December 14, 2022

Gross Domestic Product (Second Estimate) and Corporate Profits (Preliminary) in the US, Third Quarter 2022

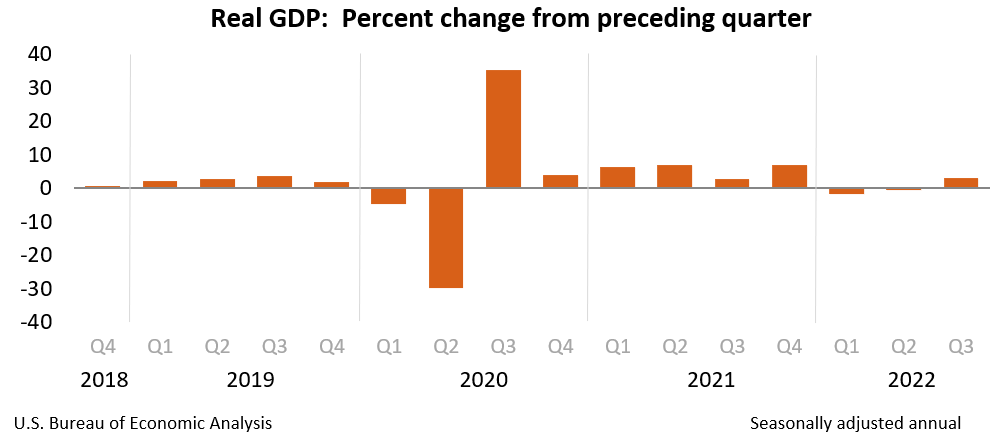

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the third quarter of 2022 (table 1), according to the “second” estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP decreased 0.6 percent.

The GDP estimate released today is based on more complete source data than were available for the “advance” estimate issued last month. In the advance estimate, the increase in real GDP was 2.6 percent. The second estimate primarily reflected upward revisions to consumer spending and nonresidential fixed investment that were partly offset by a downward revision to private inventory investment. Imports, which are a subtraction in the calculation of GDP, decreased more than previously estimated (refer to “Updates to GDP”).

The increase in real GDP reflected increases in exports, consumer spending, nonresidential fixed investment, state and local government spending, and federal government spending, that were partly offset by decreases in residential fixed investment and private inventory investment. Imports decreased (table 2).

The increase in exports reflected increases in both goods and services. Within exports of goods, the leading contributors to the increase were industrial supplies and materials (notably nondurable goods), “other” exports of goods, and nonautomotive capital goods. Within exports of services, the increase was led by travel and “other” business services (mainly financial services).

Within consumer spending, an increase in services (led by health care and “other” services) was partly offset by a decrease in goods (led by motor vehicles and parts as well as food and beverages). Within nonresidential fixed investment, increases in equipment and intellectual property products were partly offset by a decrease in structures. The increase in state and local government spending was led by increases in compensation of state and local government employees and investment in structures. The increase in federal government spending was led by defense spending.

The decrease in residential fixed investment was led by new single-family construction and brokers’ commissions. Within private inventory investment, the decrease was led by retail trade (mainly clothing and accessory stores as well as “other” retailers). Within imports, a decrease in imports of goods (notably consumer goods) was partly offset by an increase in imports of services (mainly travel).

Real GDP turned up in the third quarter, increasing 2.9 percent after decreasing 0.6 percent in the second quarter. The upturn primarily reflected a smaller decrease in private inventory investment, an acceleration in nonresidential fixed investment, and upturns in federal as well as state and local government spending that were partly offset by a larger decrease in residential fixed investment and a deceleration in consumer spending. Imports turned down.

Current‑dollar GDP increased 7.3 percent at an annual rate, or $450.5 billion, in the third quarter to a level of $25.7 trillion (table 1 and table 3), an upward revision of $35.7 billion from the previous estimate.

