. Production is therefore likely to drop off further in the coming months. This is also indicated by the medium-term production expectations of domestic companies.

“In December, the high purchase prices, especially for energy, the less favourable financing conditions following the rise in interest rates and the global economic slowdown in general led to a reduction in business expectations for the year. However, the decrease in the expectations index to 40.4 points was only minor”, says Bruckbauer, adding: “The recession in domestic industry is already weakening somewhat due to the far-reaching stabilisation of business expectations, the resilient labour market, the easing of supply disruptions and the prospect of a gradual easing of cost dynamics. However, there are no signs that industry will be returning to a growth trajectory any time soon.”

The strong first half of the year saw an increase in industrial production in Austria by an expected average of almost 6 percent in 2022. According to the economists of UniCredit Bank Austria, however, stagnation of domestic industry is all that can be expected for 2023, even in the event of a favourable development, due to the weak start to the year and the expectation of only a moderate improvement in the industrial economy over the course of the year.

Source: UniCredit Bank Austria

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.