The price index for gross domestic purchases increased 4.7 percent in the third quarter (table 4), an upward revision of 0.1 percentage point from the previous estimate. The PCE price index increased 4.3 percent, an upward revision of 0.1 percentage point. Excluding food and energy prices, the PCE price index increased 4.6 percent, also revised up 0.1 percentage point.

Personal Income

Current-dollar personal income increased $291.3 billion in the third quarter, an upward revision of $0.1 billion from the previous estimate. The increase primarily reflected increases in compensation (led by private wages and salaries) and personal interest income (table 8).

Disposable personal income increased $235.8 billion, or 5.2 percent, in the third quarter, a downward revision of $32.6 billion from the previous estimate. Real disposable personal income increased 0.9 percent, a downward revision of 0.8 percentage point.

Personal saving was $520.6 billion in the third quarter, a downward revision of $67.6 billiion from the previous estimate. The personal saving rate—personal saving as a percentage of disposable personal income—was 2.8 percent in the third quarter, a downward revision of 0.5 percentage point.

Gross Domestic Income and Corporate Profits

Real gross domestic income (GDI) increased 0.3 percent in the third quarter, in contrast to a decrease of 0.8 percent in the second quarter (revised). The average of real GDP and real GDI, a supplemental measure of U.S. economic activity that equally weights GDP and GDI, increased 1.6 percent in the third quarter, in contrast to a decrease of 0.7 percent (revised) in the second quarter (table 1).

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) decreased $31.6 billion in the third quarter, in contrast to an increase of $131.6 billion in the second quarter (table 10).

Profits of domestic financial corporations decreased $32.9 billion in the third quarter, compared with a decrease of $46.0 billion in the second quarter. Profits of domestic nonfinancial corporations increased $6.1 billion, compared with an increase of $152.2 billion. Rest-of-the-world profits decreased $4.7 billion, in contrast to an increase of $25.5 billion. In the third quarter, receipts increased $3.1 billion, and payments increased $7.8 billion.

Updates to GDP

With the second estimate, upward revisions to consumer spending, nonresidential fixed investment, state and local government spending, and exports were partly offset by downward revisions to private inventory investment, residential fixed investment, and federal government spending. Imports decreased more than previously estimated.

| Advance Estimate | Second Estimate | |

|---|---|---|

| (Percent change from preceding quarter) | ||

| Real GDP | 2.6 | 2.9 |

| Current-dollar GDP | 6.7 | 7.3 |

| Real GDI | … | 0.3 |

| Average of Real GDP and Real GDI | … | 1.6 |

| Gross domestic purchases price index | 4.6 | 4.7 |

| PCE price index | 4.2 | 4.3 |

| PCE price index excluding food and energy | 4.5 | 4.6 |

Updates to Second-Quarter Wages and Salaries

In addition to presenting updated estimates for the third quarter, today’s release presents revised estimates of second-quarter wages and salaries, personal taxes, and contributions for government social insurance, based on updated data from the Bureau of Labor Statistics Quarterly Census of Employment and Wages program. Wages and salaries are now estimated to have increased $132.5 billion in the second quarter, a downward revision of $50.4 billion. Personal current taxes are now estimated to have increased $43.0 billion, a downward revision of $9.4 billion. Contributions for government social insurance are now estimated to have increased $19.7 billion, a downward revision of $6.5 billion. With the incorporation of these new data, real gross domestic income is now estimated to have decreased 0.8 percent in the second quarter, a downward revision of 0.9 percentage point from the previously published estimate.

Source: Us Bureau of Economic Analysis

Legal Notice: The information in this article is intended for information purposes only. It is not intended for professional information purposes specific to a person or an institution. Every institution has different requirements because of its own circumstances even though they bear a resemblance to each other. Consequently, it is your interest to consult on an expert before taking a decision based on information stated in this article and putting into practice. Neither Karen Audit nor related person or institutions are not responsible for any damages or losses that might occur in consequence of the use of the information in this article by private or formal, real or legal person and institutions.